In a recent letter to investors, the head of the Pyn Elite Fund, Petri Deryng, offered a positive outlook on Vietnam’s economy, projecting an impressive GDP growth rate of 6.5% for 2024.

Last week, the National Assembly devoted the entire sixth working day of the 8th session of the 15th National Assembly to discussing various matters, including the implementation of the public investment plan for the state budget in 2024, the expected public investment plan for the state budget in 2025, and certain adjustments and supplements to the state budget estimates. Mr. Petri Deryng anticipates that public investment will positively stimulate both the private sector and domestic consumption, especially amid the global economic growth outlook, which remains fraught with risks.

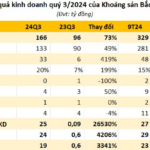

Discussing the third-quarter earnings season, the head of the Pyn Elite Fund forecasts a profit growth rate of around 20-30% for listed companies. Banks, in particular, are expected to deliver robust results, outperforming the average profit growth of the overall market. Looking ahead, bank profits for the next 12 months also appear relatively positive, with stock valuations currently lower than their historical levels when considering profit growth rates. Investor interest in the sector has been growing recently, and several securities firms have issued new buy recommendations for bank stocks.

Another notable factor is the exchange rate story. According to Mr. Petri Deryng, the USD/VND exchange rate has been volatile in 2024, rising at the beginning of the year, then falling sharply, and now trending upward again. A weaker VND against the USD often impacts the psychology of the stock market. Over the past three weeks, the VND has depreciated by -3.5% against the USD, influencing investor sentiment.

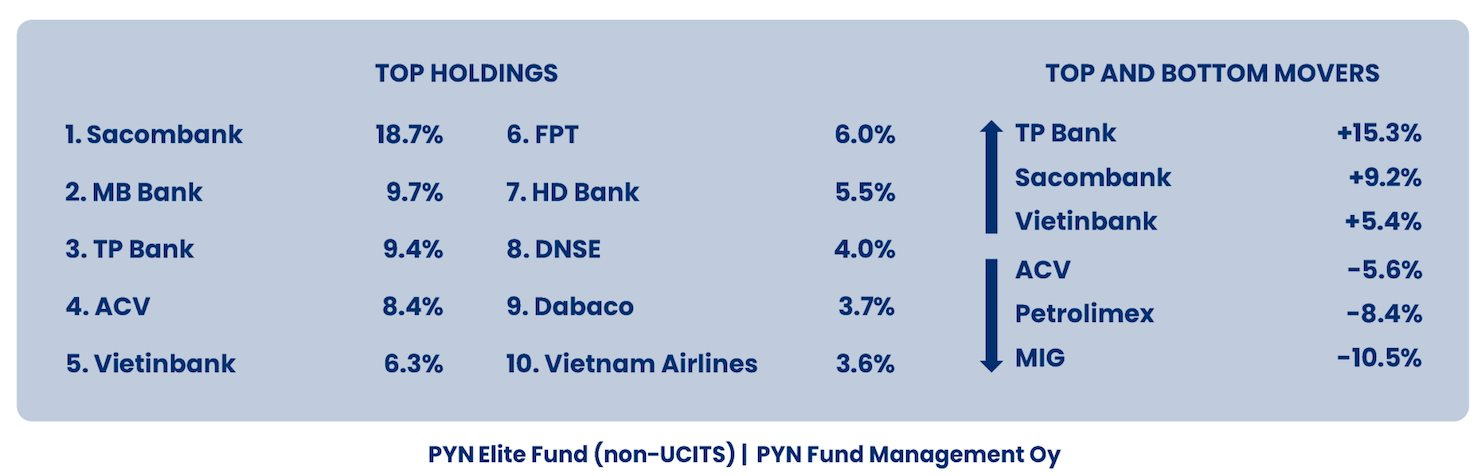

Turning to the Pyn Elite Fund, the fund recently announced a strong performance for September, with a 3.4% increase attributed to the robust performance of banks in its portfolio. For the first nine months of the year, the Pyn Elite Fund’s investment performance reached an impressive 20.61%, outpacing the broader market’s gain of over 13%.

The foreign fund’s managed portfolio size stood at 831 million EUR (~22.6 trillion VND) at the end of September. Among the top 10 largest investments, bank stocks continued to dominate, occupying 5 out of 10 positions: STB, MBB, HDB, TPB, and CTG.

The New Interest: “The Coming Year’s Slashed Interest Rates”

With the Fed and many central banks entering a cycle of cutting interest rates, Vietnam will continue to maintain its accommodative stance to support economic growth. Interest rates are expected to drop by 0.7% in the coming year, providing a boost to the economy and potentially spurring investment and consumption.