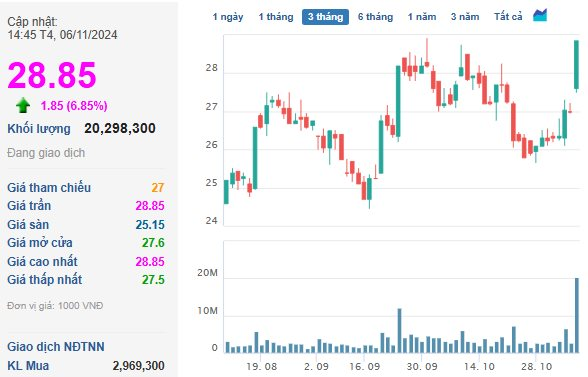

The HoSE-listed Kinh Bac City Development Holding Corporation (KBC) saw its share price soar to a nearly three-month high of VND28,550, with a trading volume of over 20 million, nearly ten times higher than the average of recent sessions. This surge in price and volume followed the announcement of Foxconn’s plan to build an $80 million chip manufacturing plant in Quang Chau Industrial Park, Bac Giang. Shunsin Vietnam, a Foxconn subsidiary, reported this plan to Vietnam’s Ministry of Planning and Investment. The proposed plant will be built on land leased from Saigon-Bac Giang Industrial Park JSC, a subsidiary of KBC.

Foxconn’s proposed plant has a planned investment of over VND1,900 billion, including VND479 billion in capital contributions from investors and the remainder funded through capital mobilization. If approved by the authorities, construction is expected to begin in early 2025, with trial operations starting in June 2026 and official operations commencing in December 2026.

Earlier in October, Hung Yen Hotel Service JSC, another KBC subsidiary, announced a strategic partnership with the Trump Organization. According to a memorandum of understanding between the People’s Committee of Hung Yen Province and the Trump Organization, the project entails a total investment of $1.5 billion, encompassing two 54-hole golf courses, luxury resorts, and high-end hotels. It will also feature a modern residential area, offering world-class entertainment and resort services to the Vietnamese market.

Hung Yen Group, established in 2021 with a chartered capital of VND1,800 billion, specializes in developing industrial real estate, urban areas, and social housing chains. As of June 30, Kinh Bac City Development Holding Corporation held 95% of the voting shares in Hung Yen Group.

Kinh Bac and its subsidiaries and affiliates currently manage over 5,000 hectares of industrial land and 900 hectares of urban land. The company has attracted more than $5 billion in foreign investment annually. In anticipation of the US presidential election, Agriseco Securities expects industrial real estate to be significantly impacted. If Trump is re-elected, Agriseco predicts changes such as increased import taxes, reduced corporate income taxes, and FDI attraction, which may affect Vietnam’s corresponding sectors. As a result, KBC’s industrial real estate business could continue to benefit from the FDI shift.

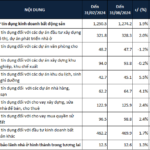

KBC’s strong performance in the third quarter of 2024, with a revenue of VND950 billion and a profit before tax of VND250 billion, coupled with positive news and strong fundamentals, has positioned the company for further growth and attracted investor interest.

The surge in KBC’s share price can be attributed to the market’s positive reaction to the news of Foxconn’s planned chip manufacturing plant in Bac Giang. This development has the potential to bring significant economic benefits to the region and boost investor confidence in KBC and its subsidiaries.

In addition to Foxconn’s planned investment, KBC has also been in the spotlight due to its recent strategic partnership with the Trump Organization. The collaboration aims to develop a large-scale, integrated project in Hung Yen, combining golf courses, luxury resorts, and modern residential areas. This project is expected to attract high-end investors and boost the local economy.

With a vast land bank for industrial and urban development, KBC has a strong foundation to capitalize on the FDI shift. Their ability to attract foreign investment, as evidenced by their annual $5 billion inflow, underscores their potential for growth and profitability.

KBC’s impressive third-quarter performance, with a revenue surge of 3.8 times compared to the previous year, further reinforces their position as a promising investment opportunity. This growth is partly attributed to the low base effect from the previous year and the successful delivery of 16 hectares of land in Quang Chau Expanded Industrial Park.

However, it’s important to consider the nine-month cumulative results, which show a 58% and 82% decrease in revenue and profit, respectively, compared to the same period last year. This highlights the impact of short-term fluctuations and the importance of long-term strategic planning.

Uni Complex Townhomes: Alleviating the Scarcity of Townhome Supply in Binh Duong

The wave of investment in Binh Duong is transformative, driving the growth of premium services and the demand for quality living spaces. Uni Complex is strategically located within the modern infrastructure of Binh Duong New City, offering an attractive proposition to customers with competitive pricing and the potential for future value appreciation.

Unlocking FDI Potential: The Vision for a Prosperous Township

Recently, the Provincial People’s Committee issued Decision No. 2972/QD-UBND, approving the Construction Planning Project for Bau Bang District until 2040.

The New Interest: “The Coming Year’s Slashed Interest Rates”

With the Fed and many central banks entering a cycle of cutting interest rates, Vietnam will continue to maintain its accommodative stance to support economic growth. Interest rates are expected to drop by 0.7% in the coming year, providing a boost to the economy and potentially spurring investment and consumption.