At the VinaCapital Annual Investor Conference, Michael Kokalari, CFA, Director of Macroeconomic Research and Market Strategy, forecasted that Vietnam would achieve a GDP growth rate of 6.5% for both 2024 and 2025.

With consumption accounting for over 60% of Vietnam’s economy (compared to about 25% for manufacturing), stronger consumption will easily offset slower-than-expected export/manufacturing growth next year. The government has announced plans to significantly increase infrastructure investment in 2025, which is also expected to boost consumer confidence and spending.

VinaCapital experts anticipate that the government will promote infrastructure investment and take significant steps to revive the real estate market in 2025. While increased infrastructure spending, accounting for about 5-6% of GDP, may not be enough to boost the Vietnamese economy or consumer confidence on its own, combining it with accelerated infrastructure projects, such as Ho Chi Minh City’s new airport and Hanoi’s new ring road, could make consumers feel more confident about spending due to the “wealth effect” associated with real estate owned by most middle-class consumers in Vietnam.

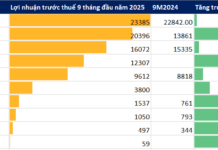

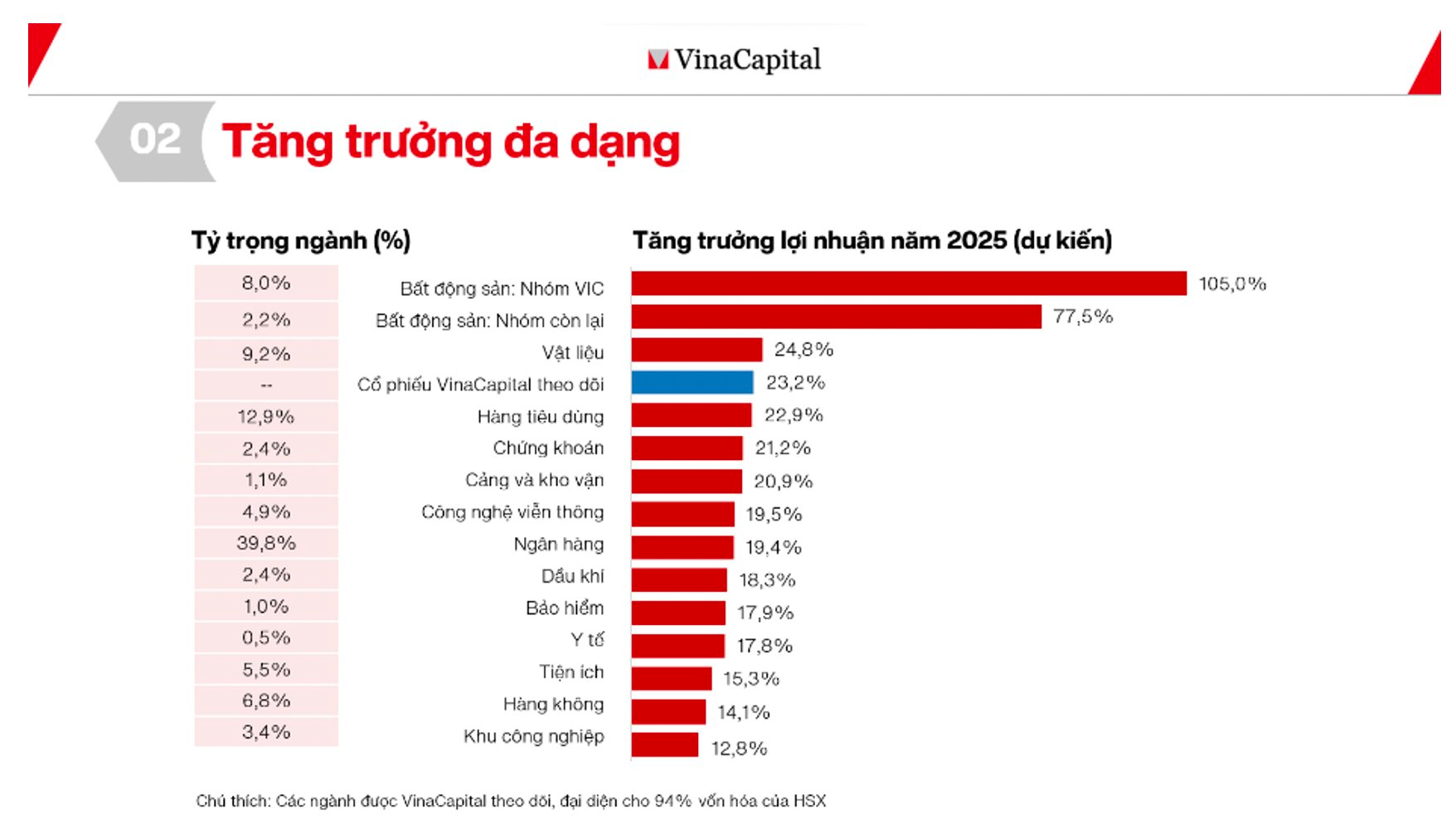

Listed company EPS growth to reach 23% in 2025

Vietnam’s GDP growth transition from being driven by external factors in 2024 to internal factors in 2025 will benefit the stock market, as most of Vietnam’s exports are produced by unlisted FDI companies.

Due to this, among other reasons, VinaCapital predicts that the EPS growth of the VN-Index (VNI) will increase from 18% in 2024 to 23% in 2025.

Additionally, Vietnam’s profit quality is high, as evidenced by the market’s expected return on equity (ROE) of about 16% next year, despite the Vietnamese stock market’s net debt-to-equity ratio of only around 24%.

Both of these metrics are favorable compared to other emerging stock markets in the region (Thailand, Malaysia, Indonesia, and the Philippines). Their ROE ranges from approximately 10-14% (in Asia, only India has an ROE comparable to Vietnam), while their net D/E ratios range from 50-100%.

Furthermore, Vietnam’s projected P/E ratio of about 10x is approximately 25% lower than that of its regional peers, and VinaCapital expects a profit growth CAGR of 17% during 2023-2025, compared to a profit growth range of 3-13% for the four regional countries.

“The Vietnamese stock market’s P/E ratio of 10.1x is also very low compared to its historical levels. The market has only traded at such a low valuation once in the past decade, during the COVID period,” the VinaCapital report stated.

Catalysts for Attracting Foreign Capital in the Coming Period

Despite the positive factors for the Vietnamese stock market mentioned above, foreign investors sold up to $2.6 billion worth of Vietnamese stocks in late September, partly due to concerns about Vietnam’s political transition and the VND exchange rate.

These issues have been largely addressed, and a Fed rate cut could put downward pressure on the value of the US dollar, which typically benefits emerging markets.

Additionally, there has been recent progress in FTSE’s potential reclassification of the Vietnamese stock market from a frontier market to an emerging market due to the government’s new measures that bring the financial system closer to international standards.

According to VinaCapital experts, all these factors are likely to attract foreign investors back to the stock market next year.

The Dollar’s Turbulent Ride: A Year-End Review of the Volatile Currency Market

Sharing at the Khớp Lệnh program on October 28, 2024, Mr. Nguyễn Việt Đức, Digital Sales Director of VPBank Securities Joint Stock Company (VPBankS), stated that the exchange rate is currently under significant pressure and has been the main factor hindering the stock market’s performance in recent times. He also highlighted the presence of numerous variables that could come into play towards the end of the year.

The New Interest: “The Coming Year’s Slashed Interest Rates”

With the Fed and many central banks entering a cycle of cutting interest rates, Vietnam will continue to maintain its accommodative stance to support economic growth. Interest rates are expected to drop by 0.7% in the coming year, providing a boost to the economy and potentially spurring investment and consumption.