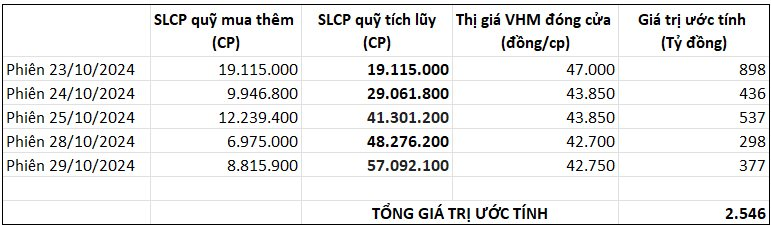

According to the latest update from the Ho Chi Minh City Stock Exchange (HoSE), as of the close of the October 29, 2024, session, Vinhomes (VHM) had purchased a total of over 57 million treasury shares, accounting for 15.43% of the registered amount. This figure increased by more than 8.8 million units compared to the previous session on October 28.

On the same day, VHM’s closing market price stood at VND 42,750 per share, marking an 11% decrease compared to the price before the treasury share acquisition initiative. Tentatively calculated based on the closing price, Vinhomes has spent over VND 2,500 billion on purchasing treasury shares in the first five sessions. The majority of these transactions were conducted through order matching, as the market only recorded around 4 million VHM shares traded through negotiation during the period of October 23-29.

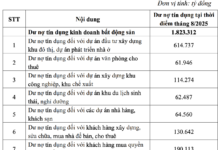

According to the previously announced plan, Vinhomes will buy back a maximum of 370 million treasury shares (accounting for 8.5% of the total outstanding shares) through order matching and/or negotiation from October 23 to November 21, 2024. The company stated that the reason for the buyback is that the market price of VHM shares is lower than the company’s actual value, and the repurchase aims to protect the interests of the company and its shareholders. As per regulations, Vinhomes will place orders to buy a minimum of 11.1 million shares and a maximum of 37 million shares each day during the trading period.

It is estimated that the total amount of money Vinhomes may have to spend on this deal could reach over VND 17,000 billion. If successful, this will be the largest treasury share purchase in the history of Vietnam’s stock market, and Vinhomes’ charter capital will decrease by VND 3,700 billion, from VND 43,543 billion to VND 39,843 billion.

The Beat of the Market on 10/28: Indecision Looms, Telecom Services Shine Brightly

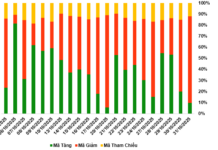

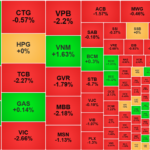

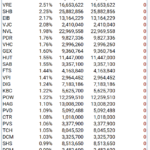

At the end of the trading session, the VN-Index rose 2.05 points (+0.16%) to 1,254.77, while the HNX-Index dipped 0.03 points (-0.01%) to 224.59. The market breadth tilted towards gainers with 389 advancers and 283 decliners. The large-cap stocks also witnessed a sea of green, as reflected in the VN30-Index, with 15 gainers, 9 losers, and 6 stocks holding steady.

Tomorrow’s Stock Market Outlook: Anticipating Real Estate and Banking Stocks to Lead the Charge

Although the VN-Index fell during the October 30th session, it was a positive day for many bank and real estate stocks, which saw their share prices rise.

The VN-Index Plunges to a 12-Week Low: A Bold Move to Cut Losses and Look to the Future

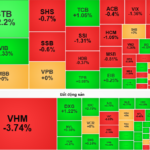

The market suffered a brutal sell-off in the afternoon, with trading liquidity on both exchanges doubling from the morning session, and stocks plunging across the board. The VN-Index evaporated 1.06% (-13.49 points) and broke through the short-term bottom at the beginning of October, falling to 1257.41 points.

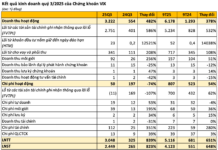

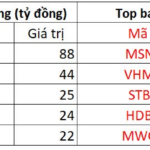

The Foreign ETF Sells Off a Stock After Weeks of Silence

After a period of silence, between October 21 and 28, the VanEck Vectors Vietnam ETF (VNM ETF) surprised the market with a substantial net sell-off of a leading securities firm’s stock. This was the only stock to witness a change during this period.