VNDirect’s report highlights a significant increase in domestic corporate bond issuance in Q3 2024, with a total value of approximately VND 160 trillion, up 30% from Q2.

According to the report, the recovery in private corporate bond issuance was driven by increased activity from the Banking group. In Q3, banks issued VND 119 trillion in private corporate bonds, accounting for 81% of the total value.

The Real Estate group issued nearly VND 21 trillion, making up 14.2% of the total value. Excluding the Banking group, the total value of private corporate bond issuance in Q3 reached nearly VND 28 trillion, a 14% decrease from Q2 and a 44.4% drop year-over-year.

VNDirect attributes the continued rise in bond issuance among banks in Q3 2024 to their efforts to increase medium and long-term capital mobilization ratios while complying with the SBV’s regulations on maximum short-term capital mobilization for medium and long-term lending.

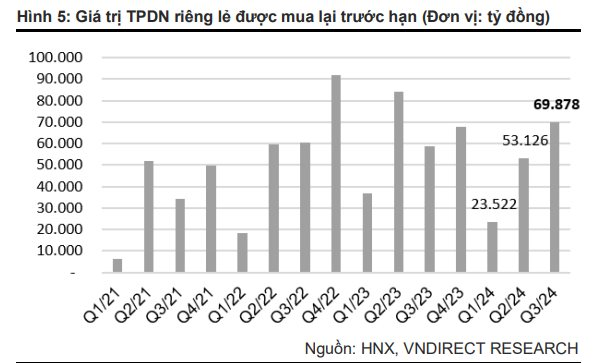

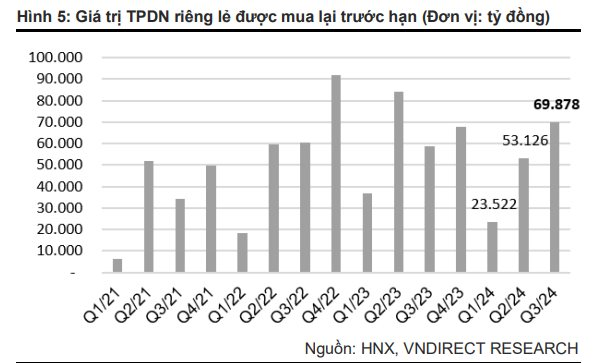

The report also notes a significant increase in early bond repurchases, with a total value of nearly VND 70 trillion in Q3, a rise of 31.5% from Q2 and 19% year-over-year. For the first nine months of the year, the total value of early repurchases exceeded VND 146.5 trillion, an 18.5% year-over-year decrease.

In Q3, banks remained active in early repurchases of bonds with remaining maturities of less than one year to reduce short-term capital mobilization ratios. The total value of bonds repurchased by banks in Q3 amounted to over VND 59 trillion, representing 84.4% of the total value of early repurchases during the quarter. Excluding banks, the total value of early repurchases in Q3 was nearly VND 11 trillion, a 15.5% increase from Q2 but 47% lower year-over-year.

Additionally, the number of companies facing challenges in repaying their corporate bond debts continues to grow. As of October 15, 2024, over 80 enterprises were reported to have missed interest or principal payment obligations on their corporate bonds, according to HNX. VNDirect estimates that the total outstanding private corporate bond debt of these 80 enterprises is approximately VND 190 trillion, accounting for about 18.6% of the total private corporate bond market. A significant proportion of these delinquent issuers are from the real estate sector.

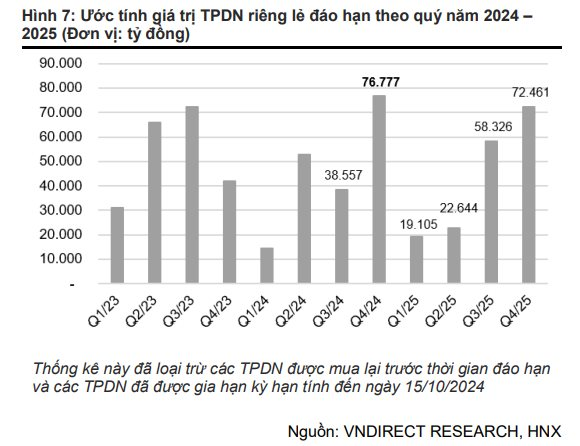

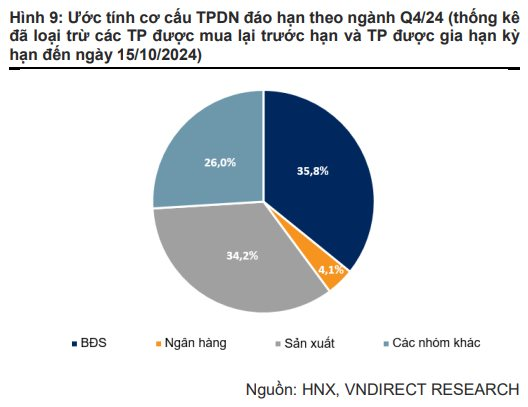

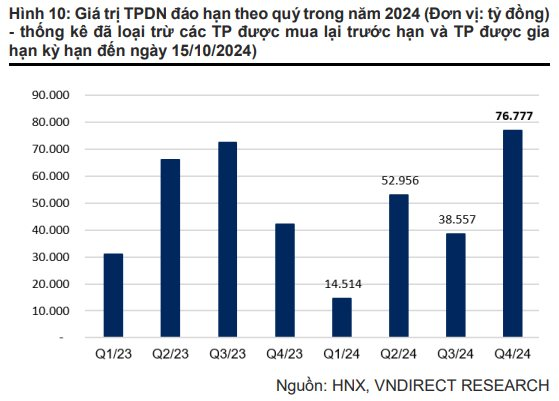

Looking ahead to the outlook for the corporate bond market in Q4 2024, VNDirect expects a resurgence in maturity pressure after a slight cooling-off in Q3. They estimate that nearly VND 77 trillion in private corporate bonds will mature in Q4, a 99.1% increase from Q3.

The Real Estate group has the highest proportion, with 35.8% of the total maturing bond value in Q3, followed by the Manufacturing group with a 34.2% share.

The Banking group is anticipated to maintain their bond issuance activity in Q4. In Q3, banks were active in repurchasing bonds with maturities of less than one year while also focusing on issuing long-term bonds to reduce short-term capital mobilization ratios and increase long-term capital mobilization.

For Q4, analysts estimate that more than VND 40 trillion of outstanding bonds from the Banking group will shift from having more than one year remaining maturity to less than one year. As a result, it is likely that banks will continue to increase their issuance of long-term bonds in the next quarter to replace and repurchase these soon-to-mature bonds.

The New Push for Corporate Bond Market

The Vietnamese corporate bond market has been on a notable recovery path since the crisis in 2022 and the first half of 2023. While it aims to become a long-term capital mobilization channel, sharing the burden with the banking system, there are numerous aspects of the corporate bond market that need improvement. A key catalyst for the market’s future growth is considered to be credit ratings.

Enterprise Private Bonds: A Playing Field for Professionals Only, Inadvisable for Retail Investors

The proposed amendments to the current Securities Law aim to foster a stable development phase, paving the way for a more transparent market recovery and preventing past risks from reoccurring. This is according to experts in the field, who emphasize the importance of creating a robust foundation for the market’s rebound.