The third-quarter business reports for 2024 revealed that most real estate enterprises on the stock exchange were struggling, with the overall market remaining gloomy.

Phat Dat Real Estate Development Joint Stock Company (stock code: PDR) announced its third-quarter financial report for 2024, showing a 99% decrease in revenue compared to the previous year, with a meager 2.6 billion VND.

However, financial activity revenue surged, increasing from 550 million VND to 194 billion VND due to profits from the transfer of shares in associated companies. As a result, the company reported a profit of over 51 billion VND. Nonetheless, this figure was still half of the previous year’s earnings.

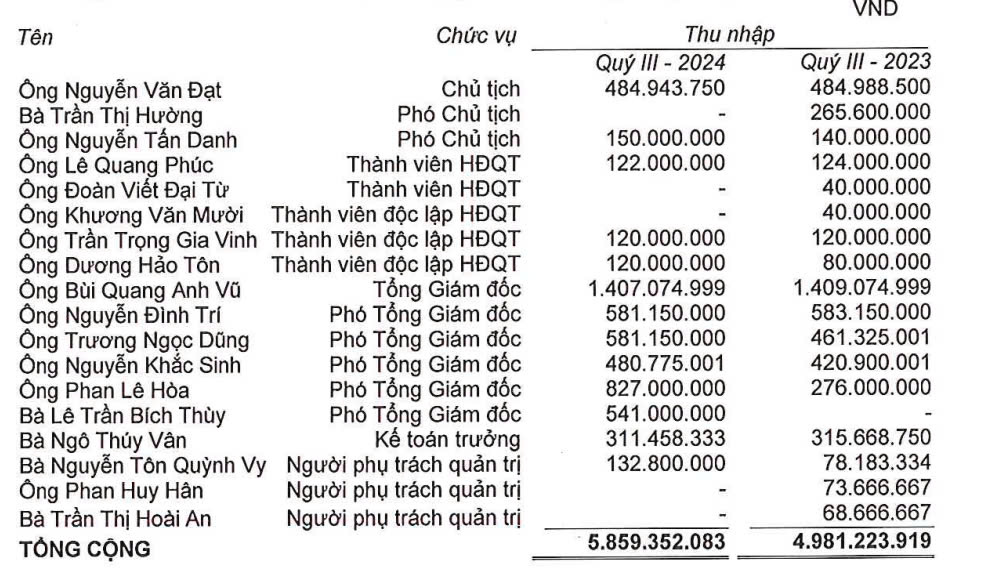

While revenue and profits declined, the income of Phat Dat’s leaders continued to rise. Specifically, the compensation of the members of the Board of Directors and the management team increased by 17% compared to the previous year, totaling 5.8 billion VND.

Extract from Phat Dat’s financial report

Leading the list was General Director Bui Quang Anh Vu, with an income of over 1.4 billion VND (unchanged from the second quarter of 2024 and the previous year), equivalent to 467 million VND per month.

Following closely was Phan Le Hoa, Deputy General Director, with an income of 827 million VND (triple that of the previous year).

Other Deputy General Directors, including Nguyen Dinh Tri, Truong Ngoc Dung, Le Thi Bich Thuy, and Nguyen Khac Sinh, earned around 500 million VND per quarter (approximately 167 million VND per month).

Nguyen Van Dat, the Chairman of the Board of Directors, who once drew attention for receiving an income of over 3 billion VND in a quarter in 2022—the highest among the leadership team—saw his income for the third quarter of 2024 drop to just under 485 million VND (unchanged from the previous quarter and the previous year).

The Vice Chairpersons and other members of the Board of Directors had incomes ranging from 120 to 150 million VND per quarter.

For the first nine months of 2024, the total income of the Chairman and the General Director of Phat Dat amounted to over 1.4 billion VND (approximately 161 million VND per month) and 4.2 billion VND (approximately 467 million VND per month), respectively.

Illustration

Similarly, Novaland Real Estate Joint Stock Company (stock code: NVL) reported consolidated revenue of 2,010 billion VND for the third quarter of 2024. After expenses, Novaland recorded a post-tax profit of nearly 2,950 billion VND, a staggering 2,000% increase compared to the 136.7 billion VND in the same period last year.

For the first nine months, Novaland’s total revenue reached 4,295 billion VND thanks to the handover of projects: NovaWorld Phan Thiet, NovaWorld Ho Tram, and Aqua City.

However, for the same nine-month period, Novaland recorded a loss of 4,377 billion VND, mainly due to provisions made in the semi-annual report for 2024. Despite the challenging business environment, the company continued to increase the remuneration of its leaders.

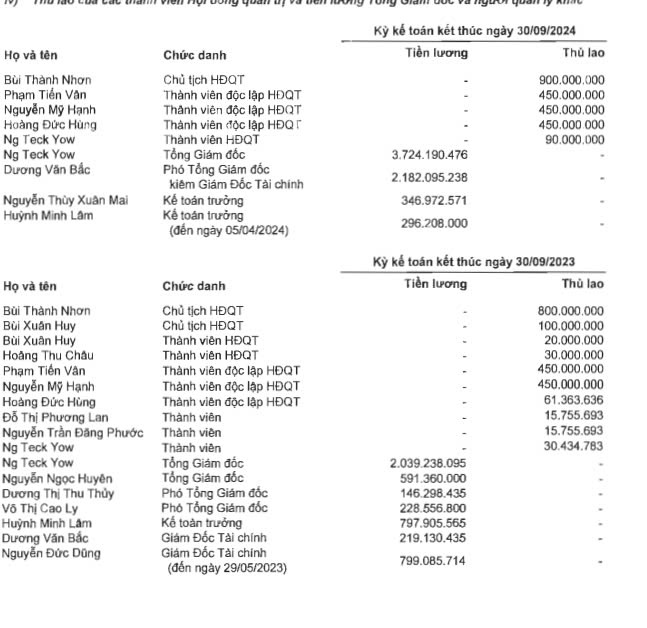

Extract from Novaland’s third-quarter 2024 financial report

Leading the pack was Mr. Ng Tech Yow, the General Director and member of the Board of Directors of Novaland, who received a total of over 3.7 billion VND in salary and remuneration for the first nine months (approximately 411 million VND per month), an impressive 82% increase compared to the previous year.

Following closely was Mr. Duong Van Bac, Deputy General Director and Chief Financial Officer, with an income of 2.1 billion VND.

In terms of remuneration, Mr. Bui Thanh Nhon, Chairman of Novaland, received 900 million VND for the first nine months, a rise of 100 million VND compared to the previous year. The independent members of the Board of Directors each received 450 million VND, while the last member received 90 million VND.

Overall, Novaland’s remuneration expenses for the nine-month period increased significantly compared to the previous year, despite the less-than-favorable business performance.

Likewise, Dat Xanh Group (stock code: DXG) reported a 54.8% decrease in post-tax profit for the third quarter of 2024, amounting to 30.7 billion VND. The company’s operating cash flow for the quarter was negative 270 billion VND, and the post-tax profit for the first nine months reached nearly 94 billion VND, a 26% decrease compared to the same period in 2023. Despite this, the company continued to pay high salaries to its top executives, amounting to billions of dong each quarter.

Specifically, Mr. Bui Ngoc Duc, the General Director of the Group, received a salary of over 1 billion VND for the third quarter of 2024, unchanged from the previous quarter but a significant 42% increase compared to the previous year.

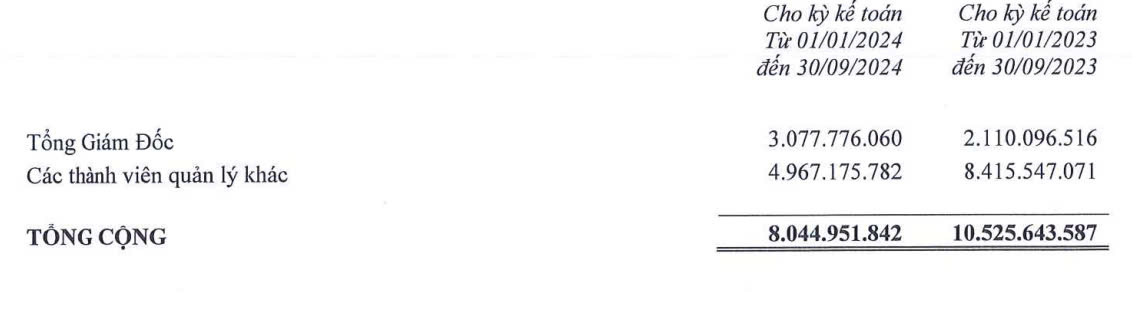

Income of the General Director of Dat Xanh and other management members

For the first nine months, Mr. Bui Ngoc Duc’s salary totaled more than 3 billion VND (approximately 334 million VND per month), nearly 1 billion VND higher than the previous year.

Meanwhile, the total salary paid to other management members decreased by 41% compared to the previous year, from 8.4 billion VND to 4.9 billion VND.

The Stock Market Optimist: Can We Expect a Revival in Liquidity?

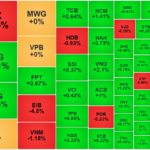

The VN-Index rallied and retested the 100-day SMA. A decisive move above this level, coupled with trading volume surpassing the 20-day average, would reinforce the bullish momentum. Notably, the Stochastic Oscillator has provided a buy signal within the oversold region. If this buy signal persists and the index climbs out of this oversold territory in upcoming sessions, the outlook will turn even more positive.

Stock Market Blog: Easing Selling Pressure, Awaiting Exhaustion of Liquidity

Short-term intraday bounces or sideways movements followed by sharper declines are often the result of a reluctant buying sentiment in a downward trend. The market and stocks have yet to find a safe bottom to entice buyers. However, today’s signals indicate a reduction in selling pressure…

“Stock Liquidity Hits 18-Month Low, Shares Stage a Surprise Comeback”

The combined trading value of the Ho Chi Minh Stock Exchange (HoSE) and Hanoi Stock Exchange (HNX) reached VND 9,782 billion today, hitting an 18-month low since May 9, 2023. During this period, there have only been three instances of trading values falling below the VND 10,000 billion mark. The extremely low trading value indicates a significant decrease in selling pressure, allowing buying forces to drive prices upwards quite favorably towards the end of the session.