According to Forbes, shares of Trump Media & Technology Group, trading under the symbol $DJT, surged as much as 18.6% to $40.74 in the early afternoon of November 5, boosting Trump’s net worth by over $600 million at that time.

The stock later pulled back, even facing a brief trading halt before recovering to close 5% higher at around $36 per share. By the market’s close, Trump’s shares had dipped 1% to $33.94, resulting in a roughly $40 million decrease in his net worth for the day.

Overall, the parent company of Truth Social has seen its stock surge by up to 85% in the past month.

Per Forbes‘ estimates, Trump’s stake in Trump Media & Technology Group accounts for $3.9 billion of his total $6 billion net worth, placing him at 540th on the list of the world’s richest people.

American media reports that Trump is on track to return to the White House.

Currently, Trump Media’s stock is heavily influenced by the betting markets surrounding Trump’s potential victory in the US election. The recent surge in stock prices is seen as a “vote of confidence” in the Republican candidate.

Last month, the shares traded at $16.50 when Trump’s win probability on the Polymarket platform was 49%. The stock price doubled as his odds climbed above 60%.

The former US President owns 57.3% of Trump Media & Technology Group. The company began trading independently after completing a lengthy merger process with Digital World Acquisition Corp.

Prior to the election-driven surge, Trump Media and Technology Group consistently reported losses and minimal revenue. The stock lost half of its value since mid-May and dropped over 40% following a short-lived spike after the attempted assassination of Trump on July 13. As of the market close on August 12, the company’s market capitalization was $4.72 billion.

Earlier in August, Trump Media & Technology Group reported a loss of over $16 million for the company founded by Trump. The loss was primarily related to legal expenses associated with the merger with Digital World Acquisition Corp in March.

According to the report, Trump Media is confident in its $344 million cash balance and lack of significant debt. The company believes that its solid financial position enables expansion into various areas, including the Truth+ television segment.

According to Forbes

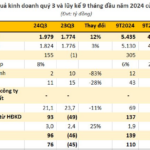

The Power of Profits: How a Power Company’s Quarterly Earnings Report Sent Stock Prices Skyrocketing

This enterprise has soared to new heights, surpassing its annual profit plan by a remarkable 180% in just nine months.

The Pennies-on-the-Dollar Stocks

As of the close of the 11th of October 2024 trading session, the VN-Index stood at 1,288 points. While it hasn’t breached the 1,300-point mark yet, the index has shown a promising upward trajectory, surging over 14% or 157 points since the beginning of the year. However, not all stocks have fared equally well. Some have witnessed a downward spiral or have been stagnant for almost a year, hovering around extremely low prices, often referred to as the “tea-and-chat” zone.