Novaland Group Joint Stock Company (code NVL-HOSE) explains and reports on the progress of overcoming the warned securities situation in Q3/2024.

Specifically: NVL has sent a document to the State Securities Commission (SSC), Ho Chi Minh City Stock Exchange (HoSE), and Hanoi Stock Exchange (HNX) explaining and reporting on the periodic situation of overcoming the warned securities.

Regarding the 2024 semi-annual reviewed financial statements and related explanations as prescribed by law, the company completed the information disclosure (CBTT) on September 26, 2024.

For the Q3/2024 financial statements, the company completed the CBTT on October 30, 2024, in accordance with the provisions on information disclosure in the securities market under Section 14.3.c of Circular No. 96/2020/TT-BTC.

“The company commits to continue to implement the regulations and regimes related to information disclosure to ensure the maximum interests of investors and the transparency of the company,” Novaland’s document states. The company also hopes that the management agency will create favorable conditions for NVL shares to be removed from the warning status in the coming time.

Previously, HoSE put NVL shares on the warning list from September 23 due to the listing organization’s late submission of the 2024 semi-annual financial statements for more than 15 days compared to the prescribed time limit. At the same time, HoSE also put this stock on the margin cut list.

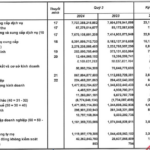

According to the newly published Q3/2024 consolidated financial statements, Novaland recorded consolidated net revenue of VND 2,010 billion, nearly doubling that of the same period (VND 1,073 billion).

Notably, in the third quarter, the company recorded a sharp increase in financial revenue compared to the same period last year, from VND 1,617 billion to nearly VND 3,900 billion.

After deducting expenses, net profit surged from VND 136.75 billion to over VND 2,950 billion, 21.5 times higher than the same period last year. Of which, profit after tax attributed to the parent company’s owners was more than VND 3,100 billion.

According to the company’s explanation, the consolidated profit after tax in Q3/2024 increased by VND 2,813,561,729,646 compared to the same period in 2023, mainly due to the increase in financial revenue compared to the previous year. same period last year. Including the financial revenue in the first 6 months of 2024, which was adjusted down by the auditing unit in the semi-annual review report of 2024 of VND 3,045,661,559,608 due to the Group has fully collected in Q3/2024.

In the first 9 months of 2024, NVL recorded revenue of VND 4,295 billion, 1.5 times higher than the same period (VND 2,731 billion). However, the accumulated profit after tax in the first 9 months was negative VND 4,377 billion; Accumulated loss attributable to the parent company’s owners was over VND 4,100 billion, while the figure in the same period in 2023 was negative VND 841 billion.

In the market, at the end of the session on October 30, the NVL share price slightly increased to VND 10,700/share and decreased by 36% compared to the beginning of 2024. Accordingly, market capitalization is less than VND 21,000 billion.

The Rise of the Securities Companies: Can Masan Reach its Audacious Target of 2,000 Billion VND Net Profit?

In the first nine months of 2024, Masan achieved a remarkable profit of 1.308 trillion Vietnamese dong after allocation of minority interests, surpassing its initial plans by a significant margin. With this impressive performance, the company is well on its way to achieving its ambitious full-year net profit target of 2 trillion Vietnamese dong, as per the positive scenario laid out.

The Rise of Digiworld: Unlocking Growth and Profitability Across Industries

In the first nine months of the year, Digiworld witnessed impressive growth with a revenue of VND 16,219 billion and an after-tax profit of VND 302 billion, reflecting a 16% and 11% increase respectively compared to the same period in 2023.