Sabeco Finalizes Timing for Sabibeco Takeover, Allocating Over VND 830 Billion

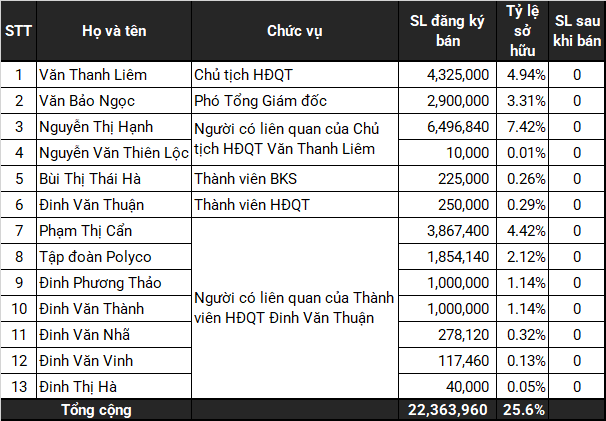

Chairman of the Board at SBB, Van Thanh Liem, along with his wife, Nguyen Thi Hanh, their daughter, Van Bao Ngoc (Vice President of SBB), and son-in-law, plan to offload the most shares, totaling 15.68% of SBB’s capital. Thus, the chairman’s family still includes his son, Van Thao Nguyen (Vice Chairman and CEO of SBB), and daughter-in-law, Nguyen Huynh Loan Anh, who respectively own 3.74% and 1.48% of the capital, with no current plans to divest.

Meanwhile, the family of Board member Dinh Van Thuan, including his wife, Pham Thi Can, their children, and his siblings, intend to offload their entire 7.49% stake. Polyco Joint Stock Corporation, where Mr. Thuan is the legal representative, also aims to sell its entire 2.12% holding.

Late October, Saigon Beer, Alcohol, and Beverage Joint Stock Corporation (Sabeco, HOSE: SAB) announced a public offer to purchase over 37.8 million SBB shares at VND 22,000 per share to increase its ownership to 59.6%. SAB also stated that it might increase the offer price if necessary to ensure the deal’s success or cancel the offer if the number of registered shares for sale does not reach at least 28.7% of the circulating shares.

If the transactions occur at the price announced by SAB, the family of Chairman Van Thanh Liem could recoup VND 302 billion, while Dinh Van Thuan and his relatives might receive VND 185 billion.

According to SBB’s leadership at the annual general meeting in July, the previous purchase price was VND 26,000 per share, but “SAB requested a reduction, so the Board is renegotiating the sale price to ensure the best interests of shareholders.” The current offer price of VND 22,000 per share is approximately 21% higher than the closing price on November 11, which had already increased by 25% in the past three months.

|

List of Executives and Their Relatives Registered to Sell SBB Shares

Source: Author’s Compilation

|

“Sabeco Sets Sights on Sabibeco Takeover, with an Estimated Budget of Over VND 830 Billion”

The Vietnam-based beverage giant, Saigon Beer, Alcohol and Beverage JSC (Sabeco) has announced its intention to acquire over 37.8 million shares, representing a 43.2% stake, in Saigon Binh Tay Beer Joint Stock Corporation (Sabibeco). This move by Sabeco, a prominent player in the Vietnamese beer industry, signals its strategic expansion plans and reinforces its dominance in the country’s vibrant beverage market.