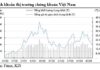

The Vietnamese stock market is going through a rather gloomy adjustment phase. At the close of the November 4 session, the VN-Index continued to fall more than 10 points, retreating to 1,244 points.

In fact, after continuously “failing” before the 1,300-point mark, Vietnamese stocks have entered a sideway down state with small-range recovery sessions, followed by deeper corrections that erased the index’s gains.

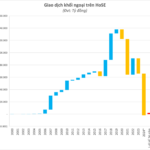

Market liquidity has almost “disappeared” as the matching value on HOSE has only hovered around VND 10,000-12,000 billion in recent sessions. The sharp drop in liquidity even in sessions where the market fell deeply shows that money flow remains resolute to stay out until there is a clear bottom signal.

The market’s sideway down trend makes trading very uncomfortable for investors. So, how long can this “sawing” state last and can the VN-Index fall to 1,200 points?

Mr. Nguyen The Minh – Director of Yuanta Vietnam Securities Analysis

assessed that the stock market is influenced by many factors, including investor psychology being cautious about the adjustment of the global stock market and the upcoming US presidential election results.

The pessimistic psychology is reflected in the continuous deep decline in liquidity while the VN-Index is still struggling before the threshold of 1,300 points. In addition, the prolonged division of stock groups and the lack of leading industries have also made money flow discouraged and oriented towards investment channels with stronger growth.

However, in the context of other channels having had a hot increase, Mr. Minh believes that securities are still a reasonable investment channel. Accordingly, the world gold price, after witnessing a strong increase, will have the risk of divergence and adjustment in the coming time. The real estate channel is also not really attractive because the land price increase is more speculative and when it reaches the peak, it will quickly run out of steam.

After the shaking, the VN-Index has fallen below the 1,250-point mark, but the positive thing is that many stocks have fallen into a “oversold” state. In addition, after the Q3/2024 business results, the P/E of the VN-Index has returned to around 13 times – a relatively reasonable valuation region. Therefore, in the short term, Yuanta’s expert believes that the 1,240-1,250-point region will be the support region to balance the index.

In a bad scenario, if the VN-Index “breaks” 1,240 points, investors need to consider the possibility of the index falling to 1,225 points. However, in 2024, the expert still maintains the view that it is very difficult for the VN-Index to “break” the 1,200-point threshold when the basic foundations are still supporting the market.

In terms of investment strategy, while the market is continuously “sawing” and has not determined the trend, Yuanta’s expert believes that investors who continuously surf will be ineffective, and their accounts may even be eroded. Therefore, investors should buy and hold if they have a good cost price position.

If you still want to trade, you should wait for a deep and strong discount to important support thresholds to allocate capital in parts. Specifically, investors can allocate a part when the index falls to 1,240 points and allocate more decisively when the index falls to around 1,200 points.

Giving a cautious view,

Mr. Bui Van Huy – Director of DSC Securities Branch

said that in the context of a lack of market support, technical recovery sessions will take place, but it is quite difficult to establish a strong upward momentum in the short term. Especially when inter-market factors are unstable, DXY has quickly increased to the current region, and if DXY exceeds 105, another strong net selling session of foreign investors is likely to continue.

”

There are times when we have to admit that the market lacks short-term opportunities and trading is frustrating and unpredictable. The market can easily recover in the current state of frustration and low liquidity, but there is still room to fall,”

Mr. Huy assessed.

According to DSC’s expert, the most expected scenario now is that the market will go sideways, accumulating more in the region of 1,240-1,270 points with recovery sessions appearing intermittently. It is quite difficult for the market to return to an uptrend immediately because there are many unpredictable factors, so investors need to be open-minded even in worse scenarios. If it accumulates around this region, the market will be more comfortable in the second half of November. Currently, large-cap stocks (VN30) have more room to fall compared to the rest.

Mr. Huy recommended that investors should not be pessimistic, but also need to be sober and patient in the short term. If trading in the short term, investors can still hold the stock portfolio, but moderately, and take advantage of the current period to restructure the current portfolio instead of expecting too much.

Unveiling a New Policy: Welcoming the Wave of Foreign Investment to Vietnam’s Stock Market

Vice President of the SSC shared that Circular No. 68/2024/TT-BTC is a result of an expedited and transparent regulatory process, showcasing the strong collaboration between regulatory bodies, operators, and market participants. This collaborative effort is aimed at upgrading and building a securities market that is safe, comprehensive, robust, integrated, and sustainably developed.

The Stock Market Week of October 21-25, 2024: Short-Term Adjustment Pressures

The VN-Index has been on a downward spiral, slipping below the middle Bollinger Band. This, coupled with trading volumes that remain below the 20-day average, indicates a persistent investor caution. To add to the woes, consistent net selling by foreign investors has also contributed to the mounting pressure on the index.

Stock Market Uplift: Vietnam’s Economy Springboard, Attracting Billions in Foreign Investment

According to calculations by the team at VinaCapital, if both the FTSE Russell and MSCI re-evaluations are considered for an upgrade, net inflows could reach a substantial $5 to $8 billion.