**Market Manipulation Cannot Be Ruled Out**

Possibility of market manipulation remains: Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong

Governor Nguyen Thi Hong has submitted a report to the National Assembly delegates regarding certain issues related to the interpellation session at the 8th session of the 15th National Assembly.

According to the Governor, the recent surge in international gold prices can be attributed primarily to escalating geopolitical tensions, trade conflicts, and armed clashes in various countries worldwide.

Governor of the State Bank of Vietnam, Nguyen Thi Hong.

Domestic gold prices have been experiencing significant fluctuations, moving in tandem with global gold price trends. From the beginning of the year until June, the gap between domestic and international gold prices widened, especially for SJC gold bars.

At certain points, the difference in SJC gold bar prices compared to global prices reached up to 18 million VND per tael (approximately $750).

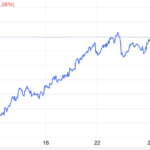

As of November 5, SJC gold bars were traded at 87-89 million VND per tael, marking a 13.5 million VND increase (roughly 18%) from the beginning of the year.

Governor Hong asserted that the fluctuations in domestic gold prices are largely dependent on the dynamics of international gold prices and the relationship between supply and demand in the market.

From 2014 to 2023, the SBV refrained from increasing the supply of SJC gold bars in the market. However, since April this year, the SBV has intervened in the gold market through auctions and direct sales of gold bars to supplement the supply of SJC gold bars, thereby mitigating potential impacts on the macroeconomy, currency, and foreign exchange rates.

On the demand side, the continuous rise in global gold prices, coupled with challenges in other investment channels such as frozen real estate, subdued corporate bond markets, and low bank deposit interest rates, have made gold a more attractive investment option.

Nonetheless, the SBV leadership revealed that feedback from their system units indicated that the demand for gold purchases was primarily concentrated in Hanoi and Ho Chi Minh City, influenced by psychological and expectation factors.

Furthermore, the SBV also acknowledged the possibility of market manipulation and violations of relevant legal provisions on taxation and competition, which may have contributed to the significant price differential between domestic gold (particularly SJC gold) and international gold prices.

44 auctions of SJC gold bars, supplying 11.46 tons of gold to the market

Following the directives of the Government and the Standing Committee of the Government, and in accordance with existing regulations, the SBV conducted gold bar auction sessions following the same principles as the auctions held in 2013.

In the future, the SBV will consider intervening in the gold market if necessary.

From April 19 to May 23, the SBV organized nine auction sessions, with a total winning volume of 48,500 taels (approximately 1.82 tons). However, even after these nine intervention sessions, the gap between SJC and global gold prices remained high.

To swiftly control and reduce the difference between domestic and international gold prices, the SBV shifted to a direct gold bar sales approach, offering appropriate volumes. Four state-owned commercial banks and the SJC company were selected for this purpose.

The report revealed that from June 3 to October 29, the SBV conducted 44 direct sales sessions of SJC gold bars, supplying the market with 305,600 taels (approximately 11.46 tons) of SJC gold.

Prior to the SBV’s announcement of its intention to directly sell SJC gold bars, SJC gold bars in the domestic market were traded at 89-92 million VND per tael, with a difference of over 18 million VND per tael (around 25%) compared to global prices.

According to the SBV, since the official announcement of the direct sales option, the difference between domestic and international gold prices has narrowed, currently standing at around 3-5 million VND per tael (approximately 5-7%).

Considering interventions in the gold market

The SBV stated that the gap between domestic and international gold prices still persists, and the market has not yet achieved sustainable stability. It remains influenced by psychological and expectation factors, posing risks to the currency and foreign exchange markets.

Additionally, certain gold jewelry and handicraft products with 99.99% purity are being used similarly to gold bars (with the possibility that the source of raw materials for production comes from smuggled gold). The SBV noted that this situation could be exploited to undermine the effectiveness of the tight management of the gold bar market as stipulated in Decree 24/2012/ND-CP.

In the future, the SBV will consider intervening in the gold market if necessary, adjusting the volume and frequency of interventions to maintain market stability and achieve monetary policy objectives. They will also coordinate with relevant ministries and sectors to conduct inspections of gold business enterprises, gold bar distribution outlets and purchase agents, and other market participants.

The Golden Rush: Record-Breaking Prices Have Investors in a Frenzy

The surge in gold prices, inching towards the $2,800/oz mark, remains unwavering despite the rise in US Treasury yields and a strong dollar, indicating that debt woes are a more potent force in the market.

The Glittering Gold Crash: When the Glitter Fades.

“Gold prices notched their fourth straight monthly gain as risk-averse investors sought safe havens ahead of the U.S. presidential election. The precious metal has been on a stellar run, buoyed by a perfect storm of factors, including a weak dollar, low interest rates, and heightened market uncertainty. This month’s performance adds to a string of impressive gains, solidifying gold’s status as a safe-haven asset in turbulent times.”

Gold Prices Slip in Early Monday Trade, Experts Point to “Anomalies”

“It’s an anomaly that gold prices have continued to break records recently, despite rises in the USD and US Treasury bond yields.