At 10:30 am on October 30th, VIB shares of the International Bank were trading at VND 19,000, up 1.33% from the previous session. VIB shares continued to rise after the trading session with a “huge” volume of matched deals totaling over 300 million shares.

The day before, foreign investors had sold 300 million shares of VIB through a matched transaction, equivalent to more than 10% of this bank’s charter capital.

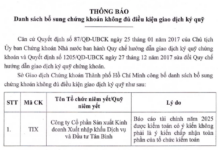

On the same day, the Commonwealth Bank of Australia (CBA) announced that it had sold approximately 10% of VIB’s shares through the Ho Chi Minh City Stock Exchange (HoSE).

The transaction was executed on October 29th, with settlement expected on October 31st, bringing in approximately AUD 320 million, equivalent to over VND 5,300 billion.

VIB share price continues to rise for the second consecutive session after the strategic shareholder divested

According to CBA’s announcement, the divestment aligns with the bank’s strategy to focus on its operations in Australia and New Zealand. Following the completion of the transaction, CBA will hold approximately 5% of VIB’s shares. CBA is one of the leading banks in the Asia-Pacific region and ranks 13th globally.

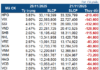

Regarding VIB’s business performance, the financial report for the first nine months of 2024 showed that credit outstanding increased by nearly 12%, higher than the industry average of 9%. In the third quarter alone, VIB’s credit growth reached nearly 7%, and it was one of the best-performing retail banks in the industry. VIB’s capital mobilization increased by 8%, nearly double the industry average, meeting the capital needs for credit activities.

However, VIB’s pre-tax profit for the first nine months reached VND 6,600 billion, down 21% year-on-year.

The bank explained that the profit decline was due to interest rate support, investment in expansion, and prudent provisioning, with provisions of approximately VND 3,230 billion, up 2% year-on-year, along with a higher provision coverage ratio compared to the previous year.