After a gloomy spell, the stock market traded brightly on November 6th. The VN-Index closed the session up 15.52 points at 1,261. Liquidity remained low, with the value of transactions on HOSE exceeding VND 14,000 billion.

Foreigners’ trading was less positive as they net sold VND 455 billion in the market.

Foreigners net sold VND 383 billion on HOSE

On the buying side, HPG was the most purchased stock by foreigners on HOSE, with a value of over VND 43 billion. This was followed by TCB and STB, which were accumulated VND 37 billion and VND 26 billion, respectively. Additionally, KBC and VND were also bought for VND 20 billion each.

Conversely, VHM was the most sold stock by foreigners, with a value of over VND 150 billion. Following suit, MSN also faced pressure from foreign investors, with net sales of VND 135 billion. Additionally, SSI and VCB were dumped VND 67 billion and VND 52 billion, respectively.

On HNX, foreigners net sold VND 74 billion

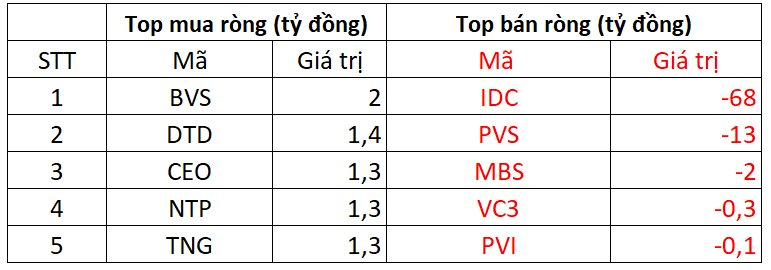

BVS was the most bought stock on HNX, with a net purchase value of VND 2 billion. Additionally, DTD ranked second in the net buying list on HNX with VND 1.4 billion. Foreigners also spent a few billion VND to accumulate CEO, NTP, and TNG.

On the opposite side, IDC faced net selling pressure from foreigners, with a value of nearly VND 68 billion; followed by PVS, MBS, and VC3, which were sold off for a few billion VND each.

On UPCOM, foreigners net bought VND 2 billion

In terms of buying, foreigners purchased HNG for VND 4.5 billion. OIL and ABW were also net bought for a few billion VND each.

Conversely, ACV was net sold by foreigners for VND 2 billion. Additionally, they also net sold DGT, QTP, and other stocks.

Why Are Bank CEOs Still Buying and Selling Stocks in a Bear Market?

(NLĐO) – The stock market remained gloomy on November 5, but the banking sector witnessed a positive trend as a flurry of insider activities signaled potential buying opportunities.

The Stock Market Soars to Record Highs as Trump Claims Victory

The S&P 500 futures hit record highs after Republican nominee Donald Trump claimed victory in the US presidential election.