The State Bank of Vietnam (SBV) has been flexible in managing exchange rates, helping to absorb external shocks.

Following the Government and Prime Minister’s directives, all levels of government, sectors, and localities have made efforts to fulfill the tasks and a large volume of work to achieve the highest results in socio-economic development in 2024, creating momentum for 2025 and the following years.

Improving Credit Growth

In terms of the monetary market, the SBV has actively, flexibly, timely, and effectively managed monetary policy, coordinating it harmoniously and closely with fiscal policy and other macro-economic policies to support economic growth, stabilize the macro-economy, curb inflation, and ensure stability in the monetary and foreign exchange markets and the banking system.

The SBV has been flexible in managing open market operations, considering market developments. Based on close monitoring of the monetary market, the SBV has maintained daily offerings of government bonds with appropriate volumes and terms, as well as continued issuing bills, settling maturing bills to support liquidity regulation, contributing to reducing market interest rates, and promoting economic growth in line with the Government’s policy of lowering interest rates.

Regarding credit management, based on the orientation of about 15% credit growth in 2024, with adjustments according to actual developments, the SBV has actively adjusted credit growth targets for credit institutions (CIs). Specifically, the SBV has announced increased credit growth for CIs, ensuring transparency and fairness. Accordingly, from August 28, 2024, CIs with a credit growth rate of 80% of the target announced by the SBV at the beginning of 2024 will be allowed to proactively adjust credit balances based on their ranking, facilitating CIs’ provision of credit capital to the economy. As of October 22, 2024, the whole system’s credit improved compared to the same period, increasing by 9.21% compared to the end of 2023.

In addition, credit programs for specific sectors and fields have been promoted. By the end of September 2024, the accumulated disbursement of the credit program for the forestry and aquatic sectors reached over VND 42,000 billion for more than 10,500 borrowers; disbursement of the package for social housing, workers’ housing, and projects to renovate and rebuild apartment buildings reached VND 1,783 billion (including VND 1,633 billion for investors in 15 projects and VND 150 billion for home buyers in 12 projects) as of September 30, 2024.

Regarding interest rate management, the SBV has kept the operating interest rates unchanged to create favorable conditions for CIs to access capital at low cost, contributing to supporting the economy. At the same time, the SBV has directed CIs to continue reducing costs to lower lending interest rates, publicly disclose average lending interest rates, the difference between deposit and lending interest rates, and information about lending interest rates for packages, credit programs, and products on the banks’ websites, providing more information for customers when accessing loans. As a result, interest rates have continued to decrease compared to the end of 2023 (as of October 10, 2024, the average lending interest rate decreased by 0.74% per year compared to the end of 2023).

Positive Growth in Cashless Payments

Cashless payment activities have continued to achieve positive results. The interbank electronic payment system, the financial switching and electronic clearing system, and the ATM system have generally operated stably, safely, and smoothly, meeting the payment needs of people and businesses.

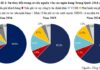

Cashless payment transactions increased by 58.52% in volume and 34.22% in value. Specifically, transactions through the Internet channel increased by 49.45% in volume and 33.19% in value; through the mobile phone channel by 57.93% in volume and 35.54% in value; and through the QR Code channel by 107.76% in volume and nearly 109.09% in value. The interbank electronic payment system increased by 6.65% in volume and 32.84% in value, while transactions through the financial switching and clearing system rose by 34.03% in volume and 18.49% in value.

The implementation of Scheme 06 has resulted in the collection of over 46.4 million customer files and the cross-referencing of biometric information, ensuring the normal operation of payment activities and contributing to reducing the number of fraud cases through the network.

Regarding the restructuring of the system of credit institutions and handling of bad debts, in October, the SBV issued a decision on the compulsory transfer of Construction Bank and Ocean Bank. The SBV has been vigorously and effectively implementing the Scheme on Restructuring the System of Credit Institutions in association with Handling Bad Debts in the 2021-2025 period.

The SBV has directed CIs to promote the handling and recovery of bad debts, improve credit quality, and prevent and limit the occurrence of new bad debts. By the end of August 2024, the ratio of bad debts was at 4.71%. Excluding the three banks under compulsory purchase and the two banks under special control, the bad debt ratio was 1.99%.

Exchange Rate Trends Back to Increase

Since the beginning of October, the USD/VND exchange rate has tended to increase again due to the strengthening of the USD internationally, combined with domestic pressure factors such as the negative interest rate gap between VND and USD and the unfavorable foreign currency supply and demand balance. In this context, the SBV has flexibly managed the exchange rate, helping to absorb external shocks and coordinating policy tools in each period to regulate VND liquidity, thereby reducing the negative interest rate gap between VND and USD in the interbank market and reducing the pressure on VND depreciation. The foreign exchange market remained stable, with smooth foreign currency liquidity, and the economy’s foreign currency needs were fully met.

The central exchange rate has been flexibly managed, in sync with monetary policy tools, to stabilize the foreign exchange market, contributing to curbing inflation and stabilizing the macro-economy. As of October 25, 2024, the central exchange rate was VND 24,255/USD, up 1.63% compared to the end of 2023; the interbank exchange rate was VND 25,393/USD, up 4.69% compared to the end of 2023. The exchange rate at VCB was VND 25,197/25,467/USD, up 4.64%/4.29% compared to the end of 2023.

In the international market, as of October 27, 2024, the US Dollar Index reached 102.88 points, up 1.91% from the previous month. More favorable US economic data, along with escalating geopolitical risks in global hotspots, were the main drivers of the USD’s appreciation. Domestically, the average USD price in the free market was around VND 25,050/USD. The US Dollar Index in October 2024 increased by 0.7% compared to the previous month, 2.41% higher than in December 2023, and 1.89% higher than in the same period last year. On average, the US Dollar Index increased by 5.1% in the first ten months of 2024.

In the gold market, domestic gold prices moved in tandem with world gold prices. As of October 27, 2024, the world gold price averaged USD 2,693.44/ounce, up 4.0% compared to September 2024, due to escalating geopolitical tensions and the continuation of loose monetary policies by major central banks. In the domestic market, the gold price index in October 2024 increased by 5.96% compared to the previous month, 29.97% higher than in December 2023, and 38.88% higher than in the same period last year. On average, the gold price index increased by 27.48% in the first ten months of 2024.