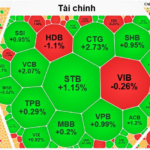

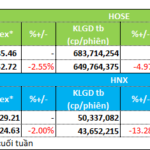

Vietnam’s stock market witnessed a positive rebound despite late-session volatility. The VN-Index closed 31/10 with a gain of 5.85 points, ending at 1,264. Trading liquidity improved compared to the previous session, with the value of transactions on HOSE exceeding VND 18,000 billion.

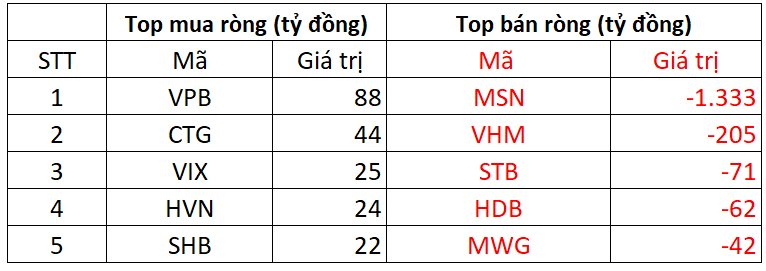

Foreign investors, however, took a different approach, with a net sell value of VND 1,631 billion across the market during this bright session.

On the HOSE, foreign investors net sold VND 1,665 billion.

VPB was the most purchased stock by foreign investors on the HOSE, with a value of over VND 88 billion. CTG and VIX followed, with net purchases of VND 44 billion and VND 25 billion, respectively. HVN and SHB were also bought, with respective values of VND 24 billion and VND 22 billion.

Conversely, MSN was the most sold stock by foreign investors, with 17.3 million units corresponding to a value of over VND 1,300 billion. VHM and STB trailed with net sell values of VND 205 billion and VND 71 billion, respectively.

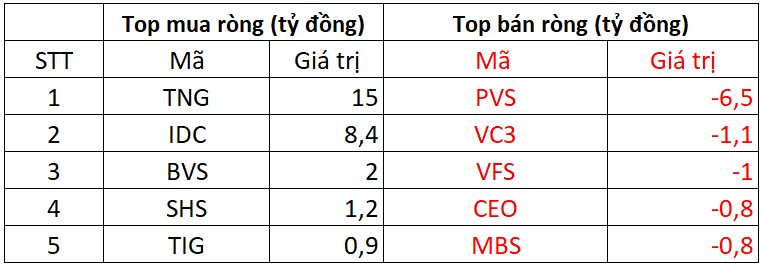

On the HNX, foreign investors net bought VND 18 billion.

TNG was the most purchased stock by foreign investors on the HNX, with a net buy value of VND 15 billion. IDC followed closely, with net purchases of VND 8 billion. Foreign investors also spent a few billion VND each on BVS, SHS, and TIG.

On the opposite side, PVS faced net selling pressure from foreign investors, with a value of nearly VND 6.5 billion. VC3, VFS, and CEO were also among the sold-off stocks, with net sell values of a few billion VND each.

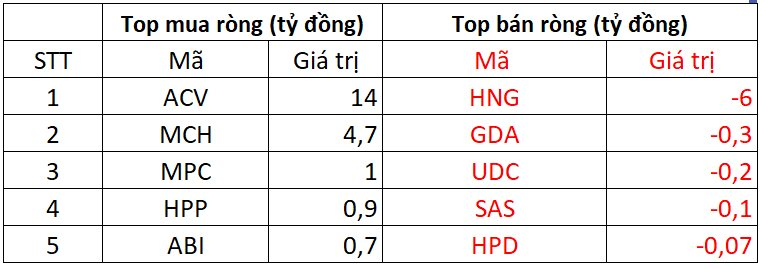

On the UPCOM, foreign investors net bought VND 16 billion.

In terms of purchases, foreign investors focused on ACV, MCH, and MPC. ACV witnessed net purchases of VND 14 billion, while MCH and MPC saw net buys of a few billion VND each.

Conversely, HNG faced net selling pressure from foreign investors, with a net sell value of VND 6 billion. Foreign investors also net sold GDA, UDC, and a few other stocks.

The King of Stocks: VN-Index Surges by Almost 6 Points

The VN-Index ended in the green on a busy day for the stock market king, with market-wide liquidity reaching over VND 19,000 billion, a significant surge compared to the previous session.

The VN-Index Plunges to a 12-Week Low: A Bold Move to Cut Losses and Look to the Future

The market suffered a brutal sell-off in the afternoon, with trading liquidity on both exchanges doubling from the morning session, and stocks plunging across the board. The VN-Index evaporated 1.06% (-13.49 points) and broke through the short-term bottom at the beginning of October, falling to 1257.41 points.

The Cash Flow Conundrum: Unraveling the Divide in Real Estate’s Portfolio.

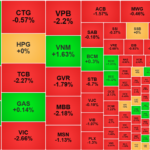

Market liquidity eased slightly in the past trading week. Money flow indicated a divergence among real estate stocks.

The Market Tug-of-War Rages On

The VN-Index slipped back into the red, despite positive effects from the two recent recovery sessions, indicating that the tug-of-war between bulls and bears is still ongoing. Moreover, trading volume remaining below the 20-day average suggests a lack of returning liquidity in the market. Currently, the MACD and Stochastic Oscillator indicators continue to trend downward, reinforcing bearish signals and dampening short-term prospects.