Hoa Sen Group JSC (code: HSG) has just announced its financial report for the fourth quarter of the 2023-2024 financial year (starting from October 1, 2023, to September 30, 2024).

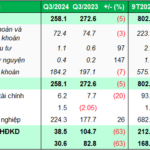

Accordingly, HSG recorded net revenue of VND 10,109 billion, up 25% over the same period last year. However, the cost of goods sold increased more strongly, causing gross profit to decrease by nearly 21% to VND 849 billion.

Financial revenue reached nearly VND 130 billion, up 12% over the same period. All expenses increased sharply, with financial expenses up 59% to VND 98 billion, selling expenses up 65% to VND 909 billion, and management expenses up 98% to VND 149 billion.

The high cost of goods sold and expenses caused Hoa Sen Group to incur a post-tax loss of VND 186 billion, down 142% over the same period of the previous year, when it made a profit of VND 438 billion.

Thanks to the positive business results in the previous quarters, HSG still exceeded its plan for the 2023-2024 financial year.

Specifically, net revenue for the whole year reached VND 39,272 billion, up 24% compared to the previous year, and after-tax profit reached VND 510 billion, 17 times higher than the previous year.

In the 2023-2024 financial year, Hoa Sen Group set its business plan with two scenarios. Scenario 1: revenue of VND 34,000 billion, up 7.4% over the same period; profit after tax of VND 400 billion, up more than 12 times. Scenario 2: revenue of VND 36,000 billion, up 14%; profit after tax of VND 500 billion, up 16 times compared to the performance in the 2022-2023 financial year.

Thus, the company has exceeded its revenue and profit plans in both scenarios.

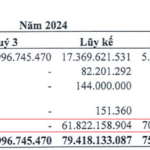

As of September 30, 2024, Hoa Sen Group’s total assets reached VND 19,561.5 billion, an increase of over VND 2,000 billion compared to the beginning of the financial year.

Notably, inventory increased the most by 30%, reaching over VND 10,000 billion, accounting for 51% of total assets. HSG had to make a provision for inventory devaluation of VND 334 billion.

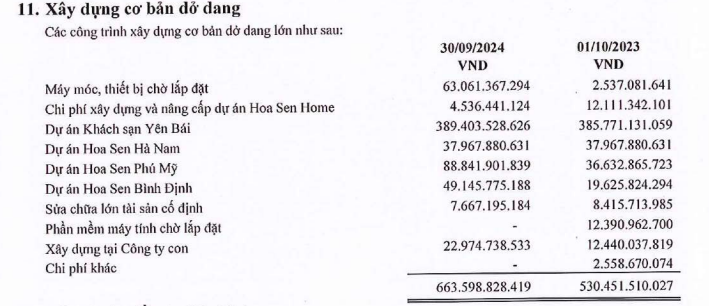

Short-term receivables amounted to VND 2,986 billion, an increase of 28.5%, mainly from short-term receivables from customers. Construction in progress increased by 25% to nearly VND 664 billion, mainly due to an increase in machinery and equipment awaiting installation and the Hoa Sen Phu My project…

Source: HSG

The Group’s total liabilities stood at over VND 8,600 billion, an increase of over VND 2,000 billion compared to the beginning of the financial year.

Of this, short-term borrowings amounted to over VND 5,300 billion, all of which were short-term bank loans. In the past year, the company paid VND 133 billion in interest, down 32% compared to the previous financial year.

“Declining Core Revenue and Soaring Expenses: Unveiling Dragon Capital’s Manager’s Earnings in Q3”

In Q3 of 2024, the financial results of Dragon Capital Vietnam Asset Management JSC (DCVFM) were significantly impacted by a decline in revenue from its two core business segments: advisory and fund management. While revenue from these key areas decreased, management expenses rose sharply, creating a challenging environment for the company.

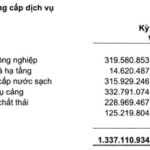

“A Stellar Performance: Sonadezi Achieves 87% of Profit Plan in 9 Months”

Sonadezi Corporation (Sonadezi, UPCoM: SNZ), a leading industrial development company, announced its third-quarter financial results, reporting a net profit of over VND 192 billion, an 8% decrease compared to the same period last year. Despite this quarterly decline, the company remains on a strong trajectory, having achieved 87% of its full-year net profit target in the first nine months of the year.