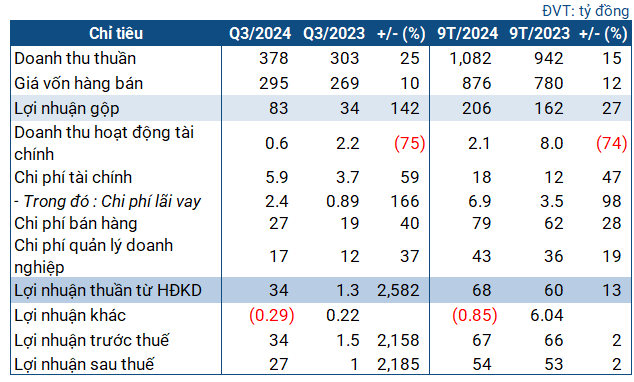

**Business Performance Indicators of HVT in Q3/2024**

|

HVT’s business targets in Q3/2024

Source: VietstockFinance

|

In the third quarter of 2024, the company under the Vinachem group reported net revenue of VND 378 billion, up 25% over the same period last year. Since the cost of goods sold only increased by 10%, the company’s gross profit was VND 83 billion, 2.4 times higher than the same period last year.

The company attributed the impressive revenue growth to the increase in the selling prices of its products during the quarter. Additionally, the introduction of their new disinfectant product, Vi-Chlorine, which has been well-received in the market, also contributed to the revenue boost.

The significant rise in gross profit was the main factor that led to HVT’s strong performance in Q3, despite a sharp decline in financial revenue and a surge in expenses. Ultimately, the company recorded an after-tax profit of VND 27 billion, nearly 23 times higher than the same period last year.

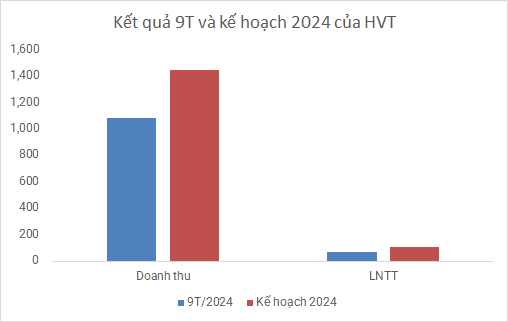

For the first nine months of the year, HVT achieved nearly VND 1,100 billion in revenue, a 15% growth. Its pre-tax and after-tax profits reached VND 67 billion and VND 54 billion, respectively, a 2% increase. These results represent 75% of the revenue target and 64% of the pre-tax profit plan approved by the 2024 Annual General Meeting of Shareholders.

Source: VietstockFinance

|

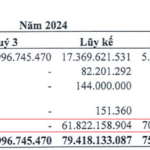

As of the end of September, HVT’s total assets slightly increased to VND 769 billion. However, its short-term assets decreased by nearly 27% from the beginning of the year to over VND 294 billion. Cash and cash equivalents fell by 46%, to over VND 40 billion, while inventory stood at over VND 96 billion, a 31% decrease.

On the capital side, the majority of the company’s liabilities are short-term, which slightly decreased from the beginning of the year to VND 307 billion. This figure exceeds the value of short-term assets, indicating that HVT faces a risk in meeting its short-term debt obligations.

Short-term borrowings amounted to nearly VND 135 billion, a 12% increase from the beginning of the year, while long-term borrowings decreased by 15% to over VND 36 billion. Both are bank loans.

Chau An

“A Stellar Performance: Sonadezi Achieves 87% of Profit Plan in 9 Months”

Sonadezi Corporation (Sonadezi, UPCoM: SNZ), a leading industrial development company, announced its third-quarter financial results, reporting a net profit of over VND 192 billion, an 8% decrease compared to the same period last year. Despite this quarterly decline, the company remains on a strong trajectory, having achieved 87% of its full-year net profit target in the first nine months of the year.

The Controller’s Wife Wants to Sell Her EIB Shares

Mrs. Tran Thi Thanh Nha, the wife of Mr. Ngo Tony, an American citizen and the Head of the Supervisory Board of Eximbank, plans to sell her entire stake in the bank. The sale, which will take place between October 30 and November 8, involves 123,298 shares, representing 0.006% of the bank’s capital. Mrs. Nha aims to recover her investment through this divestment.