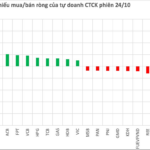

After a promising first quarter, the business situation of securities companies (Securities) slowed down and showed a downward trend in the next two consecutive quarters. In the third quarter, the total pre-tax profit (PBT) of the Securities group reached approximately VND 6,900 billion, equivalent to the same period in 2023 but 7% lower than the previous second quarter.

Figure 1: PBT of the Securities group in Q3 2024 and comparison with previous quarters

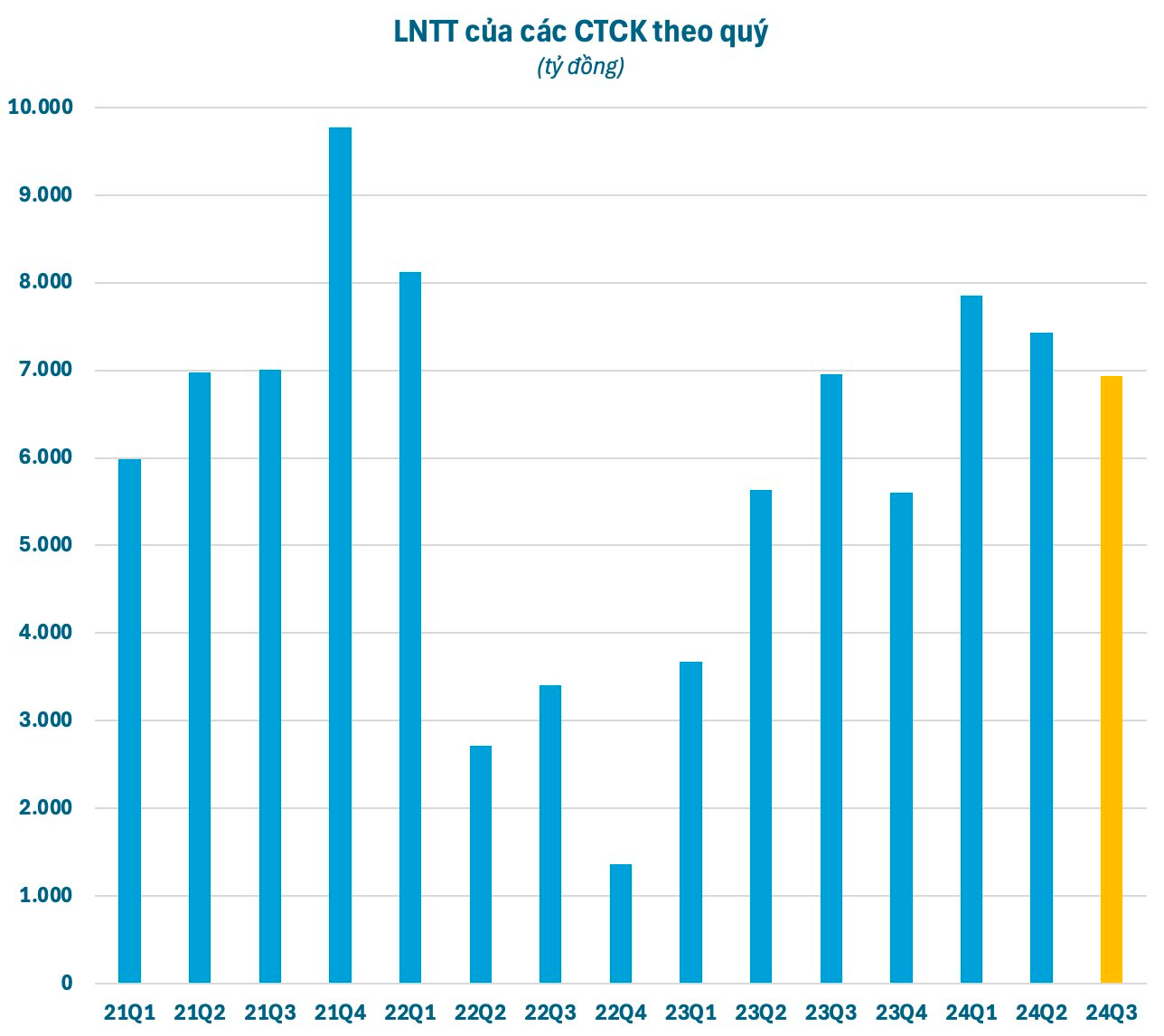

In terms of increase or decrease compared to the previous quarter, the industry’s profits in the third quarter showed a clear polarization. Many securities companies reported a decrease of over VND 100 billion in PBT compared to the second quarter, including SSI, HSC, APG, and especially SHS. On the other hand, some companies like VPS, VNDirect, VIX, and ACBS recorded significant increases in PBT compared to the previous quarter.

In the third quarter, the top 10 most profitable securities companies in the industry all recorded PBT of over VND 200 billion. However, only TCBS made a profit of over VND 1,000 billion, with a PBT of nearly VND 1,100 billion. Nonetheless, TCBS also experienced a decrease in PBT compared to the same period in 2023 and the previous quarter. The losses were mainly incurred by smaller securities companies, with the heaviest loss reported by APG with a PBT of nearly VND 150 billion in the negative.

Figure 2: Top 10 Securities Companies by PBT in Q3 2024

The third quarter was a period of volatile stock market performance, which did not favor the securities companies. The VN-Index fluctuated significantly, especially when approaching the 1,300-point threshold. While the index remained relatively flat compared to the beginning of the quarter, the support was localized and rotational among large-cap stocks. Many Midcap and Penny stocks witnessed sharp declines, which had a non-negligible impact on the proprietary trading activities of the securities companies.

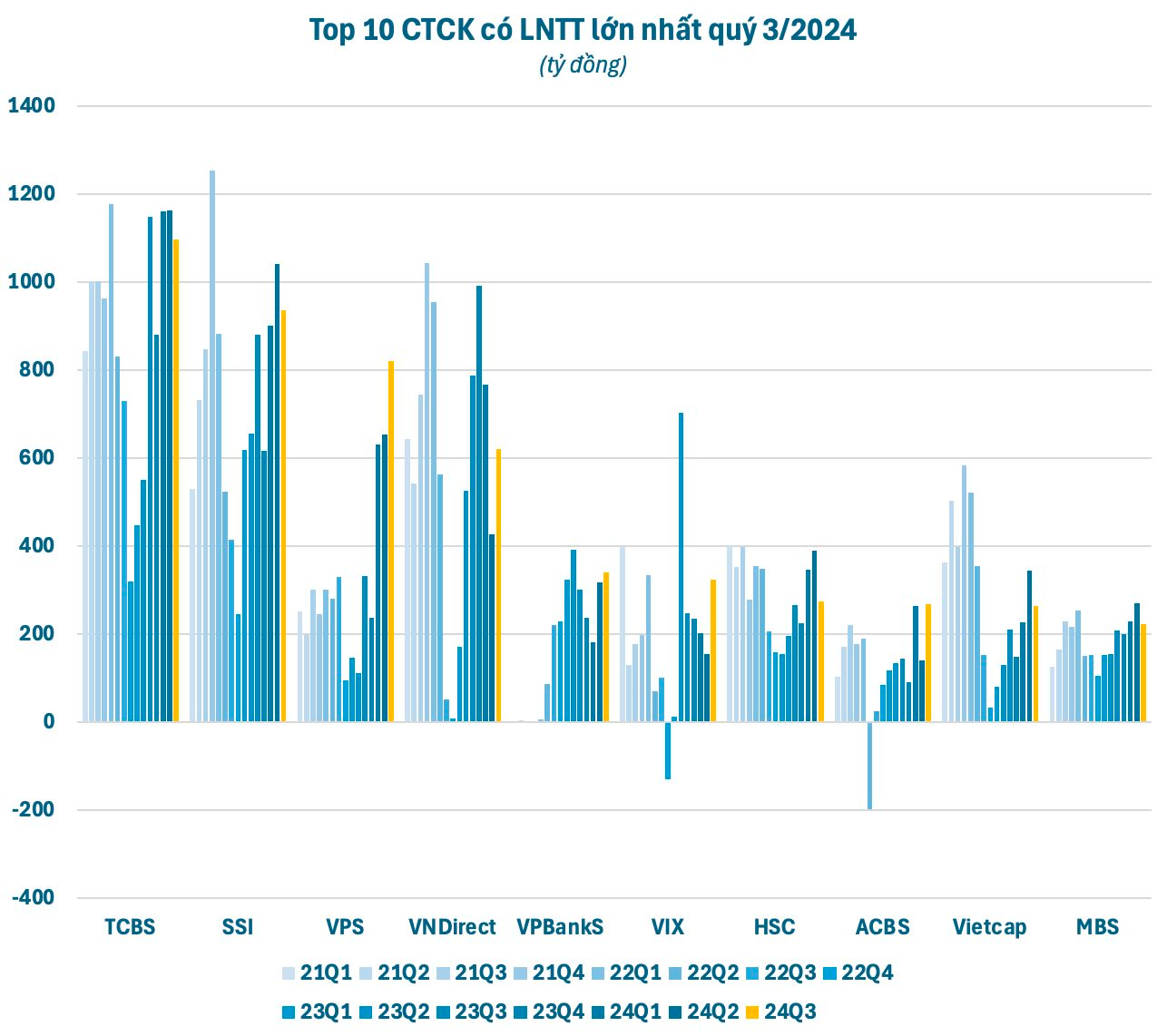

Additionally, the VN-Index’s repeated failures to conquer the 1,300-point threshold affected investor sentiment. Trading in the third quarter was lackluster, with the average value on HoSE falling below VND 15,000 billion per session, 25% lower than the same period in 2023 and the first half of this year.

The decline in liquidity led to a significant reduction in the market share pie for securities companies. Total revenue from this activity amounted to just over VND 3,000 billion, a 28% decrease compared to the same period in 2023 and 23% lower than the previous quarter. This is the lowest brokerage revenue for the securities group in the past five quarters.

Figure 3: Market Share of Securities Companies in Q3 2024

The gross profit margin for brokerage activities of securities companies in Q3/2024 also contracted to less than 14%, down from 25.5% in the same period in 2023 and 20.6% in the previous quarter. Gross profit reached just over VND 400 billion, a 60% decrease compared to the previous year and only half of the figure recorded in the first two quarters of this year.

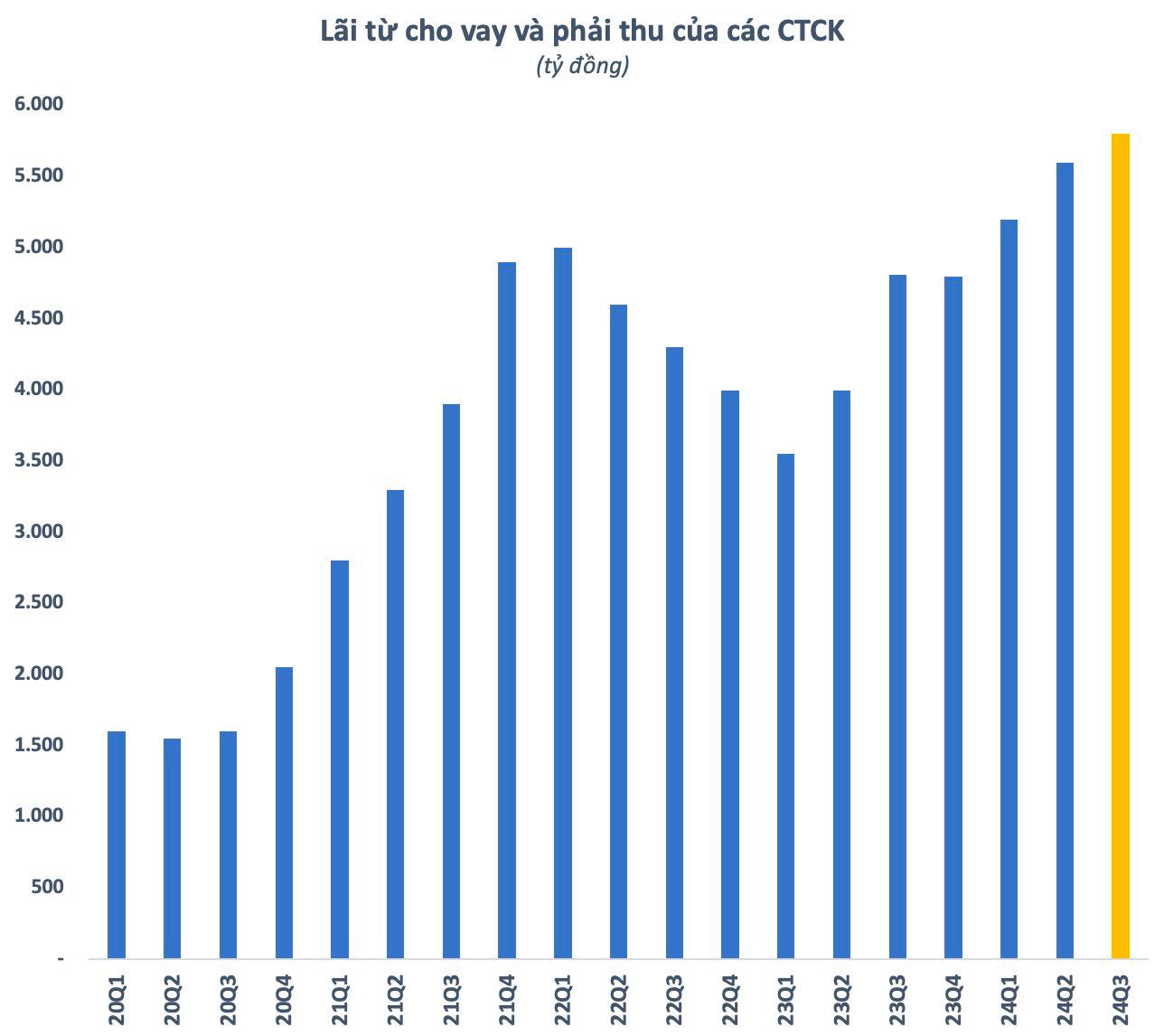

In a context where both brokerage and proprietary trading activities faced challenges, lending became a savior for the profits of securities companies. In the third quarter, interest income from loans and receivables of securities companies was estimated at VND 5,800 billion, up 20% over the same period last year and nearly 4% higher than the previous quarter. This is the third consecutive quarter that this revenue stream has grown compared to the previous quarter and is a record high.

Figure 4: Interest Income from Loans and Receivables of Securities Companies in Q3 2024 and Comparison with Previous Quarters

Figure 5: Market Share of Securities Companies in Terms of Interest Income from Loans and Receivables in Q3 2024

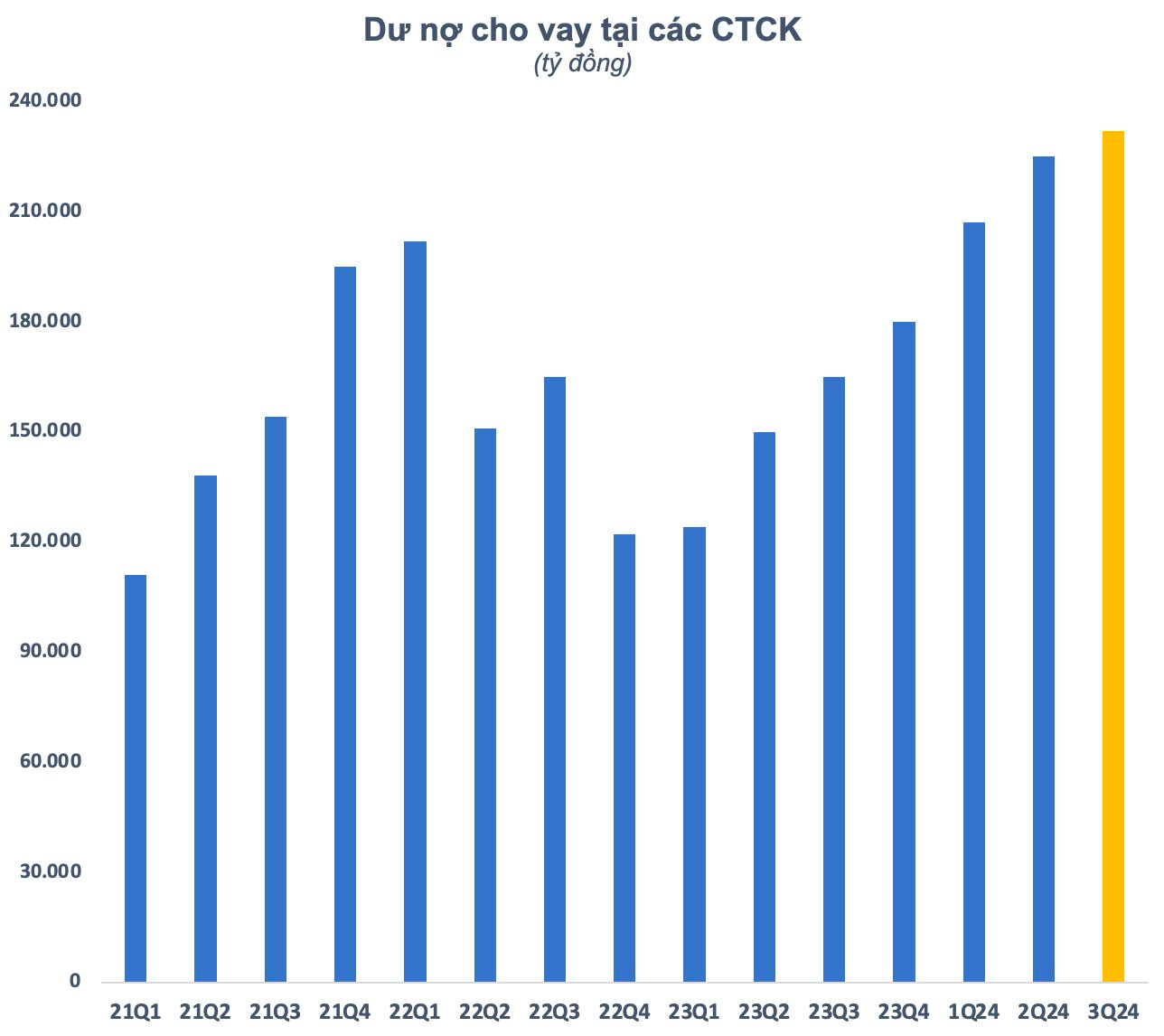

Despite the relatively low lending interest rate environment, the outstanding loans at securities companies continued to increase. After six consecutive quarters of growth, the total outstanding loans in the market reached a new record of VND 232,000 billion at the end of the third quarter. While this activity was vibrant, the demand for loans did not solely come from individual investors but also from deals between institutions and business leaders with securities companies.

Overall, the third quarter was not a favorable period for securities companies. The situation is expected to improve in the coming period with positive influences from the government’s efforts to achieve economic growth targets, the implementation of Circular 68 allowing foreign investors to trade without 100% margin requirements, and more.

However, the securities companies’ operations will still face certain risks, including global uncertainties, escalating exchange rates putting pressure on monetary policy, limited market liquidity, and subdued investor sentiment, all of which are expected to impact their business results in the near future.

Stock Market Ascension: Elevating the Vietnamese Investor

In the recent FTSE Russell review in September 2024, Vietnam remained on the watchlist for a potential upgrade to Secondary Emerging Market status. The country’s prospects for an upgrade are still open, with organizations keeping a close eye on its progress. The next review by FTSE is expected in March 2025, followed by MSCI in 2026, which could potentially elevate Vietnam’s standing in the global financial landscape.

The Stock Market Blues: A Tale of Woes and Worries

The VN-Index has been struggling to conquer the 1,300-point threshold and is now falling deeply from this region.

The Power Players of the Stock Market: When Prop Desks and Foreign Investors Unite for a Buying Spree

Self-net buying was 499.5 billion VND, with matched orders accounting for 338.3 billion VND of net buying. Foreign investors had a net buy of 456.1 billion VND, with matched orders contributing 398.5 billion VND to this figure.