Real Estate and Investment Joint Stock Company VRC (code VRC-HOSE) announces the Resolution of the Board of Directors on the dismissal and appointment of the Chairman of the Board of Directors and the organization of the 2024 Extraordinary General Meeting of Shareholders.

Accordingly, the Company’s Board of Directors approved the resignation of Mr. Tu Nhu Quynh and elected Mr. Pham Van Tuong as Chairman of the Board of Directors of the Company from October 31st.

In addition, VRC also approved the organization of the 2024 Extraordinary General Meeting of Shareholders in December. The deadline for registering the list of attending shareholders is November 21st, 2024. The meeting will focus on changing the company’s headquarter address, dismissing and supplementing members of the Board of Directors, and other issues (if any).

It is known that in his resignation letter dated October 30th, Mr. Quynh cited personal reasons for his resignation from the above-mentioned positions.

Prior to his resignation, Mr. Quynh sold all 6,276,080 shares, holding a 12.53% stake in VRC, in a negotiated deal. The transaction was executed from October 16th to October 18th.

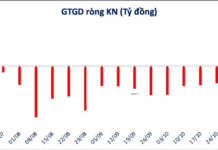

According to data from HOSE, the estimated value of the negotiated transaction during these three sessions amounted to VND 44 billion, indicating that the former Chairman of VRC divested his entire investment.

Additionally, Mr. Phan Van Tuong, a member of the Board of Directors, registered to sell his entire holding of 7,327,230 shares, representing a 14.56% stake in VRC, through a negotiated deal from October 14th to November 8th, 2024, to meet his personal financial needs.

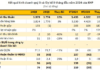

For the third quarter of 2024, the company reported a profit of over 90 million VND, compared to a profit of 116.2 million VND in the same period last year. For the first nine months, the company’s profit was 1.13 billion VND, while it was over 329 million VND in the same period last year. The decrease in profit from 116 million VND to over 90 million VND, representing a 22.19% decline, was attributed to higher cost of goods sold and financial expenses in the third quarter of 2024 compared to the previous year.