Securities companies have lower room than average

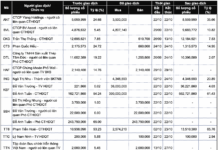

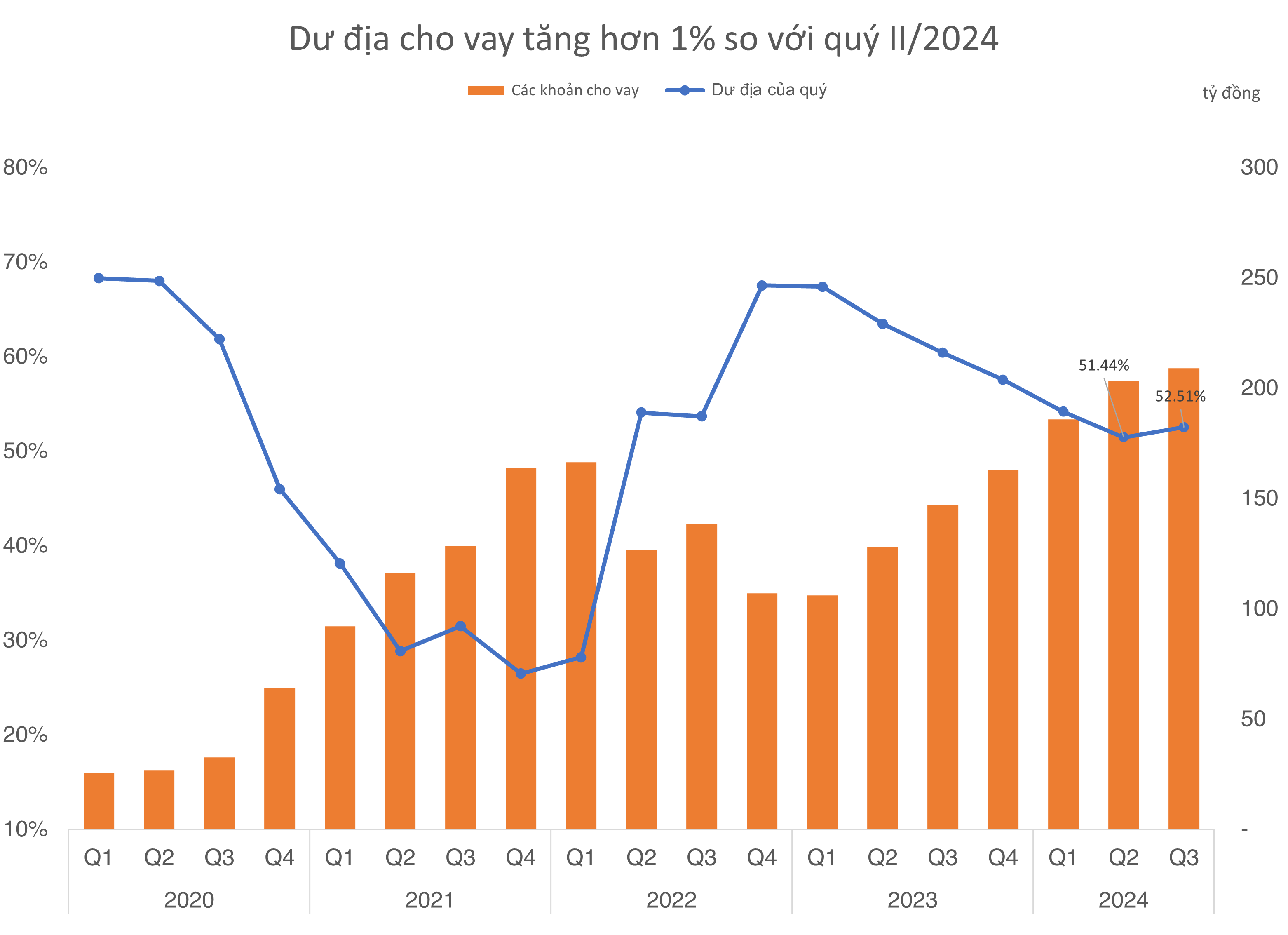

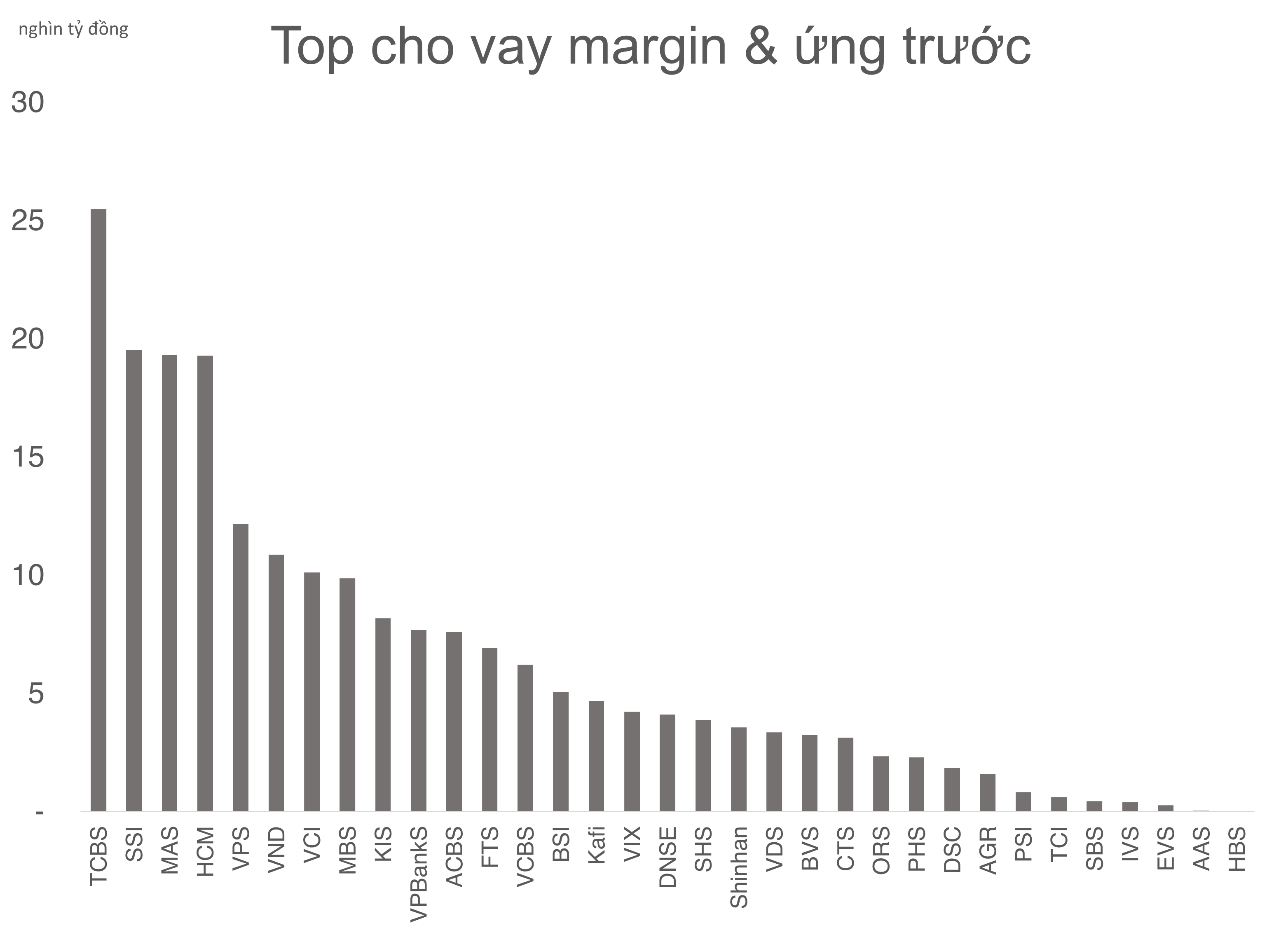

According to statistics, the total margin and advance lending from 33 securities companies (SSCs) in Q3 2024 continued to break records (VND 209 trillion). As the growth rate of debt has slowed down compared to the previous quarter (reaching 2.75%) while many SSCs are continuously increasing capital, the lending capacity of SSCs has improved to 52.5%.

According to regulations, SSCs are not allowed to lend on margin more than twice their owner’s equity

|

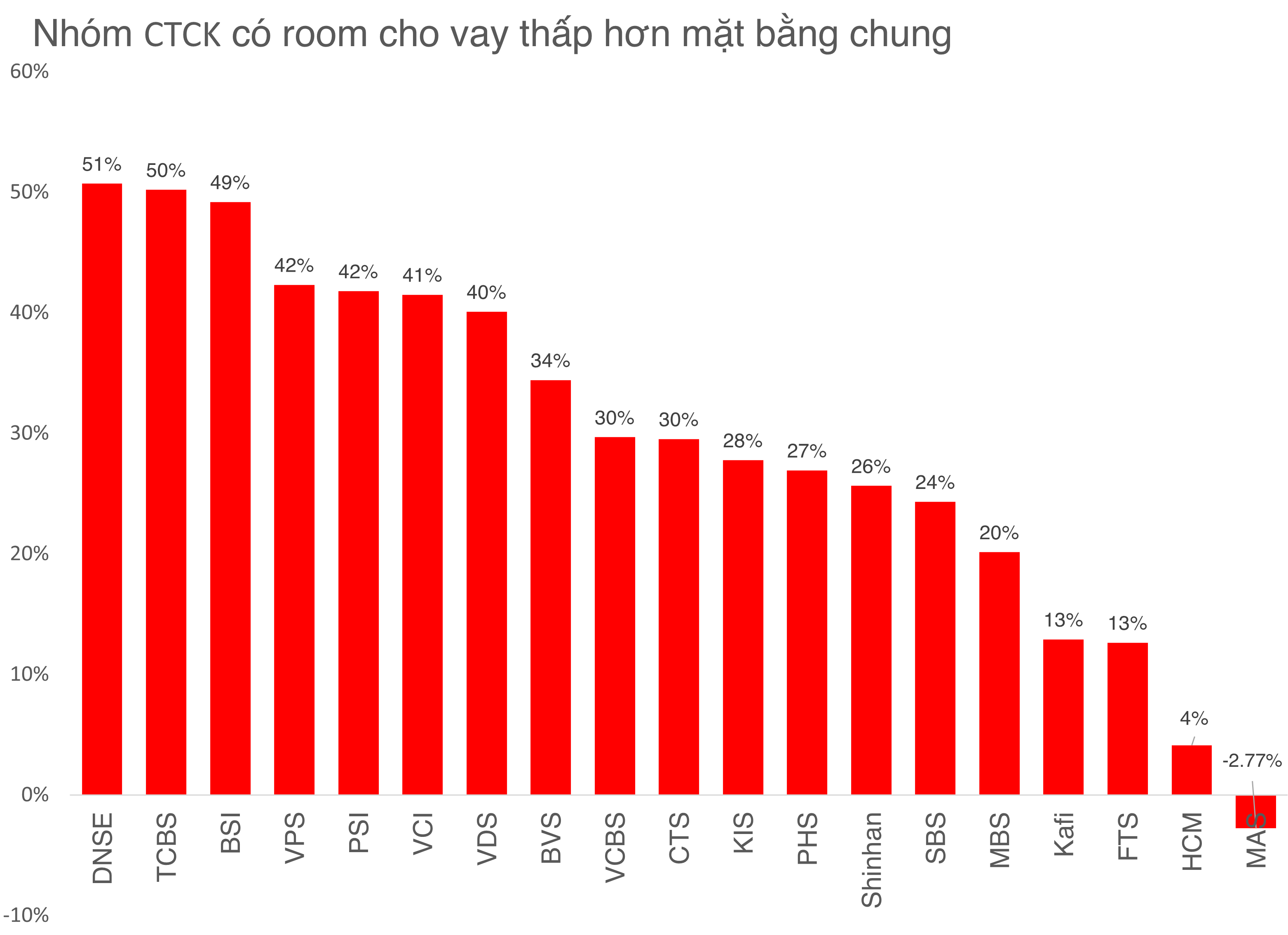

Nevertheless, with the race to expand debt, the remaining lending capacity of many SSCs has also fallen below average and even almost exhausted their ability to provide margin to customers.

The most notable is Mirae Asset Vietnam Securities Company (MAS) after 3 consecutive quarters of expanding debt to nearly VND 19,300 billion, is having debt from lending and receivables exceeding twice its owner’s equity.

Along with that, some SSCs with capital from Korea such as Shinhan and KIS are also in the group with low lending capacity.

There have been SSCs that have almost exhausted their lending capacity

|

For domestic SSCs, HSC (HOSE: HCM) has continuously expanded its debt after completing a new capital increase in Q2 2024. The total value of margin lending and advances of HSC is close to that of large companies such as SSI and MAS.

According to calculations, HSC’s remaining lending capacity (based on twice its owner’s equity) is only about 4%.

Some SSCs still maintain a lending capacity of more than 10% such as FTS and Kafi but are also witnessing a rapid narrowing after continuously expanding debt.

In addition, it is also necessary to pay attention to companies that still have relatively room for lending such as DNSE and TCBS. DNSE has had 4 consecutive quarters of expanding the lending scale, to more than VND 4,100 billion.

There have been SSCs that have almost exhausted their securities lending capacity

|

Meanwhile, TCBS has had 7 consecutive quarters of expanding debt and continues to be the SSC with the largest securities lending scale in the market with a value of more than VND 1 billion.

In parallel with the story of increasing capital

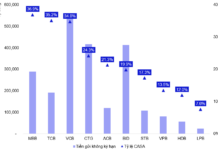

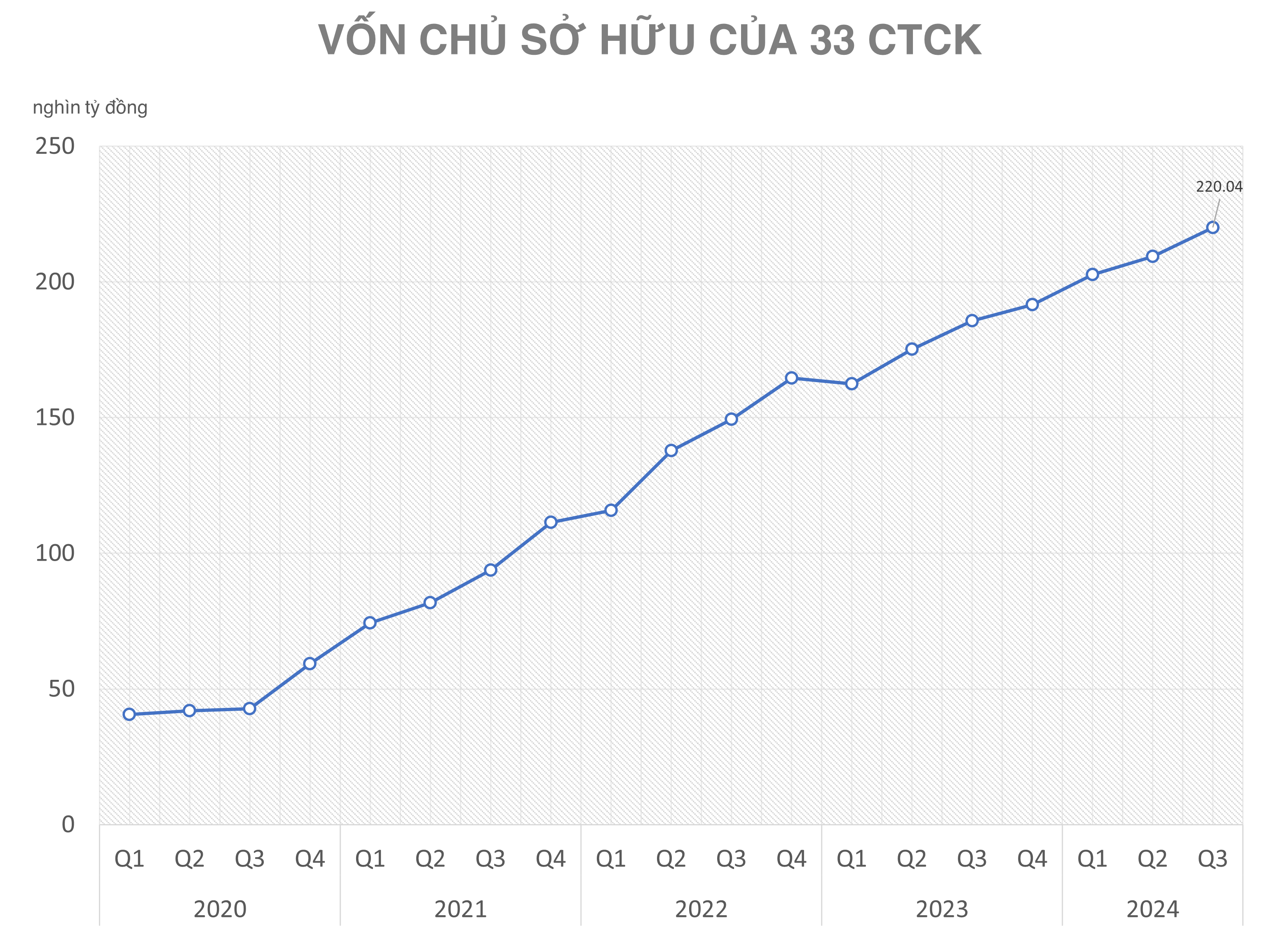

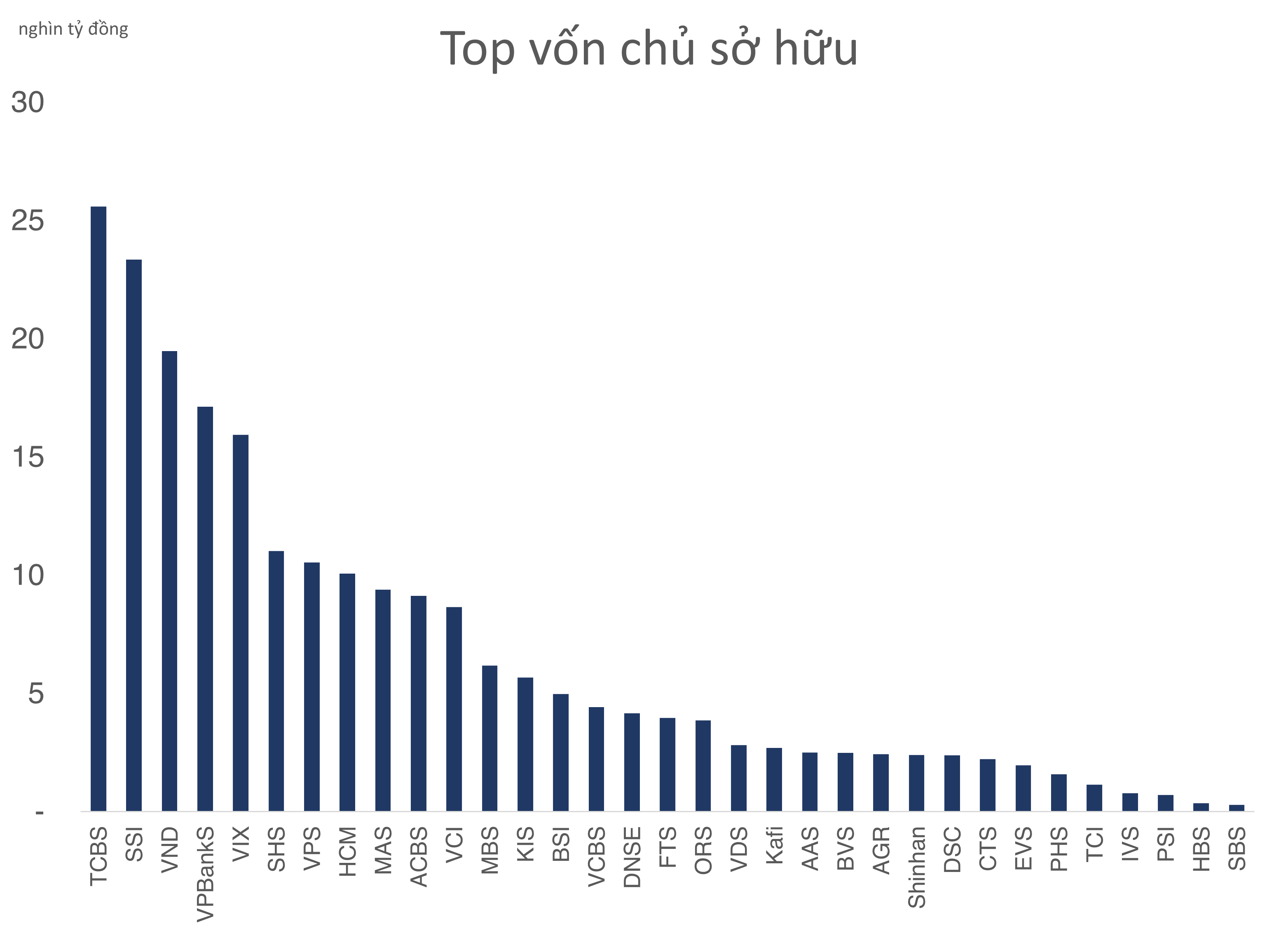

Along with the record debt figures, the scale of capital of SSCs is also continuously expanding. The total owner’s equity of 33 SSCs has increased to over VND 220 trillion. This trend will continue as SSCs are still very determined to implement additional capital increases.

There have been SSCs that have almost exhausted their lending capacity

|

Typical is HSC, after using up almost all of its lending capacity in Q3 2024, announced an extraordinary general meeting of shareholders to seek shareholders’ opinions on a new capital increase. The company plans to hold an online meeting on the afternoon of December 4 with detailed contents not yet announced.

Vietcap Securities (VCI) is preparing to offer for sale 143.63 million shares, equivalent to 25% of the circulating shares at a price of VND 28,000/share. The total expected proceeds from the offering are VND 4,020 billion, of which more than VND 3,500 billion is allocated for margin lending activities.

VCI also left open the plan to issue to strategic investors from Japan, Korea, and Thailand. However, the company may not be able to complete it in time for this year as it is in the process of negotiation.

Owner’s equity of SSCs at the end of Q3 2024

|

Meanwhile, SSCs with strong lending capacity such as SSI and ACBS are also in a hurry. Recently, ACB Bank (ACB) announced a resolution to increase capital for ACBS from VND 7,000 billion to VND 10,000 billion. The new capital increase will be implemented after being approved by the State Securities Commission.

It is known that ACBS Securities has continuously implemented two capital increases at the end of 2023 and the beginning of 2024. Specifically, the company increased its capital from VND 3,000 billion to VND 4,000 billion in Q4 2023 and continued to increase it to VND 7,000 billion in Q1 2024.

SSI is increasing capital by issuing 302.22 million shares from owner equity and issuing 151.11 million shares to existing shareholders at a selling price of VND 15,000/share.

Quan Mai

Stock Market Ascension: Elevating the Vietnamese Investor

In the recent FTSE Russell review in September 2024, Vietnam remained on the watchlist for a potential upgrade to Secondary Emerging Market status. The country’s prospects for an upgrade are still open, with organizations keeping a close eye on its progress. The next review by FTSE is expected in March 2025, followed by MSCI in 2026, which could potentially elevate Vietnam’s standing in the global financial landscape.

“A Significant Spike in Margin Lending: DNSE’s Third Quarter Report Shows a 65% Increase in Margin Debt Since the Start of the Year”

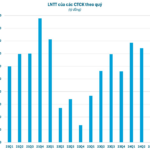

In Q3 of 2024, DNSE Securities’ margin lending outstanding balance witnessed a remarkable 65% year-to-date surge, significantly contributing to the firm’s steady growth trajectory. This quarter, DNSE reported a 12% increase in revenue, totaling VND 193.7 billion, alongside a 10% year-over-year rise in net profit, amounting to VND 44.3 billion, compared to the same period in 2023.

The Flow of Funds: What to Do When Stocks Have Good Earnings but Prices Don’t Rise?

The Q3 2024 earnings season is in full swing, yet market movements have not reflected commensurate reactions. Last week, the VN-Index declined for the first three sessions, rebounded on Thursday, but faltered in the final trading session. The index once again retreated as it approached the 1,300-point mark. The HoSE’s average matching liquidity did not show any significant improvement and even witnessed a slight decline.