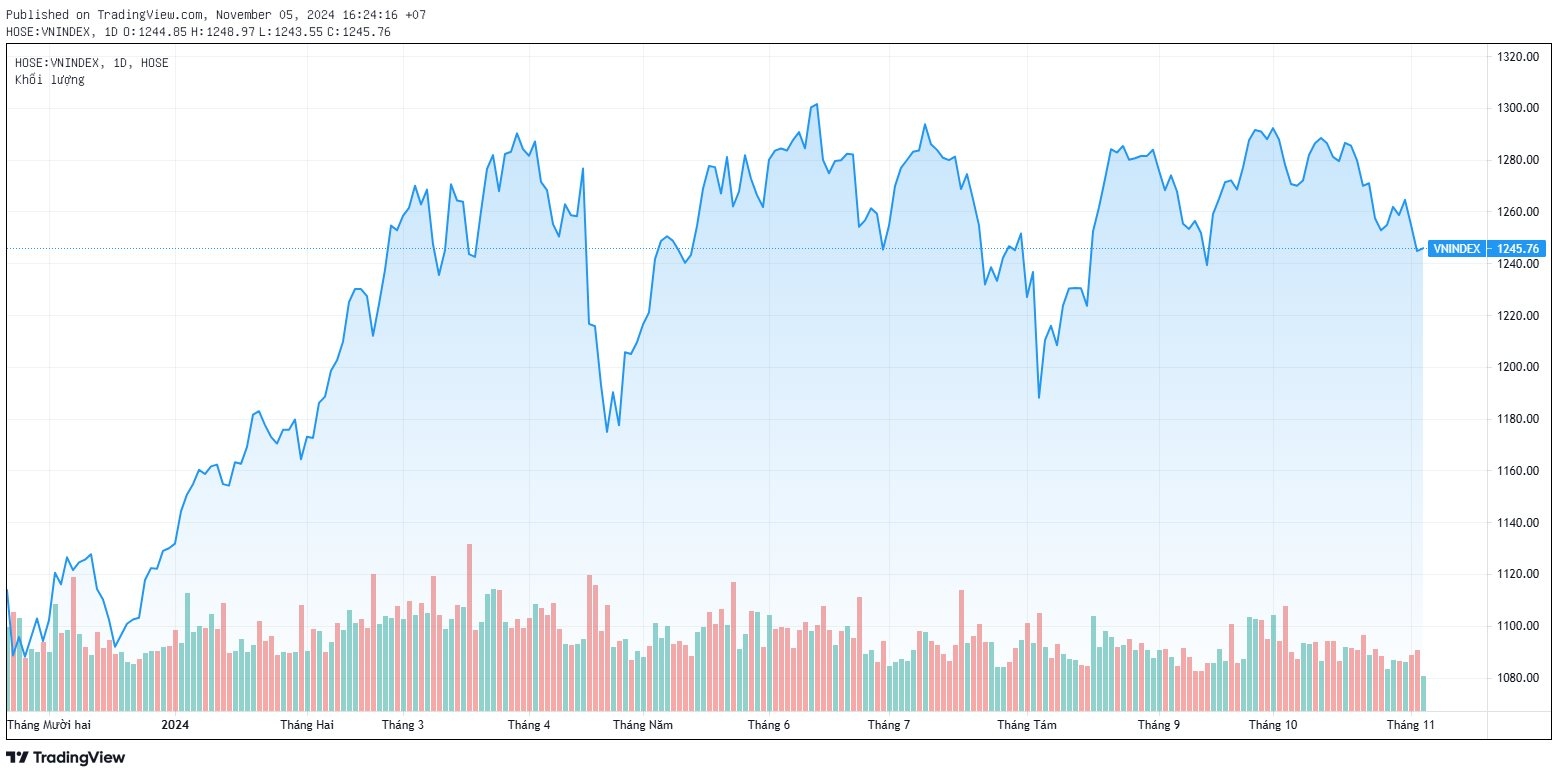

The stock market is going through a rather gloomy phase. Although the VN-Index slightly increased by over 1 point to 1,245 points at the close of the November 5 session, cautious sentiment prevailed as the matching liquidity on HOSE plummeted to a 1.5-year low of over VND8,000 billion. This has caused concern among investors about the market trend in the coming period.

November is the Best Time to Buy

Sharing at the Matching Program, Mr. Tran Hoang Son, Director of Market Strategy of VPBank Securities, stated that the market is offering a very good buying opportunity in November. Accordingly, the period when the global stock market has the highest growth in the world (often referred to as “Santa Rally” of S&P 500 or “Tet wave” of Vietnam) occurs from November to April of the following year.

Statistics over the past six years show that the “Santa Rally” cycle usually brings very good investment efficiency, with an average of about 7% for the S&P 500 during the period from November to April of the next year (including the impact of the Covid period, and the difficult phase in 2022 – 2023 when the market adjusted). Data shows that there are one to two special cases: 2020 – 2021 increased by 26% and in 2023 – 2024 by 19%.

Regarding the “Tet wave” of the Vietnamese market, VPBank Securities expert statistics over the past six years show that the average increase of VN-Index from November to April is nearly 8%. When VN-Index increases by 8%, stocks with a higher beta will increase by double or triple this average. In about three recent periods, 2020 – 2021 VN-Index increased by 32%, 2017 – 2018 increased by 18%, and 2023 – 2024 increased by 16%.

“After a stagnant phase in the middle of the year, any adjustment that occurs at this time is an opportunity for investors to restructure their portfolios and buy for the next period. In the last two years, the market bottomed out in November, and this is also the best time to buy,” the VPBank Securities expert said.

Seek Opportunities in Stocks with Fundamentals

However, in the short term, Mr. Son still expects the VN-Index to decrease. There are many variables in the US market related to elections and the Fed’s interest rates. If there is turbulence, the market is likely to fall, and the adjustment pace will be a reasonable buying opportunity.

During this period, the expert believes that after the publication of the Q3 business results, the market will witness significant differentiation. The group with poor results will continue the downward trend, while the group with promising business results in 2024 and 2025 will adjust, creating an opportunity to select target stocks for the period of December and Q1/2025.

Mr. Tran Hoang Son expects the market to rebalance around the 1,200-point threshold, with many stocks touching or falling below the MA200 threshold. Therefore, in the range of 1,200 – 1,240, investors can consider disbursing 10 – 30% for stocks with good fundamentals, especially those that have grown in Q3 and are deeply discounted.

“There is opportunity in crisis; we only have November and December to catch the Tet wave, and November is the pivotal month,” concluded the Director of VPBank Securities’ Market Strategy.

The Market Beat: A Tale of Diverging Fortunes

The market ended the session in negative territory, with the VN-Index down 2.98 points (-0.23%) to 1,287.94 and the HNX-Index falling 0.8 points (-0.34%) to 234.91. Bears dominated as 436 stocks declined while 272 advanced. The large-cap VN30-Index was a mixed bag, with 19 decliners, 8 gainers, and 3 unchanged stocks.

“Vietstock Weekly: A Cautious Outlook for the Near Future”

The sharp dip over the weekend curtailed VN-Index’s upward momentum. This pullback prevented the index from breaching the middle line of the Bollinger Bands. Moreover, the trading volume is showing signs of waning and remains below the 20-week average, indicating heightened investor caution. Currently, the MACD indicator continues to trend downward, issuing a sell signal that reflects a short-term outlook that is not yet optimistic.

The Stock Market Week of October 28 – November 1, 2024: A Fragile Recovery

The VN-Index experienced a volatile week with alternating sessions of gains and losses. The cautious sentiment among investors is evident as trading volume remains below the 20-day average. Moreover, the continuous net selling by foreign investors will likely impact the growth trajectory of the VN-Index in the coming period.