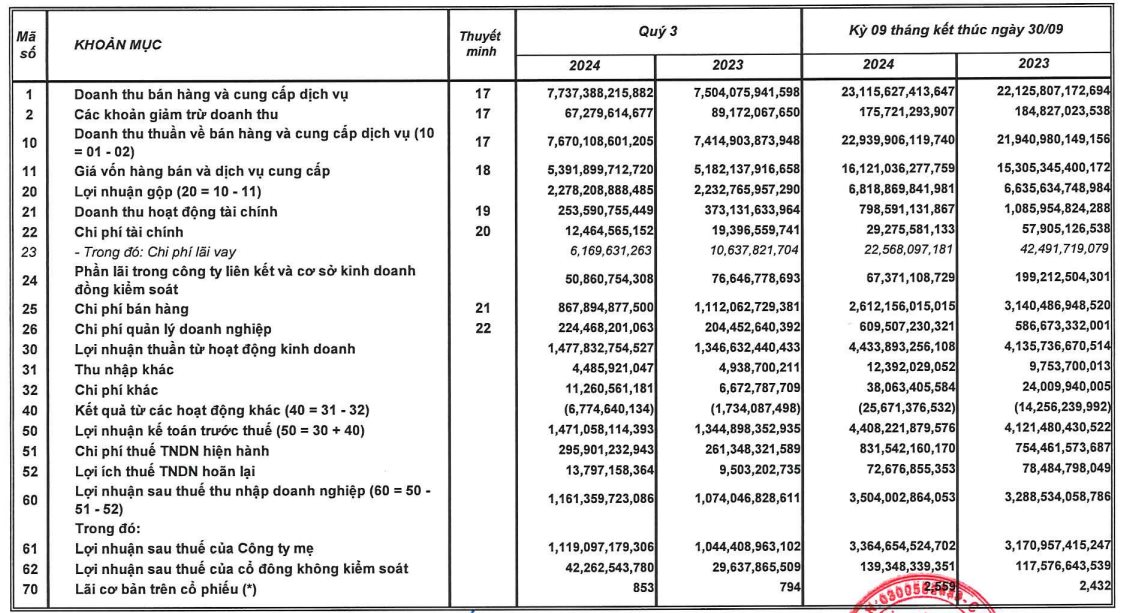

Saigon Beer, Alcohol and Beverage Joint Stock Company (Sabeco, stock code: SAB) has just announced its Q3 2024 financial report, with a slight 3% year-on-year increase in net revenue to VND 7,670 billion. Despite a 4% rise in cost of goods sold, surpassing the growth in revenue, gross profit margin remained healthy at 29.7%, a slight dip compared to Q3 last year.

Additionally, financial income was recorded at VND 254 billion, a 32% decrease from the previous year, while financial expenses decreased by nearly 36% to VND 12 billion.

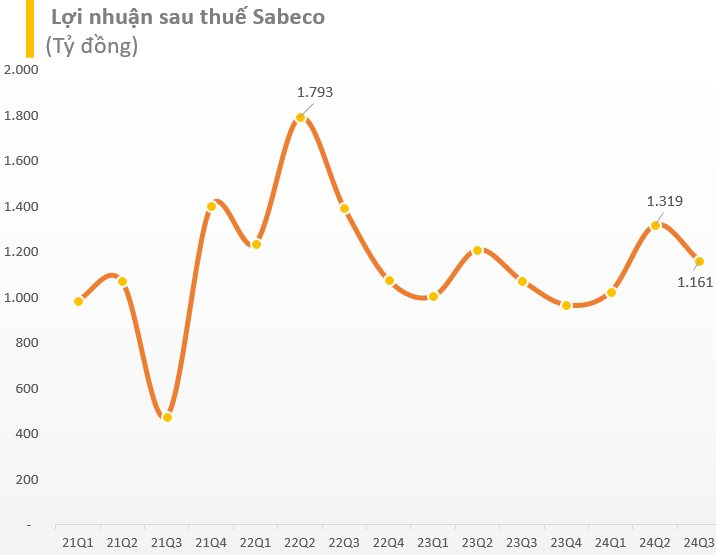

After accounting for various expenses, Sabeco reported a post-tax profit of VND 1,161 billion, an 8% increase compared to Q3 2023. Post-tax profit attributable to the parent company’s shareholders reached VND 1,119 billion, a 7% rise year-on-year.

For the first nine months of the year, SAB recorded net revenue of VND 22,940 billion and post-tax profit of VND 3,504 billion, representing a 5% and nearly 7% increase, respectively, from the same period last year. Thus, Sabeco has accomplished nearly 67% of its revenue target and 77% of its profit goal for the first nine months.

According to Sabeco’s explanatory note, the higher net revenue compared to the previous year was mainly due to the positive impact of price increases, an improved economy, the stringent enforcement of Decree 100, and intensifying market competition. Similarly, net profit remained higher due to increased gross profit and lower selling expenses, partially offset by reduced interest income and lower profits from joint ventures and associates.

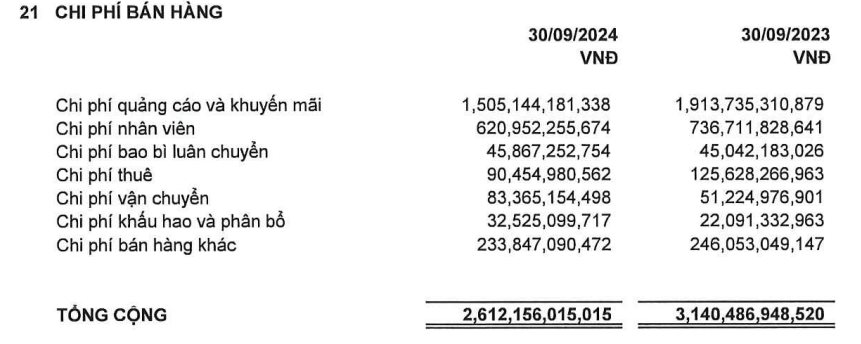

As per the financial statement notes for the first nine months, Sabeco recorded selling expenses of VND 2,612 billion, a nearly 17% decrease year-on-year; with advertising and promotion expenses accounting for the largest proportion at 58%, amounting to VND 1,505 billion, a 21% decrease compared to the same period last year.

As of September 30, 2024, Sabeco’s total assets amounted to VND 32,234 billion, a 5% decrease from the beginning of the year. Cash and bank deposits continued to account for the largest proportion (~70%) of the asset structure, valued at VND 22,414 billion. This generated VND 780 billion in interest income for the company during the first nine months of 2024, equivalent to nearly VND 2.9 billion in daily interest income. The company’s equity at the end of the period stood at VND 26,222 billion, including VND 10,914 billion in undistributed post-tax profits.

Unlocking Profits: Novaland Requests Removal of Stock Warning Post-Record Earnings

Novaland has just released its Q3 financial report, boasting an impressive after-tax profit of VND 2,950 billion, a massive 21.5x increase compared to the same period last year and a record-breaking feat since its listing.

The Heir Apparent’s Accounts Receivable: A Novaland Saga – Unraveling the Financial Mysteries of the Elusive Bùi Cao Nhật Quân in Q3 2024

As per the Q3/2024 financial statements, Novaland reported a long-term receivable of VND 76 billion from Mr. Bui Cao Nhat Quan, son of Chairman Bui Thanh Nhon.