After two consecutive weeks of decline, the VN-Index not only moved away from the strong psychological resistance of 1,300 points but also retreated to near 1,250 points – the lowest level this month.

Struggling to Break Out

Up to now, individual investors have almost lost faith in the growth cycle or the “Century Uptrend” touted by some securities consultants. Most of them have “turned off their apps” and temporarily halted trading, causing the stock market to become even more lackluster. It only takes a not-too-large selling force to plunge the entire market into the red.

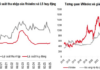

Mr. Bui Van Huy, Director of Ho Chi Minh City Branch – DSC Securities Company, pointed out several domestic and international factors that caused the stock market to decline. Firstly, the global stock market is weakening, with indices in many large markets such as the US, Europe, and Japan peaking; Chinese stocks plunged after a sharp rise earlier this month. Next, the yield on US government bonds surged, and the US dollar quickly strengthened as the DXY index rose to the 104-point region, putting pressure on the USD/VND exchange rate.

“Domestically, expectations for a bull market seem to be fading. The stock market upgrade will have to wait at least another year, while many stocks have risen quite strongly in the past time. After the season of reporting third-quarter business results in 2024, the stock market will fall into a trough of information, the pressure of corporate bond maturity at the end of the year is still large, and the risk of bad debts in banks tends to increase. Therefore, it is normal for the VN-Index to adjust and this may last until early December,” said Mr. Bui Van Huy.

However, Ms. Nguyen Thi Thao Nhu, Senior Director of Individual Customers – Dragon Capital Securities Company (VDSC), opined that the VN-Index moving sideways in the range of 1,280 – 1,300 points, along with low liquidity, and now retreating to 1,250 points, is an opportunity for investors to profit if they can take advantage of the resistance and support levels around 1,250 – 1,300 points.

“Overall, the stock market is still in a fairly long uptrend, starting from the beginning of November 2023 until now. The differentiation between stocks will become stronger when the driving force is not as strong as in the early stages of the year,” said Ms. Thao Nhu.

Mr. Vu Tuan Duy, Market Strategy Specialist, Strategy Analysis Center – SHS Securities Company, assessed that in the medium term, calculated in months to one year, the overall liquidity of the economy is the main factor determining the stock market. As for factors such as business results, they are only one of the necessary conditions that affect psychology and behavior in trading. If the sufficient conditions are not met and the necessary conditions are not too prominent, the stock market will struggle to break out.

Investors are discouraged as the market repeatedly struggles at the 1,300-point threshold, but experts remain optimistic about the prospects. Photo: Lam Giang

Waiting for Bottom-fishing Cash Flows

According to Mr. Vu Tuan Duy, investors’ trading psychology is still considering the 1,300-point threshold as a very “stiff” resistance level, and the stock market has made many attempts to conquer it but has failed due to insufficient cash flow and a lack of consensus among investors to break through.

However, the months of November and December 2024 are expected to be more favorable for the VN-Index, as the pressure on the exchange rate eases and the Federal Reserve (Fed) is expected to have two more policy meetings with hopes of further interest rate cuts. Mr. Duy and other experts anticipate that the Fed’s continued interest rate cuts in the last two months of the year will be a driving factor for foreign capital to return to frontier and emerging markets, including Vietnam.

Ms. Nguyen Thi Thao Nhu believed that if China’s recently announced economic stimulus measures could revive the country’s growth, it would have a positive impact on Vietnam, given the significant trade between the two economies. On the other hand, the risk of escalating conflicts in the Middle East region is a factor that needs to be cautiously considered in the short term.

“In the remaining months of 2024, the VN-Index is expected to conquer the range of 1,334 – 1,380 points, reflecting the growth rate of third-quarter profits corresponding to the expected P/E valuation of 14.5-15 times. Banking and real estate stocks can continue to recover and grow as the government is making strong efforts to bring the amended Laws on Real Estate Business, Housing, and Land into life,” Ms. Thao Nhu analyzed.

Regarding the impact of exchange rates on the stock market, Mr. Dinh Quang Hinh, Head of Macroeconomics and Market Strategy Department – VNDIRECT Securities Corporation, said that the pressure on the exchange rate this time is only temporary. The stock market is expected to soon witness bottom-fishing cash flow as the VN-Index falls to the strong support zone of 1,240 – 1,245 points, and the probability of breaking through this support zone is low.

According to Mr. Bui Van Huy, in the long run, there is still a certain level of optimism about the stock market. The third-quarter production and business results were not too surprising but still showed a solid recovery of the economy. Sectors that benefit from the recovery process, such as banking, securities, consumer goods, retail, and industry, will continue to grow in profits.

Many experts said that in this deep correction phase of the VN-Index, investors can pay attention to groups of stocks with positive business prospects, such as banking, residential real estate, and import-export groups (textiles, seafood, wood). In addition, industrial real estate stocks and those benefiting from public investment are also expected to perform well.

Awaiting a Boost from Foreign Investors

Regarding the implementation of Circular 68/2024/TT-BTC of the Ministry of Finance on supporting and promoting the participation of foreign investors in the Vietnamese stock market, a representative of Vietcap Securities Company (VCI) said that they are actively preparing business processes, human resources, systems, risk management mechanisms, and capital sources to implement this policy. As a company leading the market in terms of foreign brokerage market share with more than 30%, Vietcap has been in contact and exchanged information with foreign institutional investors, management agencies, market members, and consultants about trading stocks without requiring sufficient funds when placing orders (Non-prefunding).

“We are in the process of issuing private placement shares to raise new capital, strengthen our financial capacity for business activities, including the implementation of Non-prefunding services, complete internal procedures, and start testing the system, ready to deploy right on November 2 when Circular 68 takes effect,” said the representative of Vietcap.

“Equities Next Week (Oct 28 – Nov 1): Testing Investors’ Patience”

The gloom that has enveloped the stock market in recent days has cast a shadow over investor sentiment, with the VN-Index consistently shedding points to hover perilously close to the 1,250 mark.

The Great Bank Heist: How Did the Tycoons’ Assets Vanish into Thin Air?

Last week, a number of banks, including Eximbank, ACB, and Techcombank, witnessed a notable dip in their stock prices, despite having reported robust financial results.