KHP’s Q3 2024 Financial Report shows impressive growth with a 12% increase in revenue compared to the previous year.

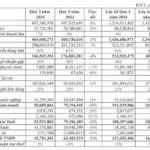

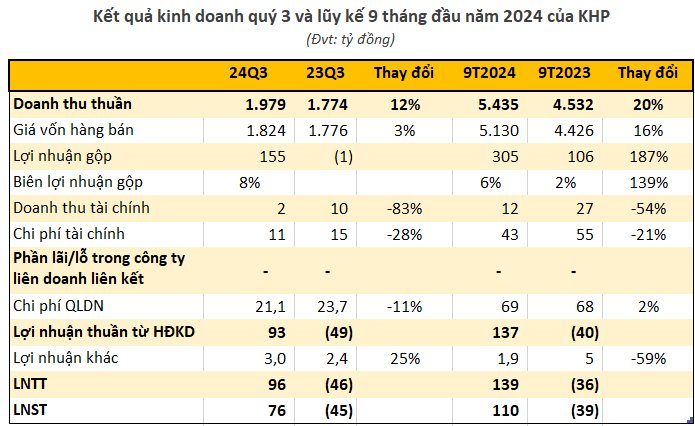

Khánh Hòa Power Joint Stock Company (code: KHP) has just announced its Q3/2024 financial report, with net revenue reaching VND 1,979 billion, a 12% increase compared to the same period last year. After deducting capital expenses, gross profit was VND 155 billion, a significant improvement from the VND 1 billion loss in the previous year.

Financial revenue decreased by 83% to VND 2 billion, while financial expenses were reduced by 28% to VND 11 billion.

After deducting other expenses, this power enterprise reported a pre-tax profit of over VND 96 billion, a significant increase compared to the same period last year (loss of VND 46 billion). Post-tax profit exceeded VND 76 billion.

KHP’s nine-month cumulative results show a 20% increase in net revenue compared to 2023, with a pre-tax profit of VND 139 billion, already surpassing the full-year target.

Nine-Month Cumulative Results for 2024

: KHP’s net revenue reached VND 5,435 billion, a 20% increase compared to the same period in 2023. Pre-tax profit was VND 139 billion, which already surpasses the full-year target of VND 50.1 billion, with a 180% achievement rate after just nine months.

In the revenue structure for the first nine months, electricity sales accounted for the largest proportion at 98%, with a value of nearly VND 5,319 billion, a 20% growth compared to the previous year. Revenue from electricity pole leasing increased slightly by 3% to VND 43 billion. Revenue from the sale of other products, such as electrical construction, survey and design of electrical works, wire installation, and repairs, grew by 28%, bringing in nearly VND 48 billion.

As of September 30, 2024, Khánh Hòa Power’s total assets were recorded at VND 2,264 billion, a decrease of VND 35 billion from the beginning of the year. Of this, cash, cash equivalents, and bank deposits accounted for nearly 20% of total assets, valued at VND 451 billion. In terms of capital sources, owner’s equity reached nearly VND 756 billion, an increase of VND 56 billion from the beginning of the year, with post-tax profit retained at VND 153 billion.

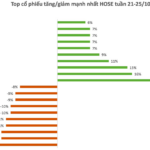

On the stock exchange, following the announcement of the Q3/2024 financial results, KHP shares surged. KHP’s market price reached the ceiling price of VND 11,600 per share (closing price on October 25), with a significantly higher trading volume of over 750,000 units.

Notably, this was the second consecutive ceiling-hitting session for this stock, pushing KHP’s market price to its highest level in 2.5 years (since April 15, 2022).

KHP’s stock price hits the ceiling for the second consecutive session, reaching its highest level in 2.5 years.

KHP stock reaches a 2-year high

‘Harvesting’ Dividends from Subsidiaries, Minh Phu – the ‘Shrimp King’ Reports a Windfall Third-Quarter Profit

Minh Phu reports a remarkable post-tax profit of over 198 billion VND for Q3 2024, a significant improvement from the 13.3 billion VND loss incurred in the same quarter last year. This impressive growth is largely attributed to the dividends received from its subsidiary companies, showcasing the strength and diversity of their business portfolio.

The Stock Market’s New Power Player: DSC Securities Lists on HoSE, Joining the Ranks of Billion-Dollar Brokerages

Over 204.8 million DSC shares were officially listed and traded on HoSE starting October 24th, with a reference price of VND 22,500 per share.

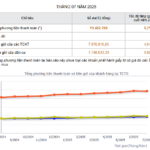

The Stock Market Week of October 21-25, 2024: Short-Term Adjustment Pressures

The VN-Index has been on a downward spiral, slipping below the middle Bollinger Band. This, coupled with trading volumes that remain below the 20-day average, indicates a persistent investor caution. To add to the woes, consistent net selling by foreign investors has also contributed to the mounting pressure on the index.