Asia-Pacific Securities Joint Stock Company (Apec Securities, code: APS) has just announced that it received an administrative fine from the State Securities Commission of Vietnam (SSC).

According to Decision No. 413/QD-XPHC by the Chief Inspector of SSC, Apec Securities was fined VND 62.5 million for late reporting of the results of selling 8.1 million API shares in 2023.

Specifically, APS registered to sell 8.1 million shares of Asia-Pacific Investment Joint Stock Company (Apec Investment, code: API) from June 6 to June 20, 2023. However, the Hanoi Stock Exchange (HNX) only received the transaction report on August 18, 2023.

In fact, APS was also unable to sell any API shares during the aforementioned period, citing unfavorable market conditions. Following the transaction, the organization’s ownership ratio in API remained unchanged at 11.3%, equivalent to more than 11 million shares.

Notably, the purpose of this transaction was to comply with Decision No. 1041/QD-XPHC dated December 21, 2022, of the SSC, after Apec Securities was administratively sanctioned with a fine of VND 250 million for “failing to register a public offering in accordance with the law.”

Specifically, from September 22 to October 15, 2021, APS purchased 4.5 million API shares, causing the number of shares owned by the company and related parties to exceed the regulated limit (Mr. Nguyen Do Lang, who was then a member of the Board of Directors of both API and APS, and also the General Director of APS), increasing from nearly 8 million to nearly 12.5 million API shares, equivalent to a percentage increase from 22.59% to 35.31%, without registering a public offering.

The remedial measure was for APS to be forced to sell shares to reduce its holding ratio below the threshold requiring a public offering for the violation within a maximum period of six months.

On October 18, APS issued a letter regarding the remedy of the situation that led to the warning and control of its shares. Specifically, APS was put on warning by HNX’s decision dated April 1, 2024, due to negative post-tax profits as of December 31, 2023, and the auditor’s qualified opinion on the company’s financial statements.

On the same day, HNX also decided to place APS shares under control due to negative post-tax profits for 2022 and 2023 in the audited financial statements for 2023.

In explanation, Apec Securities stated that they are in the process of gradually recovering the temporary advance debt of VND 172.2 billion. In addition, APS also focuses on boosting proprietary trading, improving service quality, and minimizing expenses. As a result, net profit in the third quarter of 2024 reached VND 14.1 billion.

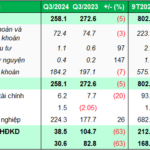

According to the third-quarter 2024 financial report, APS recorded operating revenue of more than VND 41 billion, an 11% decrease compared to the same period last year. Proprietary trading contributed VND 34 billion, a 13% decrease year-on-year.

During this period, operating expenses were reduced by 76% to over VND 19 billion. Thanks to cost-cutting measures, APS reported a net profit of VND 14.1 billion, a 144% increase compared to a loss of nearly VND 32 billion in the same period last year.

For the first nine months of the year, APS’s operating revenue reached over VND 220 billion, just over half of the same period last year. Again, cost savings contributed to a net profit of over VND 49 billion, a significant improvement from the loss of VND 168 billion in the same period last year.

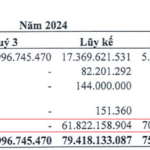

As of September 30, 2024, APS’s total assets amounted to over VND 840 billion, an increase of more than VND 37 billion from the beginning of the year. Loans also increased slightly to VND 152 billion.

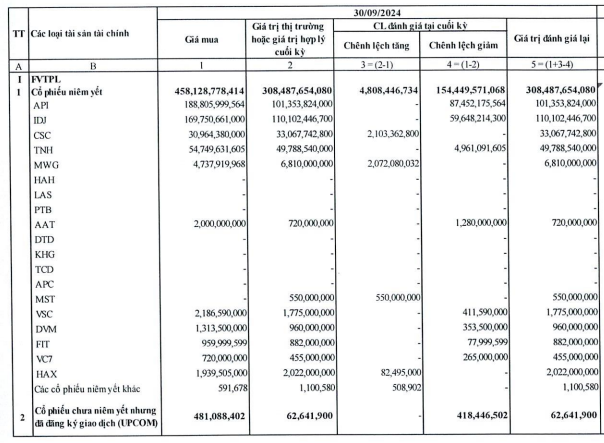

The FVTPL asset portfolio had a book value of over VND 680 billion, an increase of VND 27 billion from the beginning of the year, including VND 458 billion in listed shares, VND 222 billion in unlisted shares, and the remainder traded on UPCoM.

APS’s listed shares portfolio is currently losing VND 150 billion

The listed shares portfolio is temporarily losing nearly VND 150 billion, with the largest proportion held in API, IDJ, and TNH stocks; the most significant gain was in MWG.

The unlisted shares portfolio is also losing about VND 30 billion, with the largest proportion held in Appec Group Joint Stock Company.

Total liabilities decreased by more than half to just over VND 10 billion, with the most notable being VND 4.6 billion in bonds.

“Declining Core Revenue and Soaring Expenses: Unveiling Dragon Capital’s Manager’s Earnings in Q3”

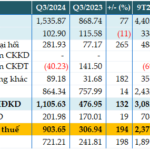

In Q3 of 2024, the financial results of Dragon Capital Vietnam Asset Management JSC (DCVFM) were significantly impacted by a decline in revenue from its two core business segments: advisory and fund management. While revenue from these key areas decreased, management expenses rose sharply, creating a challenging environment for the company.

“Eximbank Triples Pre-Tax Profit in Q3, Borrowing Over VND 1,500 Billion from SBV”

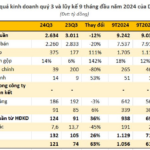

The Q3 2024 consolidated financial statements show that the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Eximbank, HOSE: EIB) posted a remarkable performance with a pre-tax profit of nearly VND 904 billion, tripling its year-on-year earnings.

The Mighty Makeover: “Camau Protein’s Quarterly Profit Plunge: Hoarding a Staggering $9,000 Billion in Cash”

The explanation provided in the consolidated financial statements attributes the almost 63% increase in profit to the reduction in cost of goods sold, which outpaced the decrease in revenue. Additionally, this year’s revenue deductions were significantly lower than those of the previous year, contributing to the substantial growth in profit.