Vinamilk, Vietnam’s leading dairy company (stock code: VNM), recently held an investor meeting to discuss its financial performance for Q3 2024. CEO Mai Kieu Lien emphasized that the dairy market is still experiencing negative growth, and Vietnam’s dairy consumption remains low compared to global standards.

In Q3 2024, Vinamilk’s net revenue reached VND 15,549 billion, similar to the same period last year. After expenses, the company reported a post-tax profit of VND 2,403 billion. This quarter’s performance was driven by exports, which have seen positive growth for the fifth consecutive quarter.

For the first nine months of 2024, the company’s net revenue was VND 46,306 billion, a 3.5% increase, and post-tax profit was VND 7,306 billion, a 10% increase compared to the same period last year. With these results, the company has nearly achieved 78% of its full-year profit plan.

According to Vinamilk, the gross profit margin in Q3 was impacted by domestic sales performance. However, a recovery trend was observed in the nine-month period, with a 140-basis point improvement year-over-year due to positive shifts in sales structure and more stable imported raw material costs.

Q3 2024 performance driven by exports.

Investor Q&A:

1. Vinamilk’s performance in Q1-2 improved to its highest level in five years due to restructuring and rebranding. Why did it decrease in Q3, and how much did Typhoon Yagi impact the business in the North?

The Vietnamese dairy market has not recovered and is still experiencing negative growth. This is a global trend, not unique to Vietnam; for example, the Chinese dairy market is also facing a 6% decline.

The main reasons are lower birth rates and reduced income. The impact of Typhoon Yagi was only partial, and as VNM’s business is spread across the country, the impact on the overall business was limited to a third, especially in Moc Chau.

Since October, the North has started to recover, and the South and Central regions are also showing improvement. VNM has a specific strategy for Q4 and is confident in making up for the Q3 decline and supporting full-year growth.

Domestic revenue is expected to increase by approximately 4% in Q4 2024 compared to the same period last year.

2. What measures is the company taking to stimulate growth?

We have observed a shift from traditional to modern channels (stores, e-commerce, and special customers). In China, traditional channels account for only 20%, while in Vietnam, they still represent 70-80%. However, the market is evolving, and modern channels have grown from zero to 15-20% in recent years.

E-commerce, in particular, is performing well. At VNM, we attribute this growth to direct increases in customers rather than price reductions or promotions. We are simultaneously boosting our e-commerce presence while maintaining our traditional channels.

3. Does the company have metrics on new and old customers to gauge the increase in new customers after the rebranding?

For General Trade (GT) or traditional channels, we don’t have specific measurements, but we can see an upward trend as new customer growth leads to revenue increases.

Regarding modern channels, VNM has developed its digital transformation program, which has provided valuable customer data and insights. This data is a precious asset for the company.

4. Will the gross profit margin for 2025 be affected by the rising prices of raw material milk?

As mentioned earlier, VNM has already “booked” most of its raw material needs for 2024, so this year’s index will not be significantly impacted. For 2025, some raw milk prices will increase, while others will decrease. We have started purchasing raw materials for Q1 2025 and are in the planning process.

5. Can the management provide details about the powdered milk segment?

In November, VNM plans to complete the repositioning of its entire powdered milk portfolio, covering the mass, mid-range, and premium segments.

As mentioned, due to the aging population in Vietnam and globally, the powdered milk segment is experiencing double-digit negative growth. The low birth rate and longer maternity leave contribute to this decline, with the industry seeing a decrease of around 15-16%. VNM’s powdered milk segment is performing better, with only a 4-5% decline, indicating a positive trend compared to the market. Additionally, VNM’s adult powdered milk segment continues to grow.

We believe that the powdered milk segment is improving, especially in 2024, due to the “dragon-chasing” trend this year, which has led to an increase in birth rates.

6. Can the company share the strengths of its R&D department?

VNM’s R&D department has been integral since the company’s inception. We continuously update ourselves with new trends and products. As you can see, we have launched numerous new products in the last year and a half. Notably, our plant-based milk products have no competitors.

We aim to maintain our current position while developing new products. Our growth in the next five years will depend on these innovations.

7. Can the company reduce its dependence on raw material prices? While VNM is known for its large dairy farms, this dependence remains high.

Vietnam’s climate and conditions are not ideal for dairy farming. However, VNM operates 15-16 farms, with an average milk yield of 30 liters per cow per day, which is relatively high for Southeast Asia.

VNM wants to expand, but acquiring land for dairy farms in Vietnam is challenging. Therefore, we focus on increasing productivity by implementing technology to boost milk yield to 35-40 liters per cow per day, which will also help reduce costs.

8. Can the company share which product lines saw a decrease in revenue in Q3 2024 and why?

The most significant impact was on liquid milk. However, other product lines, such as drinking yogurt, condensed milk, and plant-based milk, continued to grow, with some even achieving double-digit increases.

Global trends show that many beverages are being replaced with milk. Therefore, VNM is diversifying liquid milk flavors and developing new products like yogurt.

It’s important to highlight that milk consumption in Vietnam and Asia lags compared to Europe. Europeans often drink milk instead of water, contributing to their superior height and physical strength.

If we replace milk with other beverages, it will be challenging to improve the population’s genetic makeup. Compared to Europeans, Asians, and specifically Vietnamese, suffer from malnutrition regarding weight and height due to low milk consumption. This is a concerning issue.

9. Will the proposed tax increase on sugary products affect VNM?

We have clarified that dairy products do not fall into this category.

10. Can you share any updates on VNM’s new projects?

The Hung Yen project has not started construction due to paperwork issues. The new project in Laos is promising, although we cannot import cows from Laos to Vietnam. We are working with the Ministry of Agriculture to obtain the necessary permits.

The beef joint venture with Japan has started trial operations, and official products will be available next year. VNM has been selling products at AEON, but the supply is limited and often sells out.

11. What percentage of VNM’s domestic revenue comes from plant-based milk sales?

As a new category, plant-based milk is growing at a double-digit rate.

12. Does VNM plan to build farms in Indonesia?

Over the past five years, we have received invitations from Indonesian investors as we once targeted that market. However, we don’t find it suitable at this time.

Regarding exports, VNM has reached about 60 countries. Our teams are persistent, and even if a market has low revenue, we strive to enter it. As a result, VNM is now ranked 6th-7th among global dairy brands for brand value and 5th for sustainability.

13. Does the company have a team researching exchange rates to stabilize raw material purchases?

VNM maintains a raw material reserve for at least three months: one month for production, one month for transportation, and one month for auctions. Meanwhile, global dairy auctions occur twice a month. Many buyers purchase monthly, but VNM buys three months in advance, and we have never made a loss.

Exchange rates do not significantly impact raw material costs. The most significant factor is price.

14. Has VNM been benefiting from the Middle East market? Will this continue in Q4?

In fact, growth will come from new markets rather than benefiting from the war.

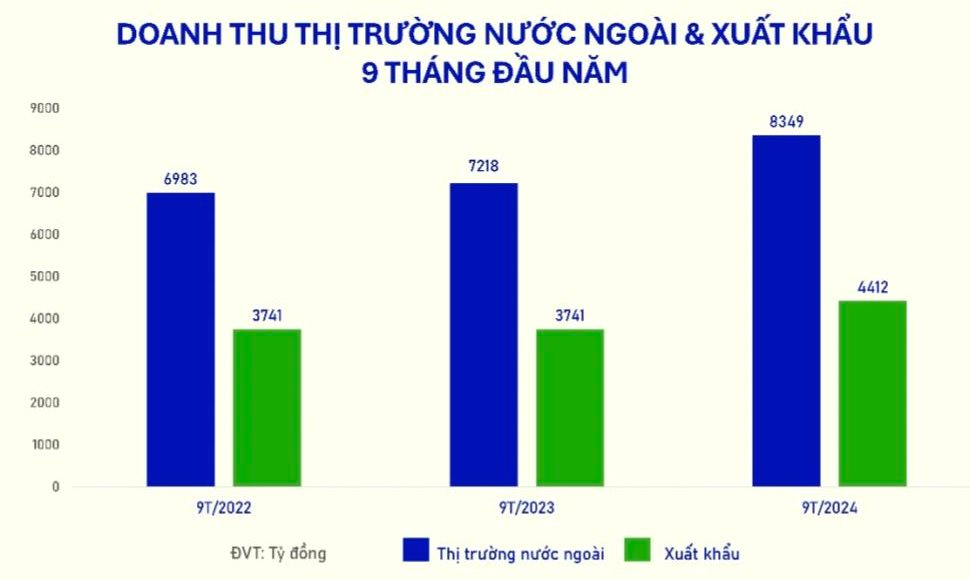

Vinamilk: Overseas Market Revenue Surges 15.7%, Exports Remain the Key “Driver”

For the fifth consecutive quarter, Vinamilk’s overseas market revenue has maintained its stellar performance, with a notable boost from its export business. In the first nine months of the year, international markets contributed 8,349 billion VND to Vinamilk’s coffers, marking an impressive 15.7% increase.

The Ultimatum for Temu: A Make-or-Break Moment

The General Department of Taxation representative stated that the new Temu platform is expected to generate taxable revenue in October and will declare its revenue in the fourth quarter of this year. The deadline for submission is January 31, 2025, provided it receives permission from the state management agency to operate. Meanwhile, the Ministry of Industry and Trade has issued an ultimatum, demanding that the platform complete the necessary procedures as per regulations.

“The Case for Curbing Excessive Discounts: A Proposal to Regulate Promotional Ads on E-commerce Platforms”

The rise of e-commerce platforms on social media has brought to light a concerning issue: the disregard for fair competition. It has come to our attention that certain platforms are engaging in unethical practices, with advertisements and promotions offering discounts of over 50% on goods and services. This is a blatant violation of competitive norms and has the potential to create an unfair marketplace. It is imperative that we, as responsible digital citizens, address this issue and hold these platforms accountable for their actions.