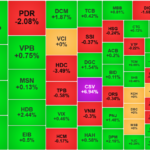

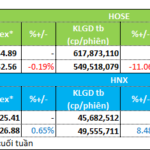

The VN-Index rose by 0.46% to close at 1,264.48 on October 31, 2024. Total trading value across the three exchanges reached VND 19,234.1 billion, a 35.2% increase from the previous session. While the trading value of matched orders reached VND 12,047.4 billion, a decrease of 1.9% from the previous session, it also decreased by 5.3% compared to the 5-day average and by 20.7% compared to the 20-day average.

Liquidity decreased notably in the Real Estate, Construction, and Retail sectors, with the latter two experiencing gains. Conversely, the Banking sector witnessed both price and liquidity increases compared to the previous day’s trading.

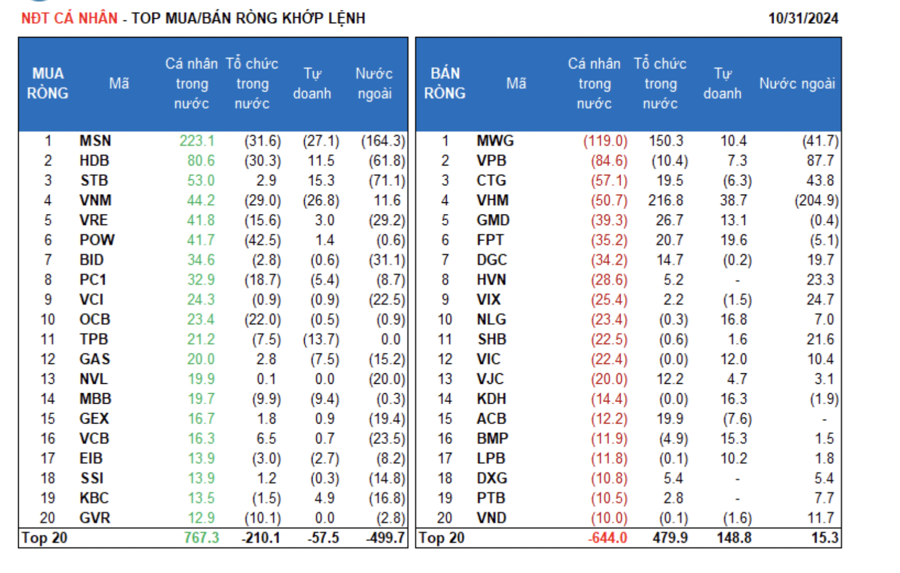

Foreign investors sold a net amount of VND 1,584.2 billion, with a net sell of VND 497.0 billion in matched orders. Their main net buy orders were in the Travel & Entertainment and Chemicals sectors, focusing on VPB, CTG, VIX, HVN, SHB, DGC, VND, VNM, FRT, and VIC stocks. On the other hand, their main net sell orders were in the Real Estate sector, specifically targeting VHM, MSN, STB, HDB, MWG, VRE, HPG, VCB, and VCI stocks.

Individual investors bought a net amount of VND 869.4 billion, with a net buy of VND 136.9 billion in matched orders. In terms of matched orders, they net bought 8 out of 18 sectors, mainly in the Food & Beverage sector, focusing on MSN, HDB, STB, VNM, VRE, POW, BID, PC1, VCI, and OCB stocks. Their net sell orders were in 10 out of 18 sectors, primarily in the Retail and Real Estate sectors, with a focus on MWG, VPB, CTG, VHM, GMD, FPT, HVN, VIX, and NLG stocks.

Proprietary traders bought a net amount of VND 115.4 billion, with the same net buy value in matched orders. Focusing on matched orders, they net bought 8 out of 18 sectors, mainly in the Real Estate and Information Technology sectors. Their top buys were VHM, FPT, NLG, KDH, BMP, STB, GMD, HPG, VIC, and HDB stocks. Conversely, their top net sells were in the Food & Beverage sector, targeting MSN, VNM, TPB, MBB, ACB, GAS, CTG, DPM, PC1, and EIB stocks.

Domestic institutional investors bought a net amount of VND 633.0 billion, with a net buy of VND 244.7 billion in matched orders. In terms of matched orders, domestic institutions net sold 9 out of 18 sectors, with the highest value in the Food & Beverage sector. Their top net sells were POW, MSN, HDB, VNM, OCB, PC1, VRE, CTR, VPB, and GVR stocks. Their top net buys were in the Real Estate sector, focusing on VHM, MWG, GMD, FPT, ACB, CTG, DGC, VJC, HPG, and VCB stocks.

Today’s matched orders contributed 37.4% of the total trading value, with a notable transaction in MSN stock, where foreign institutions traded over 61.1 million shares worth VND 4,493.3 billion. Additionally, individual investors continued to be active in the Banking sector stocks, including VIB, SHB, LPB, MSB, and EIB.

The money flow allocation increased in Banking, Securities, Steel, Food, Oil & Gas Production and Exploration, and Aviation sectors, while it decreased in Real Estate, Construction, Chemicals, Agro-Forestry-Fisheries, Retail, Oil & Gas Equipment and Services, and Software sectors. Specifically, for matched orders, the money flow allocation increased in the large-cap VN30 group while decreasing in the mid-cap VNMID and small-cap VNSML groups.

The Surprising Surge of Penny Stocks: A Market Phenomenon

Liquidity saw a significant improvement during the afternoon session; however, funds did not largely flow into the blue-chip stocks. It was the mid-cap and small-cap stocks that witnessed a surge as the liquidity in the mid-cap group increased by 37% compared to the previous day, while the small-cap group witnessed a remarkable 44% increase, leaving the VN30 with just a 14% gain.

Technical Analysis for the Afternoon Session of November 12th: A Notable Drop in Liquidity

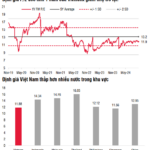

The VN-Index and HNX-Index moved in opposite directions, forming a Doji candlestick pattern, indicating investor indecision and a potential turning point in the market.

SSI Research: Short-term Volatility Presents Buying Opportunities for Long-term Investors

“According to SSI Securities Corporation’s November 2024 strategy report, the SSI Research Center for Analysis and Investment Consulting believes that the market may fluctuate in the short term. However, this also presents an opportunity to buy potential stocks at reasonable prices to build a long-term investment portfolio.”