October’s data revealed a recovery in Vietnam’s manufacturing sector following the impact of September’s storm, with both output and new orders rising. However, some after-effects of the storms lingered into October, constraining output growth and leading to supplier delivery delays and a buildup of backlogged work.

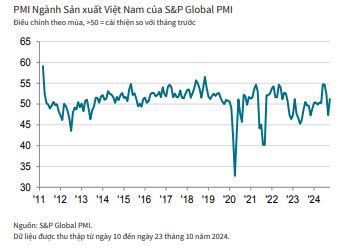

Vietnam’s Manufacturing Purchasing Managers’ Index™ (PMI®), compiled by S&P Global, rose to 51.2 in October from 47.3 in September, rebounding above the 50-point threshold that separates expansion from contraction after disruption caused by Storm Yagi in the previous month.

Business conditions have now strengthened in six of the past seven months, although the pace of improvement in October was only marginal. The recovery in output and new orders, as post-storm reconstruction efforts gained traction, was at the heart of the sector’s improved health. However, the growth rate of each of these indicators was slower than in the months preceding September as some companies continued to experience disruption in the aftermath of the storm and associated flooding.

Along with the rise in total new orders, new export orders also increased in October. However, the rate of expansion was only modest as several respondents reported weaker international demand. Backlogs of work rose for the fifth consecutive month as some companies reported operating below maximum capacity due to storm impacts, although the rate of increase was slower than the two-and-a-half-year high seen in September.

Manufacturers continued to utilize pre-production inventories to fulfill orders at a time when production was partially affected. Post-production inventories declined at the fastest pace in three months.

Meanwhile, employment fell, reversing the previous month’s increase. Some companies attributed the decline in workforce numbers to resignations. Supplier delivery times lengthened for the second month in a row in October as storm-related disruptions continued to affect transportation. However, the extent to which lead times lengthened was milder than in September.

Purchasing activity picked up again amid rising new orders and expectations of higher output in the coming months. However, the rate of increase was only marginal as some companies reported having sufficient stocks of inputs.

Pre-production inventories continued to be drawn down to support output growth. However, the rate of depletion was far weaker than the near-record drop recorded in the previous survey period.

Manufacturers reported higher input costs amid currency weakness and rising oil, metal, and freight prices. To offset these increased costs, companies raised their output prices. However, the rate of charge inflation was only marginal as some survey respondents mentioned that competitive pressures had led them to reduce their selling prices. Sales growth, hopes for stable market conditions, and plans for business expansion all contributed to positive expectations for manufacturing output over the next year.

However, the degree of optimism softened to a nine-month low and was below the historical average for the series. Some companies mentioned that uncertainty surrounding the US presidential election had dampened business confidence.

Commenting on the latest survey results, Andrew Harker, Economics Director at S&P Global Market Intelligence, said: “October’s data showed a recovery from the disruption caused by Storm Yagi taking place during the month, with companies seeing new orders rise and being able to expand production. However, some companies were still feeling the after-effects of the storm, thereby constraining the rate of growth. As such, we would hope to see a further strengthening of growth as more manufacturers return to operating at full capacity in the coming months.”

The Job Market’s Hot Ticket: Which Industries are in High Demand for Q3?

Adecco Vietnam observes a steady demand for recruitment, with the total number of job openings remaining consistent year-on-year.