Gold prices fell 1.8% this week, the biggest drop in more than five months, due to a stronger US dollar and predictions about the potential impact of Donald Trump’s event on future US interest rates.

Spot gold ended the week at $2,684.03 an ounce, while December 2024 gold futures settled at $2,694.80.

Domestic gold prices also fell sharply this week. SJC gold bars on Saturday (Nov 9) were quoted at VND 82-86 million/tael (buy-sell), compared to VND 87.5-89.5 million/tael a week ago. Meanwhile, SJC 9999 gold rings fell to VND 83.32-85.15 million/tael, from VND 83.32-85.12 million/tael previously.

The Dollar Index, which measures the US dollar against a basket of major currencies, rose 0.6% this week.

Gold price movement this week

“In the past month, the story has revolved around the risks and uncertainties of the election, and whether the transition will be normalized. But this election seems to be decisive for the White House,” said Alex Ebkarian, CEO of Allegiance Gold.

“Many risky assets have started to benefit from the potential impact of future policies, so we have taken money out of metals and moved on to these alternatives,” added Ebkarian Gold.

The US Federal Reserve (Fed) cut interest rates by 25 basis points on Thursday (Nov 7) but said it would be cautious about further cuts.

Trump’s victory has raised questions about whether the Fed can continue to cut interest rates at a slower and smaller pace than expected, given the former president’s tariff policies, although Fed Chairman Jerome Powell said the election result would have no “short-term” impact on monetary policy.

The prospect of interest rate cuts, starting with a half-point cut in September, has supported gold’s record-breaking rally this year. While bullion is considered an inflation hedge, high interest rates reduce the appeal of non-yielding gold and vice versa.

“If the market restores the odds of the Fed cutting rates once before Christmas… that would help keep spot gold prices above the psychological $2,700 level,” said Han Tan, chief market analyst at Exinity Group.

The Kitco News survey showed overwhelming pessimism among industry experts, while retail traders also turned pessimistic for the first time in many months.

“Prices will fall,” said Darin Newsom, senior analyst at Barchart.com. “Although I think investors will return to gold for long-term risk aversion, the December contract has not yet ended its short-term downtrend. This opens the door to a new sell-off early next week.”

David Morrison, senior market analyst at Trade Nation, said the technical picture suggests gold prices will continue to fall.

“Gold prices fell on Wednesday (Nov 6) as it became clear that Trump had won a second term as US president. Much of the gold sell-off can be blamed on the surge in the US dollar after this news, as the stronger greenback was fueled by a sharp rise in bond yields as investors worried that the tariffs and tax cuts Trump has promised will lead to a return of inflation.”

Mr. Morrison said that since the election results, the dollar and yields have returned to more reasonable levels. “This has helped gold find a bottom and stage a mild rally on Thursday (Nov 7). But the rally ended early Friday (Nov 8) morning and gold once again came under selling pressure. The current support level is $2,635-2,675. This was the resistance level in the last week of September and early October. Gold tried to break above $2,700 on Thursday evening but failed to hold this level as support. Instead, prices fell during the Asia-Pacific trading session until finding support around $2,680.”

“Prices will fall,” said Adam Button, currency strategy director at Forexlive.com. “I think prices could move sideways after the election, but I’ll be watching closely for signs of who will be the next Treasury secretary. In previous elections, Trump announced Mnuchin on November 29 and Biden chose Yellen on November 23, so the upcoming announcement is probably not next week but soon. If the choice is John Paulson – a big gold speculator – then I expect gold to rally.”

“Gold will rise,” said James Stanley, senior market strategist at Forex.com. “It looks like gold prices will fall after the election, but the reaction since then has been quite positive, with bullish speculators defending the $2,650 level and pushing prices up to $2,700. Typically with that move, I would start to lean towards a bearish outlook, but given how strong gold has been this year, I’m not yet ready to believe in a trend reversal, so I remain bullish.”

“It will fall,” said Adrian Day, president of Adrian Day Asset Management. “Gold’s continued decline would not be a disadvantage, as some investors are still taking profits even as central banks and Chinese consumers buy less than previous highs. However, the momentum for all these different buyers remains: the desire of some central banks to diversify away from the US dollar, as well as China’s concerns about the economy and banks remain, while it is clear that the Fed and other central banks will continue to ease policy in the face of a slowing economy, even before inflation is completely extinguished, against the backdrop of high budget deficits and no ability to control them.”

“Remember that gold had a similar reaction to Donald Trump’s election in 2016, also due to optimism about economic growth, a strong dollar, and a strong stock market,” Day added. “At that time, the retreat lasted about six weeks.”

Frank Sohlleder, analyst at ActivTrades, also believes that gold is likely to fall further in the coming weeks. He said: “Despite the uptrend, gold has not been able to escape the risk of a major correction. Even the cut in the key interest rate in the US cannot guarantee that there will be strong demand for gold. Therefore, it must be assumed that the gold price may continue to fall. Gold is currently trading at around $2,680 an ounce.”

“Down,” said Mark Leibovit, publisher of VR Metals/Resource Letter. “Trump’s success in the Middle East could slow gold’s upward momentum – which has risen in recent times due to conflict. True, there are other reasons, and overall, my next big target of $3,700 remains unchanged, but I don’t have a specific timeline for that target.”

“In summary, we’re about to see a price drop,” he added. “The best strategy I’ve used is to maintain core buying positions and hedge risks with inverse gold and silver ETFs like GLL and ZSL.”

Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, explained the impact of the election on gold in the short and medium term. He said that much of gold’s decline on Tuesday night was due to the diminishing risks of election turmoil.

“I think what happened is that gold was priced according to the 2000 scenario,” he said. “Then, when there was a decisive winner – to some extent, it doesn’t matter who, just that there was a winner – a certain amount of event risk was removed. Less than a month ago, gold was trading at $2,600. Currently, gold is trading at $2,680 and peaked at around $2,780, so essentially, the increase has been from $2,600 to $2,780, and we’ve come back about halfway through that increase.”

The second factor Cieszynski cited was the US dollar, which strengthened after Trump’s victory, exacerbating the gold sell-off.

“The US dollar has strengthened,” he said. “The US dollar is the enemy of gold, and the US dollar has also had a rally, but that could also be due to the same underlying reason. The removal of election uncertainty has boosted the US dollar and depressed gold. So it’s not that ‘gold fell because the dollar rose’, but that ‘gold fell AND the dollar rose’ because of this other event.”

“The inflation scenario probably won’t change much,” he added, “especially if [Trump] actually imposes tariffs, which could lead to inflation.”

The third factor Cieszynski believes could change gold’s recent trajectory is the Fed returning to rate cuts.

“Looking at the medium term, one of the fundamental drivers of this gold rally has been central banks starting to cut interest rates,” he said. “They cut them frequently and, in some cases, quite aggressively. That could slow down. This is the first week we’ve started to hear rumors that the Fed may skip a meeting. Even last week, there were no such rumors. The Bank of Canada is still going full throttle, and some other banks are still cutting aggressively.”

This has devalued paper money and boosted the value of gold. “But if the situation starts to become one where central banks start to slow down the pace of rate cuts, that’s also a headwind for gold,” he said. “I think gold could move sideways for a while, which is normal.”

“I don’t fully believe it will have a major correction,” Cieszynski added. “I don’t think it will go back to $2,000 or anything like that. Maybe $2,500, it could test the $2,500 level.”

Turning to the short term, Cieszynski believes gold will fall sharply next week.

“I’m actually bearish for next week,” he said. “The reason I say that is that gold has had a big rally, and technically, it’s due for a correction. It may not be a major correction, but I think gold could struggle for another week.”

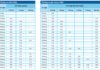

Fourteen analysts participated in the Kitco News Gold Survey, and the strong sell-off this week has left most Wall Street analysts believing that gold prices will fall again next week. Only three experts, or 21%, expected gold prices to rise during the week, while nine analysts, or 64%, predicted that gold would fall. The remaining two analysts, or 14%, expected gold to trade sideways.

Meanwhile, 249 retail investors voted in an online Main Street poll. Among these, 114 voters, or 46%, expected gold to rise next week, while 91 people, or 36%, predicted that gold would fall. The remaining 44 voters, or 18%, were neutral on prices.

Kitco News survey results on gold price forecasts for the coming week

Reference: Kitco News

The Currency Financial Market Stability

According to a report by the Ministry of Planning and Investment, the economy in October and the ten-month period showed a strong recovery despite ongoing challenges and difficulties. Economic and social activities rebounded quickly after natural disasters and floods. In October, several international organizations upgraded their growth forecasts for Vietnam in 2024, predicting it could be the highest among ASEAN+3.

“Gold’s Gloomy Outlook as ‘Risk-On’ Assets Reign Supreme Post-Trump Victory”

Last week’s markets were dominated by the US Presidential election, and the precious metals sector was no exception, as expected. What was surprising, however, was the pace of the volatility and the ensuing gold sell-off, which has left market participants wondering about the future direction of this metal.

The Great Gold Crash

This morning (November 10th), the domestic gold market witnessed an unprecedented end to a week-long downward spiral. SJC gold and gold rings rebounded to the 85 million VND per tael mark.