In Q3 2024, according to surveys and reports from several major provinces and cities such as Hanoi and Ho Chi Minh City, apartment prices in Hanoi continued to rise for both new and old projects. New project prices increased by about 4-6% quarter-on-quarter and 22-25% year-on-year.

The increase in real estate prices over the past time was largely due to the impact of factors such as fluctuations in costs related to land, especially in some localities; there was an insufficient supply of affordable housing to meet market demand. As a result, it pushed up apartment prices, especially in some areas, increasing by about 35-40% depending on the location compared to the previous quarter.

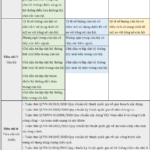

In the market, affordable apartment segment (with selling prices below VND 25 million/sqm) almost no transactions and products for sale; middle-class apartments (with prices ranging from VND 25 million/sqm to under VND 50 million/sqm) still accounted for a large proportion of transactions and supply in the market, the rest were high-end and luxury apartments (with prices above VND 50 million/sqm).

In Hanoi, the Vinhomes Ocean Park project in The Zurich subdivision is priced at around VND 46-55 million/sqm in Trung Hoa ward, Cau Giay district; Lumi Prestige is priced from VND 69 million/sqm in Tay Mo ward, Nam Tu Liem district; The Ninety Complex is priced at around VND 60-75 million/sqm in Dong Da district; The Sapphire – Vinhomes Smart City is priced at around VND 47-61 million/sqm in Nam Tu Liem district; Vihacomplex mixed-use building at 107 Nguyen Tuan is priced at VND 75-97.2 million/sqm in Thanh Xuan district; High-rise housing construction, green trees and parking lots at the land plots coded: HH4, HH5, CL2, CL3, CX and P1 of Khai Son City project in Ngoc Thuy, Thuong Thanh, Long Bien wards are priced from VND 50-68 million/sqm…

Lumi Prestige Project Perspective

|

In Ho Chi Minh City, the Diamond Centery project is priced from VND 61-73.3 million/sqm in Tan Phu district; Stown Tham Luong project is priced from VND 29.8-43.5 million/sqm in District 12; Urban Green is priced from VND 52-59.7 million/sqm in Thu Duc City; Glory Heights – Vinhomes Grand Park is priced from VND 40-80 million/sqm in Thu Duc; The Aurora Phu My Hung in District 7 (priced from VND 88-90 million/sqm); The Beverly Solari – Vinhomes Grand Park in District 9 is priced from VND 46.83-65.6 million/sqm.

Selling prices of some prominent projects in other localities such as Lumiere Spring Bay project is priced at VND 60-73 million/sqm in Hung Yen; Green Tower Di An is about VND 50-60 million/sqm in Binh Duong; Central Park Residences is priced at VND 32-45 million/sqm in Nghe An; Grand Mark Nha Trang is priced at about VND 45 million/sqm in Khanh Hoa…

Reasons for the increase in real estate prices in the past time

A summary shows that in Q3 2024, real estate prices in some localities tended to increase, especially in Hanoi, Ho Chi Minh City and other major cities. The price increase is localized, occurring in some areas, some types, and some real estate segments, leading to an overall price increase. Analysis shows that there are many reasons for the increase in housing real estate prices, including some basic and main reasons such as the increase in real estate selling prices is partly due to fluctuations in costs related to land recently, as well as the impact of the application of new calculation methods and land price frames.

Especially in some localities and areas, there is a phenomenon of auctioning land use rights with winning bids many times higher than the starting price. The management and implementation of land use right auctions in some areas and localities are not good; there is a phenomenon that many investors establish associations and groups to participate in auctions; offer land prices many times higher than the starting price, then they can “give up their stakes” after winning the land auction to create fake prices in the area to make a profit.

Auctioning land use rights with winning bids many times higher than the starting price will affect the increase in land prices, real estate prices, and housing prices in the surrounding areas and localities; at the same time increasing the cost of implementing housing projects, causing difficulties for enterprises, reducing supply to the market, and negatively affecting the real estate market.

The phenomenon of “creating fake prices”, “price manipulation” by speculators and individuals practicing real estate brokerage; taking advantage of people’s lack of understanding and investing according to the psychology of the crowd to take advantage of it. These are individuals who act as freelance brokers, without a real estate brokerage certificate, weak in expertise, limited in legal knowledge, unprofessional, and lacking in business ethics, leading to a situation of doing business in a hurry, colluding to fix prices, pushing prices higher than their actual value, manipulating the market, causing damage to customers and reducing the transparency of the real estate market.

In addition, the lack of real estate supply to meet the needs of the majority of the people, low-income and middle-income earners in urban areas, especially in Hanoi and Ho Chi Minh City, is due to a number of reasons such as real estate businesses encountering difficulties and obstacles in legal procedures, especially in determining land prices, calculating land use fees, site clearance, and land allocation. Many enterprises have difficulties in credit loan capital and capital from corporate bond issuance. Many projects that have been and are being implemented in the past time have had to be temporarily stopped, slowed down, and delayed in construction progress.

Although the Land Law 2024, Housing Law 2023, and Real Estate Business Law 2023 have been promulgated and took effect, the difficulties and obstacles in the legal system and legal provisions (land, housing, real estate business, credit…) for enterprises have been basically removed, and the real estate supply has improved. However, there are still some limitations because it takes time for new mechanisms, policies, and laws to be implemented effectively and “put into life.”

In addition, the fluctuations of the economy in the past time related to the stock market, bonds, gold… have also affected the psychology of the people and investors, leading to a tendency to shift the flow of money from people and investors to invest in houses and land as a “safe haven” for accumulated money and investment capital.

The Soaring Land Prices and the Struggling Real Estate Stocks: Unraveling the Mystery.

The real estate market has witnessed a scorching surge across almost all segments, including land, low-rise homes, luxury apartments, affordable condos, and even older apartment buildings. This surge in property values contrasts sharply with the prolonged slump in real estate stocks, which continue to languish at rock-bottom levels.

“A Focused Approach: Targeting the Affordable Housing Market of $2.5 Billion and Below”

In the National Assembly session on October 28, a representative suggested that the government should focus on the affordable housing segment, specifically properties valued at 2.5 billion VND and below. This targeted approach would prevent the government from spreading its resources too thin. However, it is crucial to streamline the processes and avoid a bureaucratic maze when implementing social housing support policies.