In recent times, it’s not uncommon to come across information about soaring land prices in many provinces and cities across the country, especially in major urban areas. The auction of land plots at exorbitant prices has particularly attracted attention. It’s not just land plots; almost all real estate segments, including low-rise and high-rise luxury and affordable apartments, as well as old apartments, have experienced a surge in prices.

According to data from Batdongsan.com.vn, apartment prices at Times City in Hanoi have more than doubled from 30-40 million VND/m2 in 2020 to nearly 90 million VND/m2. In the more affordable segment, apartment prices at HH Linh Dam in Hanoi have also skyrocketed to nearly 40 million VND/m2, up from only about 17 million VND/m2 four years ago.

However, there is a “paradox”: the stocks of real estate businesses on the stock market remain stagnant, despite the rapid rise in land prices. The VNREAL index, representing the real estate sector, is currently hovering around 900 points, the lowest level in six years since 2018. Compared to its peak at the end of 2021 and early 2022, the index is now less than half of what it used to be.

Many once-prominent names in the real estate group have lost their positions. Novaland (NVL), Dat Xanh (DXG), DIC Corp (DIG), Phat Dat (PDR), and CEO Group (CEO) have all seen significant declines in market capitalization, even halving or more compared to their peaks in late 2021. Some cases are now at their lowest since listing.

Several factors can explain the disconnect between real estate stocks and land prices:

First, there is a shortage of primary supply. It is undeniable that the demand for housing is high, especially in large cities. However, the primary supply is limited due to legal issues and financial instability among businesses. The lack of eligible projects for sale affects the business results and cash flow of real estate enterprises. Some large enterprises even incur significant losses, as in the case of Novaland in the second quarter of this year.

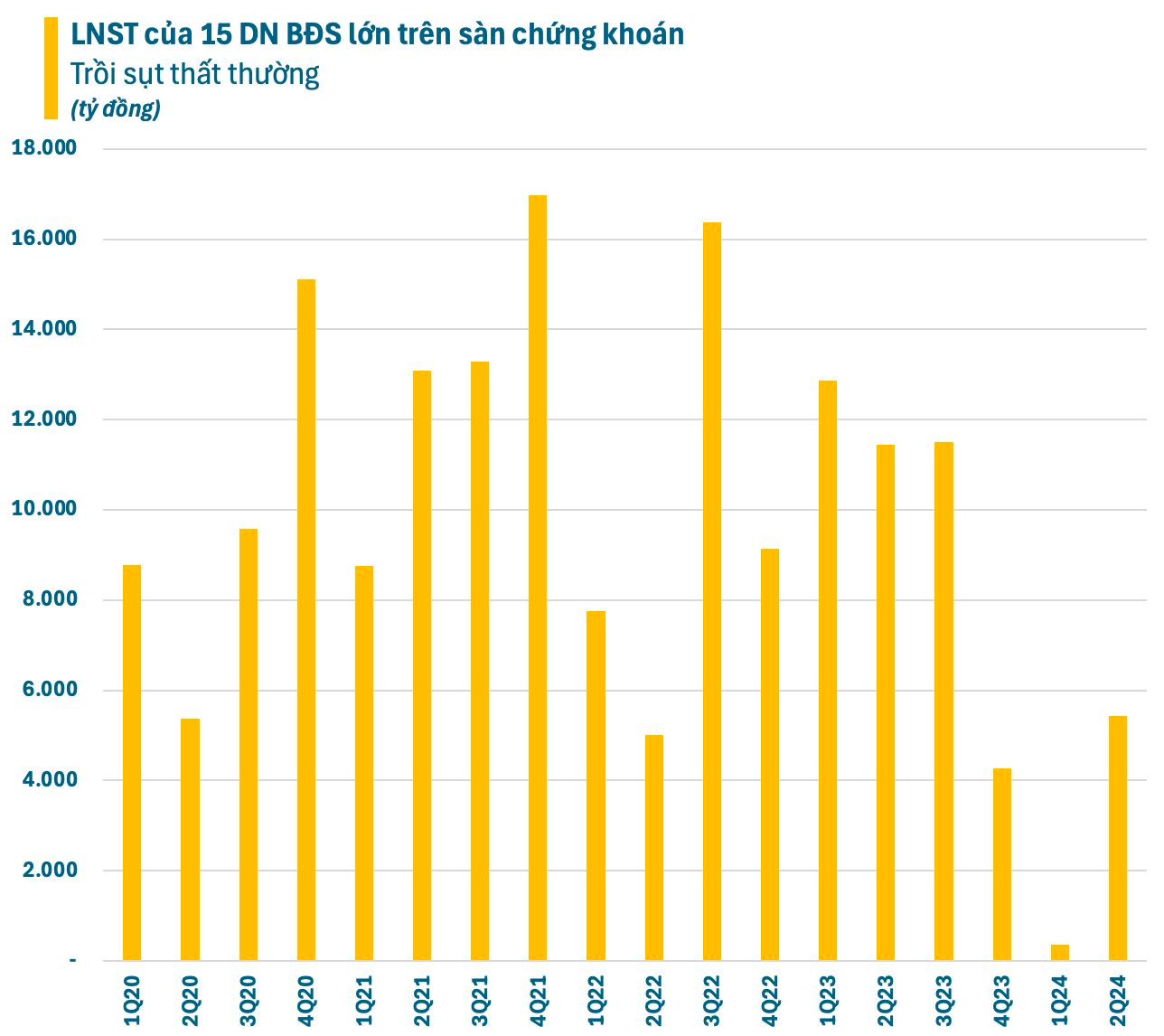

In reality, the real estate industry is also heavily cyclical and seasonal, depending largely on monetary policies. This makes the profits of real estate businesses erratic and challenging to predict. One quarter can show record-high profits, and the next may result in significant losses, and vice versa.

This factor limits the attraction of long-term investment funds to real estate stocks. Speculative money comes and goes quickly, causing real estate stocks to be highly volatile. Due to the lack of sales, the business results of real estate enterprises do not match the rapid increase in land prices. In this context, it is challenging for this group of stocks to maintain an upward trend.

Secondly, there is a mismatch between supply and demand. Secondary supply comes with exorbitant prices, far exceeding the purchasing power of buyers. The disconnect between supply and demand is partly why the actual liquidity in the real estate market remains subdued. Some opinions attribute the high land prices to the actions of some units and “speculators” who engage in price manipulation.

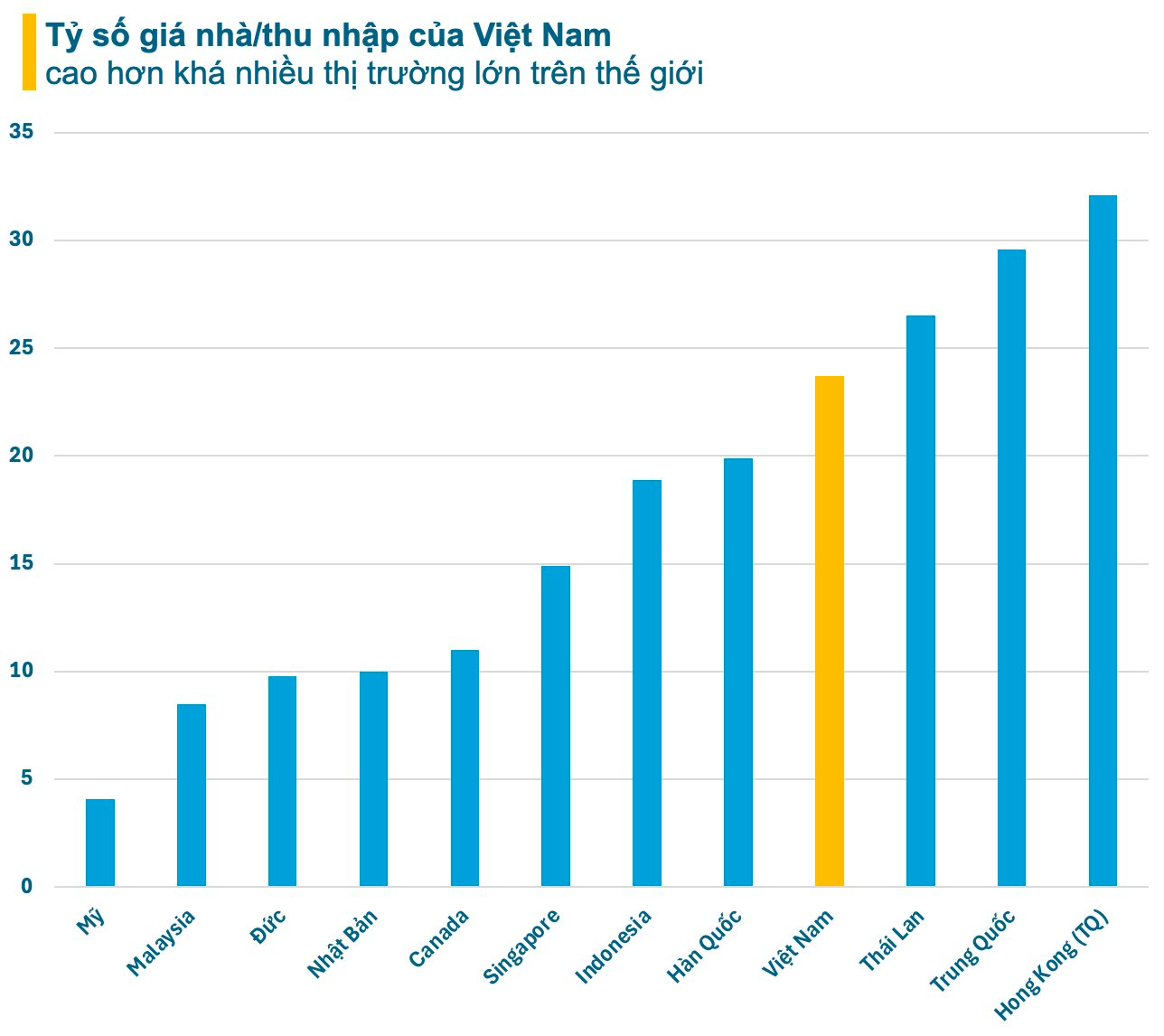

In reality, land prices have been increasing for many years, outpacing the growth in people’s income. According to updated data for 2024 from Numbeo, a platform for cost-of-living data, Vietnam’s House Price to Income Ratio (HPR) is 23.7 times, a slight increase from 2023. This figure places Vietnam among the top countries in terms of the ratio of house prices to income, second only to some regions like Thailand, China, and Hong Kong (China).

Thirdly, the incidents involving Van Thinh Phat and Tan Hoang Minh have significantly impacted the bond market, making investors more cautious. The regulatory measures contributed to cooling down the bond market after a period of overheating. This affected an important fundraising channel for enterprises, in addition to credit.

As bond issuances became more challenging, and bank loans were tightened, many real estate business owners turned to securities companies to negotiate pledging their shares for project funding and debt repayment. However, this cycle couldn’t continue indefinitely, given the unrealistic prices in the market, which affected cash flow. When setbacks occurred, a wave of massive forced liquidations, spreading across various real estate stocks in 2022-2023, became inevitable. This was one of the main reasons many real estate stocks plunged to long-term lows.

Fourthly, the use of high financial leverage, extended over many years, and applied to multiple projects has resulted in substantial capitalized interest expenses. This barrier prevents real estate businesses from reducing housing and land prices in their projects to find common ground with homebuyers with genuine needs.

The already limited sales, coupled with the pressure of bank debt repayment, significantly impact the cash flow of real estate businesses. The financial distress of many enterprises negatively affects the stock market performance.

Lastly, real estate stocks are challenging to value due to the lack of clarity in legal and ownership aspects across projects. Many investors find themselves in a situation where they “count crabs in a hole” when calculating land and housing prices in projects to determine the enterprise’s value. In reality, the actual ownership and the value of benefits that enterprises and shareholders receive from projects are difficult to calculate accurately.

During the hot growth phase from 2021 to early 2022, speculative waves pushed the stock prices of many real estate companies to extremely high levels. However, as the tide receded, the business results began to reveal limitations, and the valuations of real estate enterprises underwent significant adjustments to align with their business performance.

“The Murky Waters of Real Estate: A Delicate Dance of Uncertainty and Valuation”

At the 8th session of the 15th National Assembly on October 28, National Assembly deputies pointed out the inadequacies of the current real estate prices and urged the Government to continue implementing social housing policies for low-income earners.

“A Focused Approach: Targeting the Affordable Housing Market of $2.5 Billion and Below”

In the National Assembly session on October 28, a representative suggested that the government should focus on the affordable housing segment, specifically properties valued at 2.5 billion VND and below. This targeted approach would prevent the government from spreading its resources too thin. However, it is crucial to streamline the processes and avoid a bureaucratic maze when implementing social housing support policies.

Where is the Most Expensive Residential Land in Lam Dong Province According to the New Official Price List?

The latest land price index has revealed that Ward 1, Da Lat City, boasts the most expensive land in Lam Dong Province, with prices reaching a staggering 72.8 million VND per square meter. This marks a significant increase, with agricultural land prices in Da Lat rising by up to six times their previous value, rural residential land increasing by 2.3 times, and urban residential land witnessing a 1.3-fold surge.

The City’s Strategy: How Adjusted Prices are Accelerating Ho Chi Minh City’s Land Recovery and Resettlement Valuation

“According to the Director of the Department of Natural Resources and Environment in Ho Chi Minh City, the adjusted land price framework promotes transparency and expedites the process of land acquisition and determining the selling price of resettlement land plots.”