The US Presidential Election is a significant quadrennial event, selecting the President and Vice President of the world’s largest economy. Analysts suggest that the outcome could lead to substantial policy changes, impacting global economies, including that of the US.

Regarding the Vietnamese stock market, historical data reveals that out of the last six White House races, the only time the Vietnamese stock market witnessed a decline was when Barack Obama first won the presidency in 2008. In contrast, the VN-Index tended to increase during the subsequent elections, including Obama’s re-election.

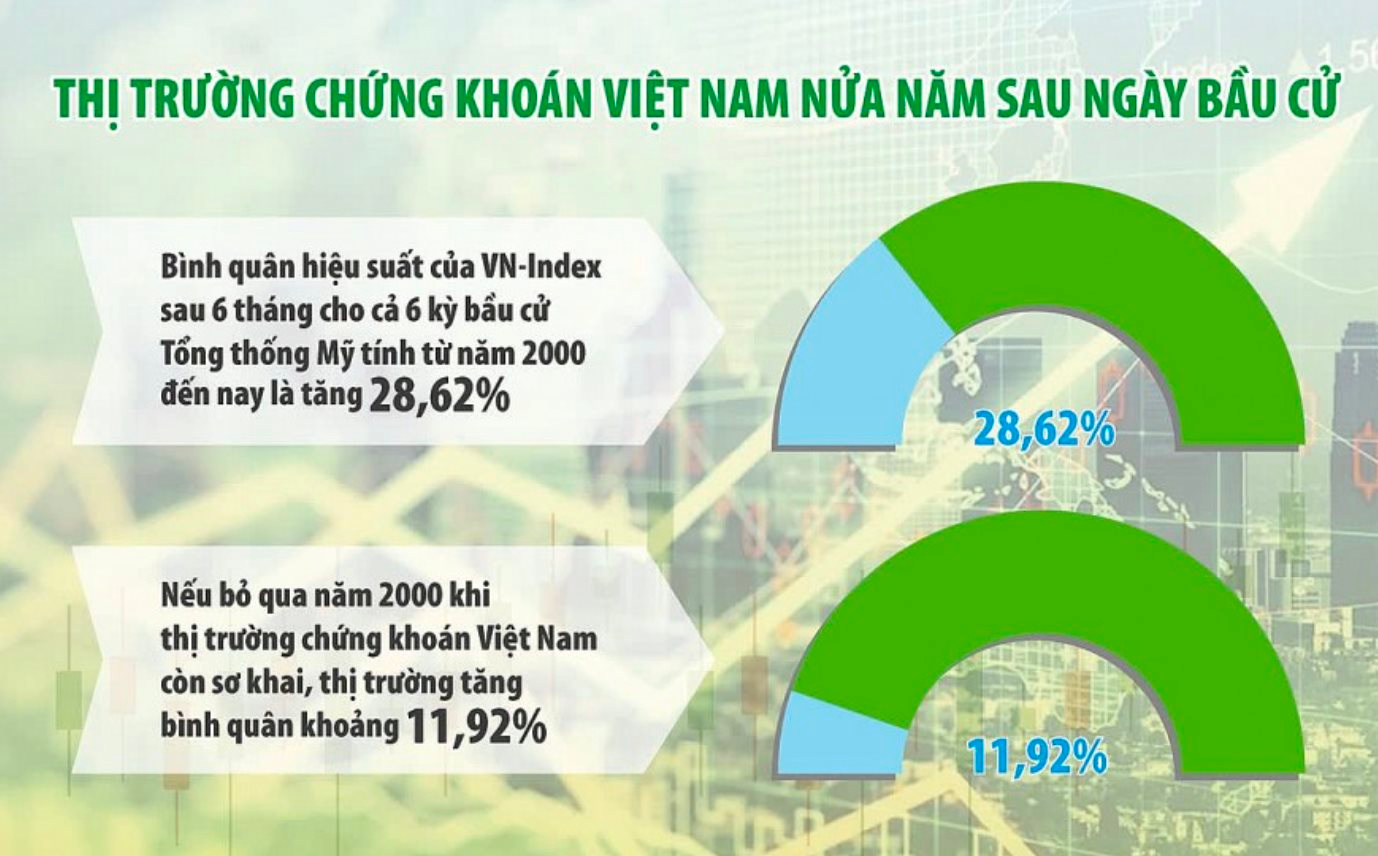

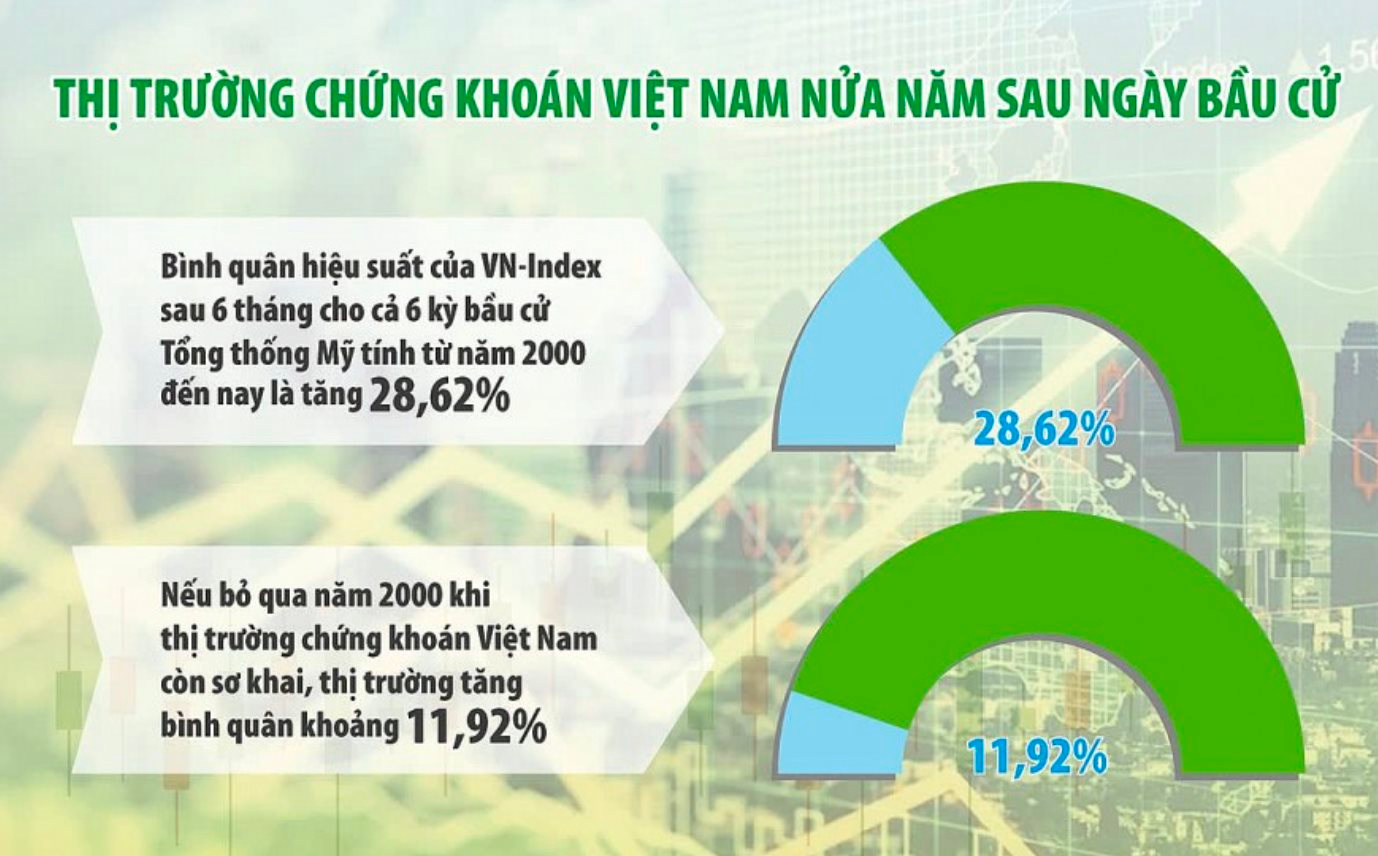

Echoing this sentiment, the Agriseco analysis team found that in the six most recent elections, the VN-Index rose in five of the six periods during the six months post-election.

Specifically, in the six election cycles since 2000, the VN-Index climbed by 28.62% six months after the elections. Excluding the year 2000, when the Vietnamese stock market was still in its infancy, the market has averaged an increase of approximately 11.92%.

Similarly, Mirae Asset Securities (Vietnam) forecasts a potential positive shift in the Vietnamese stock market, aligning with the performance of Wall Street. According to the analysis team from MASVN, while the US presidential election may not always have a significant impact, the domestic stock market tends to move in tandem with the US stock market.

“We observe that the VN-Index often shows a positive short-term reaction after the US presidential election, except in 2008 due to the economic crisis,” notes the analysis team from Phu Hung Securities Co., Ltd. (PHS).

According to PHS, if former President Donald Trump were to win, the VN-Index could experience more significant fluctuations (as seen during the 2016-2020 term) due to his unpredictable policies. However, in the long run, the analysis team maintains a positive outlook on the Vietnamese economy and its stock market.

Why Are Bank CEOs Still Buying and Selling Stocks in a Bear Market?

(NLĐO) – The stock market remained gloomy on November 5, but the banking sector witnessed a positive trend as a flurry of insider activities signaled potential buying opportunities.

Why Did Vietnamese Stocks Soar Post US Presidential Election?

The VN-Index soared and closed at a record high right after the US Presidential election results were announced, surprising many investors.