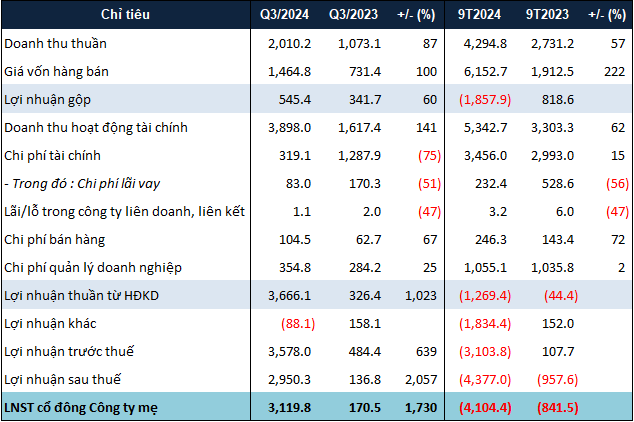

In Q3, NVL‘s net revenue surpassed 2,000 billion VND, an impressive 87% increase compared to the same period last year. Additionally, financial revenue doubled, reaching nearly 3,900 billion VND.

On the expense side, thanks to a significant reduction in interest expenses, NVL’s financial costs narrowed by 75%, to over 319 billion VND. In contrast, selling and management expenses increased by 67% and 25%, respectively, totaling 105 billion VND and 355 billion VND.

As a result of the surge in revenue, NVL recorded a net profit of over 3,100 billion VND in Q3 2024, an astonishing 18-fold increase year-over-year.

However, for the first half of the year, the company incurred a net loss of more than 7,200 billion VND due to additional financial expenses and provisions as per the auditor’s recommendation regarding land rent, land use fees, and late payment fees for the over-30ha Nam Rạch Chiếc project in An Phú ward, Thủ Đức city. Additionally, the revaluation of foreign currency-denominated payables and losses from the liquidation of a subsidiary contributed to the loss. Consequently, for the nine months ended September 30, 2024, NVL still posted a net loss of over 4,100 billion VND.

|

NVL’s Q3 and 9-month business results. Unit: Billion VND

Source: VietstockFinance

|

On the balance sheet, NVL’s total assets as of September 30, 2024, stood at over 232,000 billion VND, a 4% decrease from the beginning of the year. Short-term receivables and fixed assets decreased by 5% and 32%, respectively, to 44.5 trillion VND and 1.6 trillion VND.

On the other hand, cash holdings and inventory increased by 11% and 4%, respectively, to 3.9 trillion VND and 145 trillion VND. NVL disclosed that as of the end of September 2024, nearly 58 trillion VND of its inventory was used as collateral for loans, an increase of 773 billion VND from the beginning of the year.

Meanwhile, payables decreased slightly by 2%, to 191.4 trillion VND. This decrease was mainly due to a reduction in long-term payables from investment cooperation in project development, which fell by over 32%, to 44.2 trillion VND.

Borrowings, on the other hand, increased by 4%, to 59.8 trillion VND, with bond debt accounting for the majority at nearly 38.9 trillion VND.

Furthermore, taxes and other state budget contributions surged to 7.8 trillion VND, nearly eight times higher than at the beginning of the year. This increase was mainly due to land use fees, which amounted to over 5.1 trillion VND, compared to only 34 billion VND at the start of the year. Other expenses also saw a significant jump, from 51 billion VND at the beginning of the year to over 1.6 trillion VND by the end of September.

NVL’s project updates as of September 2024

As of September 2024, NVL reported that over 1,200 villas at NovaWorld Phan Thiet (Binh Thuan) had been handed over, with more than 600 fully furnished and operational. At NovaWorld Ho Tram (Ba Ria-Vung Tau), over 400 villas had been delivered, while Aqua City (Dong Nai) had handed over more than 650 villas and townhouses to customers.

Following Military Commercial Joint Stock Bank’s (MB) commitment to disburse a 1,100 billion VND financial package, the total credit limit for the Aqua City project reached nearly 3,250 billion VND. Additionally, other banks agreed to provide financing for the project after the approval of the 1/500 planning adjustment.

In Ho Chi Minh City, the Sunrise Riverside project in Nha Be district has delivered 292 Smart Office products in Tower A since July 2024. The project is expected to complete Towers A and H (the last two towers) and hand over an additional 360 products in 2024. The Grand Manhattan project in District 1 has topped out Towers A2 and A3 and is undergoing finishing works, with Tower A1 expected to be delivered starting Q3 2025.

At Victoria Village in Thu Duc City, NVL is constructing and completing four towers in the high-rise area, with delivery anticipated from the end of Q4 2025. Meanwhile, Palm City, also in Thu Duc City, is in the process of handing over the remaining low-rise residential products.

“Q3 2024: NVL Records Impressive Profits, Requests HOSE to Lift Warning”

Previously, HOSE placed NVL stock in alert status from September 23 onwards due to the listed entity’s delay in submitting its semi-annual 2024 financial statements, which exceeded the regulated deadline by over 15 days. Concurrently, HOSE also included this stock in the list of those subjected to margin cuts.

The Rise of the Securities Companies: Can Masan Reach its Audacious Target of 2,000 Billion VND Net Profit?

In the first nine months of 2024, Masan achieved a remarkable profit of 1.308 trillion Vietnamese dong after allocation of minority interests, surpassing its initial plans by a significant margin. With this impressive performance, the company is well on its way to achieving its ambitious full-year net profit target of 2 trillion Vietnamese dong, as per the positive scenario laid out.

“Overcoming ‘Breathalyzer’ Challenges, Sabeco, the Beer Industry Giant, Reports Profitable Q3 Growth with 70% of Assets in Cash”

For the first nine months of the year, Sabeco recorded net revenue of VND 22,940 billion and a remarkable after-tax profit of VND 3,504 billion, reflecting a 5% and nearly 7% increase, respectively, compared to the same period last year.