The last trading session of October witnessed several massive negotiated transactions involving Masan Group’s shares (code: MSN) with a total volume of 76.4 million units. With an average negotiated price of 73,500 VND per share, the total value of these transactions exceeded VND 5,600 billion.

The negotiations primarily took place between foreign investors, while a small portion involved domestic investors. On October 31st, foreign investors sold 78.7 million MSN shares while purchasing 61.3 million, resulting in a net sell-off of 17.3 million shares, equivalent to a value of over VND 1,300 billion, the largest on the stock exchange.

MSN shares concluded October at 76,600 VND per share, a 5% decrease from its peak of over a year but still 15% higher than the beginning of 2024. Its market capitalization stands at approximately VND 110,000 billion.

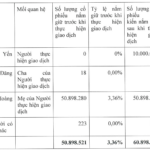

In another development, Nguyen Yen Linh, daughter of Mr. Nguyen Dang Quang, Chairman of Masan Group’s Board of Directors, has registered to purchase 10 million MSN shares to increase her ownership stake. The transaction is expected to be carried out through negotiations and/or order matching from October 29th to November 18th, 2024.

Prior to this transaction, this individual did not hold any MSN shares. If successful, the daughter of billionaire Nguyen Dang Quang will increase her ownership in Masan to 0.66% of the charter capital.

Regarding the third-quarter business results of 2024, Masan Group’s net revenue reached VND 21,487 billion, a 6.6% increase compared to VND 20,155 billion in the same period last year. The growth in the consumer retail business segments helped offset the restructuring of the farm chicken business of Masan MeatLife and the temporary disruption in the operations of Masan High-Tech Materials.

Masan Group’s profit after allocation of non-controlling interests reached VND 701 billion in the third quarter of 2024, a nearly 14-fold increase compared to the same period in 2023, thanks to the growth in the consumer retail segment and savings in borrowing costs.

Notably, WinCommerce (WCM) recorded a 9.1% year-on-year increase in revenue, reaching VND 8,603 billion across its network. WCM’s after-tax profit was VND 20 billion, the first positive figure since the COVID-19 pandemic. As of September, WCM operated 3,733 stores, an increase of 60 stores compared to the second quarter of 2024. The company plans to accelerate the opening of new stores during the year-end shopping season.

Masan: Confident to Achieve 2024 Profit Plan of $86 Million

In Q3 2024, Masan reported a staggering 701 billion VND in profit, an astonishing nearly 14-fold increase compared to the same period last year, and surpassing its quarterly profit plan by 130% in the base-case scenario. The company is now focused on the final quarter, aiming to get closer to its ambitious 2,000 billion VND profit goal for the year.

The Billionaire’s Holdings: A Glimpse into Nguyễn Đăng Quang’s Masan Empire

As of Forbes’ latest calculations, Nguyen Dang Quang boasts a staggering net worth of $1.2 billion. This places him at an impressive 2561st on the global billionaire’s list and cements his position as Vietnam’s 6th richest individual.