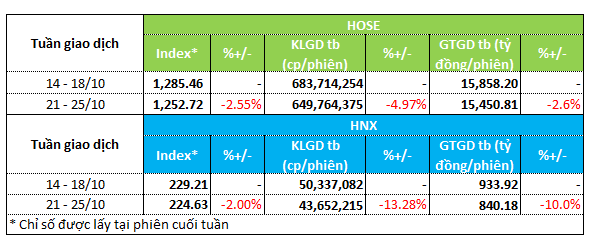

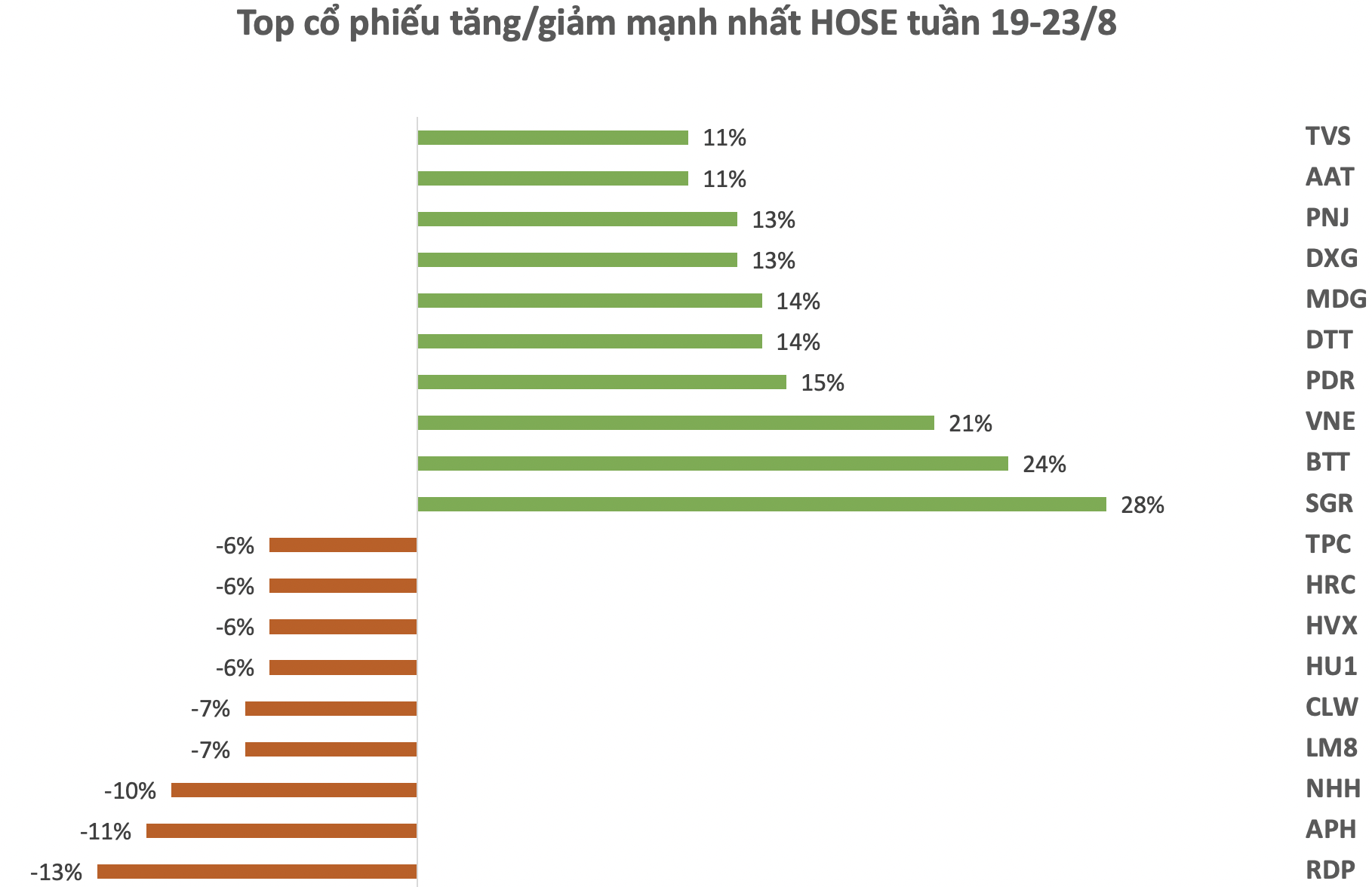

The stock market experienced a subdued trading week from October 21-25, with both market scores and liquidity turning red. The VN-Index fell 2.5% to 1,252.72, while the HNX-Index dropped 2% to 224.63.

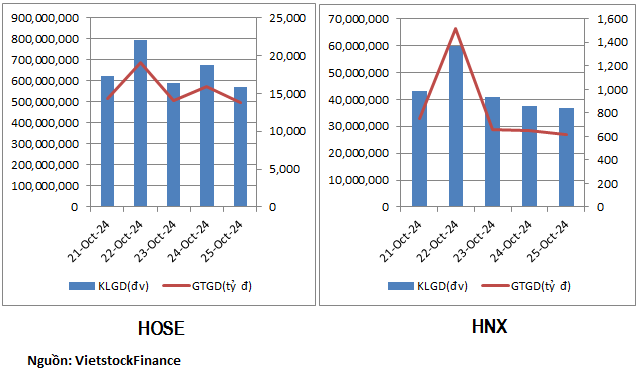

Liquidity slightly decreased on both exchanges. For HOSE, volume and value traded fell 5% and 2.6%, respectively, to 650 million units/session and VND15.4 trillion/session.

The HNX floor recorded a sharper decline, with trading volume dropping over 13% to 43.6 billion units. Trading value also decreased by 10% to VND840 billion/session.

|

Market Liquidity Overview for Week of Oct 21-25

|

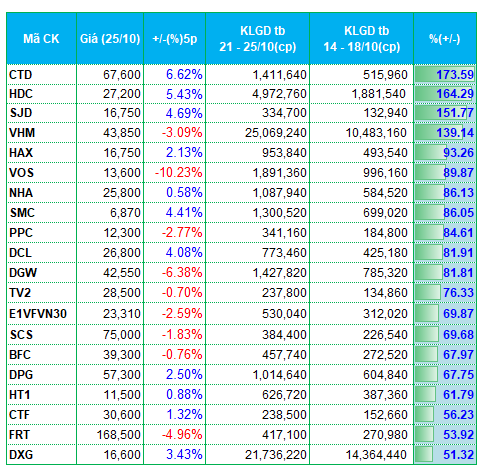

On the two exchanges, many real estate stocks witnessed improved liquidity compared to the previous week. Notable mentions include HDC, with trading volume surging over 160% to nearly 5 million units/session, and VHM, which saw an increase of almost 140% to 25 million units/session.

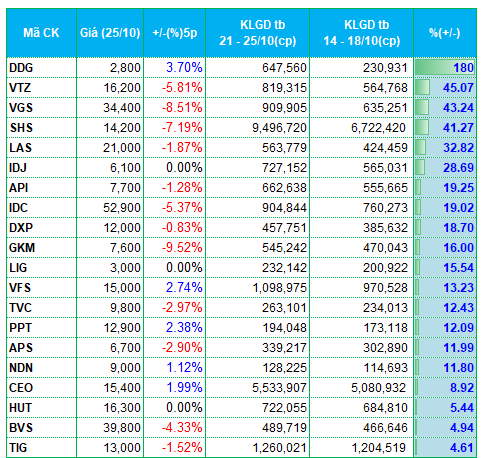

Several other real estate stocks, such as NHA, DXG, IDJ, API, IDC, NDN, CEO, and TIG, also made it to the list of stocks with significant liquidity gains. However, there was still a partial outflow of funds from this group. VPH, IJC, HPX, NVL, NRC, DTD, AAV, VC3, and VC7 experienced substantial declines in liquidity, indicating a divergence in money flow within this sector.

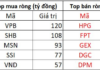

The securities group attracted strong capital inflows on the HNX floor. Several securities stocks on the HNX exchange, including SHS, VFS, TVC, APS, and BVS, were among those with the highest increases in trading volume.

Additionally, two stocks in the automobile distribution group, HAX and CTF, had a positive week in terms of capital attraction. Their trading volumes rose by 93% and 56%, respectively.

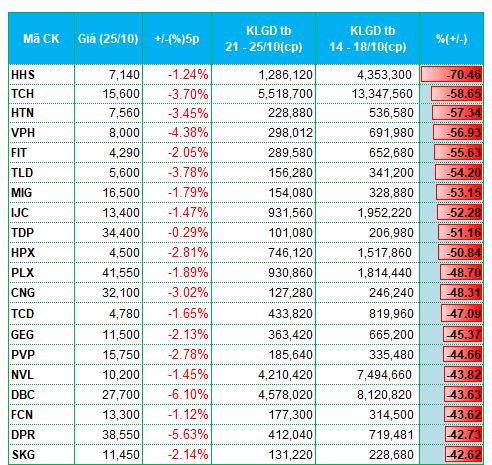

On the other hand, the Hoang Huy duo of HHS and TCH experienced the most significant liquidity declines on the HOSE floor, with trading volumes dropping by 70% and 58%, respectively, compared to the previous week.

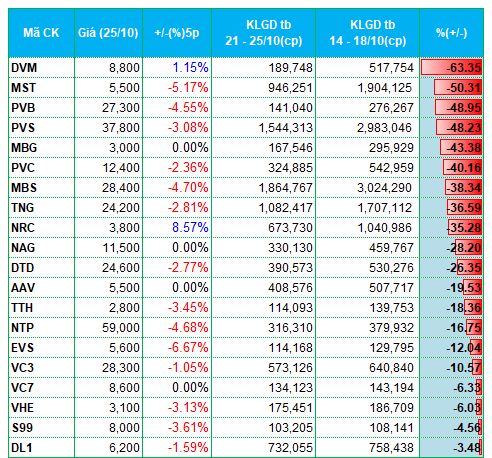

Oil and gas stocks had another uneventful week in terms of capital flow. PVB, PVS, and PVC witnessed trading volume decreases ranging from 40% to 50%. This group had also faced significant outflows in the previous week.

|

Top 20 Stocks with Highest Liquidity Increases/Decreases on the HOSE Floor

|

|

Top 20 Stocks with Highest Liquidity Increases/Decreases on the HNX Floor

|

The list of stocks with the highest liquidity increases/decreases is based on a minimum average trading volume of 100,000 units/session.

The Market Tug-of-War Rages On

The VN-Index slipped back into the red, despite positive effects from the two recent recovery sessions, indicating that the tug-of-war between bulls and bears is still ongoing. Moreover, trading volume remaining below the 20-day average suggests a lack of returning liquidity in the market. Currently, the MACD and Stochastic Oscillator indicators continue to trend downward, reinforcing bearish signals and dampening short-term prospects.

The Dollar’s Turbulent Ride: A Year-End Review of the Volatile Currency Market

Sharing at the Khớp Lệnh program on October 28, 2024, Mr. Nguyễn Việt Đức, Digital Sales Director of VPBank Securities Joint Stock Company (VPBankS), stated that the exchange rate is currently under significant pressure and has been the main factor hindering the stock market’s performance in recent times. He also highlighted the presence of numerous variables that could come into play towards the end of the year.

The Market Beat: A Surprising Rebound Led by Banking and Real Estate Sectors

The VN-Index staged a strong recovery in the afternoon session, buoyed by gains in the banking and real estate sectors. It closed the day up 5.85 points, or 1.264.48%. The HNX-Index also turned green, rising 0.49 points to 226.36, while the UPCoM-Index edged slightly lower, falling 0.08 points to 92.38.

The Stock Market Optimist: Can We Expect a Revival in Liquidity?

The VN-Index rallied and retested the 100-day SMA. A decisive move above this level, coupled with trading volume surpassing the 20-day average, would reinforce the bullish momentum. Notably, the Stochastic Oscillator has provided a buy signal within the oversold region. If this buy signal persists and the index climbs out of this oversold territory in upcoming sessions, the outlook will turn even more positive.