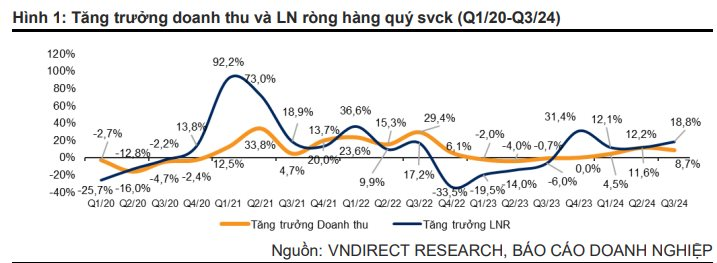

In a recent report, VNDirect Securities estimated the market-wide profit growth for Q3 2024 to reach 18.8% year-over-year, mainly due to a low base in Q3 2023.

The market-wide gross profit margin for this quarter increased by 0.8 percentage points to 17.2%. This improvement was contributed by the Transport (+5.0 percentage points) and Real Estate (+3.2 percentage points) sectors.

Borrowing costs decreased to 5.9% in Q3, down from the previous quarter, reflecting the efforts of commercial banks to reduce lending rates to boost credit demand and stimulate economic recovery.

However, VNDirect expects interest rates to unlikely decrease further, as the DXY index remains above 103, putting pressure on the USD/VND exchange rate. The debt-to-equity ratio increased to 73.6% in Q3, up by 1.2 percentage points from the previous quarter.

Looking at specific sectors, the analysis team believes that Support Services, Retail, Electricity, and Personal & Household Goods are the top-performing industries in Q3 2024.

Leading the profit growth this quarter is the Support Services sector, with a 175% yoy increase. However, profit growth compared to the previous quarter slightly decreased by 3.7%.

Retail saw a 142% yoy increase, led by MWG with a net profit surge of 1,965% yoy. This positive result was achieved through improved revenue per store and the closure of underperforming stores.

The Electricity sector recorded a 124% yoy profit increase, as hydropower stocks benefited from the La Nina phase and POW realized a gain of VND 265 billion from unrealized exchange rate differences, resulting in POW’s net profit nearly quadrupling yoy.

The Personal & Household Goods sector’s profit increased by 112% yoy, as the global economic recovery boosted export orders.

The Real Estate industry witnessed a 16.2% rise in revenue and a 49.3% yoy profit increase, ending four consecutive quarters of losses. The warming of the real estate market, rising land prices, and companies starting to recognize revenue drove these positive results, even though most of the projects were sold in Q3 and Q4 of the previous year.

Regarding the Oil and Gas industry, VNDirect attributes its negative performance to the volatile oil prices, resulting in a 119% yoy decline in the sector’s profit in Q3 2024. The nearly 20% drop in oil prices during this period adversely affected the industry, particularly BSR, which incurred losses of over VND 1,200 billion.

Gold Prices Slip in Early Monday Trade, Experts Point to “Anomalies”

“It’s an anomaly that gold prices have continued to break records recently, despite rises in the USD and US Treasury bond yields.