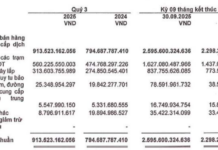

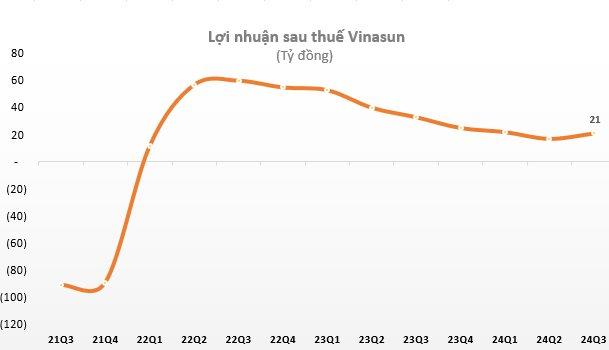

Vietnam Sun Joint Stock Company (Vinasun, code VNS) announced its business results for Q3 2024 with revenue of VND 246 billion, down 21% over the same period last year, and this is also the lowest quarterly revenue in over 2 years of this taxi company. Although cost of goods sold decreased, it remained high, causing the company’s gross profit to decrease by 33%, reaching VND 45 billion.

Vinasun’s financial revenue decreased by 56% to VND 3.6 billion, while expenses did not decrease significantly. As a result, Vinasun’s after-tax profit was over VND 21 billion, down 36% compared to the same period last year.

For the first 9 months of the year, Vinasun’s revenue reached VND 778 billion, down 17% over the same period. After-tax profit was approximately VND 60 billion, down more than 52% compared to the previous year.

Explaining the sharp drop in profit, Vinasun’s management board said that in Q3, the company’s revenue decreased by 21% compared to the same period last year, while the company continued to maintain its policy of supporting drivers and partners. From the beginning of the year, the company’s management board has identified that the taxi business this year faces fierce competition, along with the company’s adjustment of the policy to support drivers and the revenue-sharing ratio.

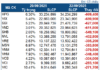

In 2024, Vinasun set a target of VND 1,010 billion in total revenue and VND 81 billion in after-tax profit, down 11% and 47%, respectively, from the previous year. Thus, as of the end of Q3 2024, Vinasun has completed 70.3% of its revenue plan and 74.4% of its profit plan.

As of September 30, 2024, Vinasun’s total assets increased by VND 159 billion to VND 1,812 billion. Of which, fixed assets accounted for VND 1,173 billion, or 65% of total assets, and cash and short-term financial investments were VND 293 billion, or 16% of total assets.

Launched in 2003, Vinasun used to be the dominant taxi company in the Southern market, with revenue in the thousands of billions of VND each year. However, the emergence and rapid development of ride-hailing companies such as Grab and GoJek have shrunk Vinasun’s market share, leading to a continuous decline in its business performance.

In the context of increasingly challenging business conditions, major shareholders have also continuously sold their shares to reduce their holdings in Vinasun.

Accordingly, Tael Two Partners Ltd. – a shareholder from Singapore, has continuously sold Vinasun’s shares since October 2023. At that time, the fund owned 18.3% of the charter capital, and now it only holds 10.97%.

Most recently, from October 30 to November 28, Tael Two Partners Ltd. continued to register to sell 1 million VNS shares to reduce its ownership to 6.44 million shares, equivalent to 9.49% of the charter capital.

In the stock market, VNS shares have continuously declined since the beginning of the year. As a result, VNS shares fell 16.5% to VND 10,350/share (closing price on October 25).

The Electric Car Distributor’s Plight: A Record Loss in Vietnam

“Wuling’s Mini EV is now in Vietnam, distributed by TMT Motor. However, the company has hit a rough patch in the first half of 2024, with losses amounting to nearly 100 billion VND. With short-term debts exceeding short-term assets by 120.7 billion VND, the auditing firm has expressed doubts about TMT Motor’s ability to continue operating.”