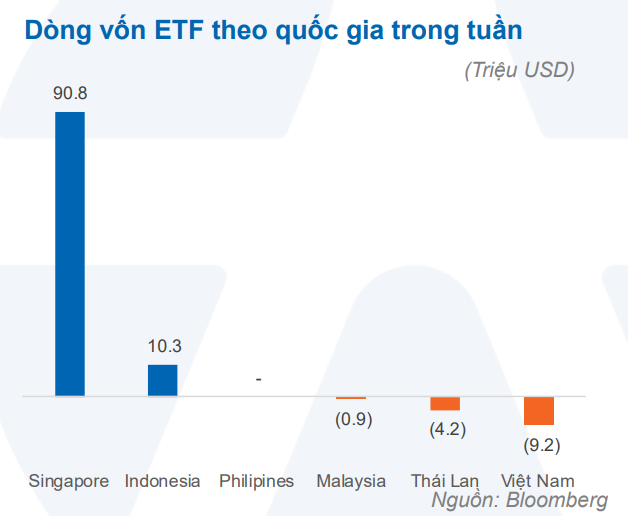

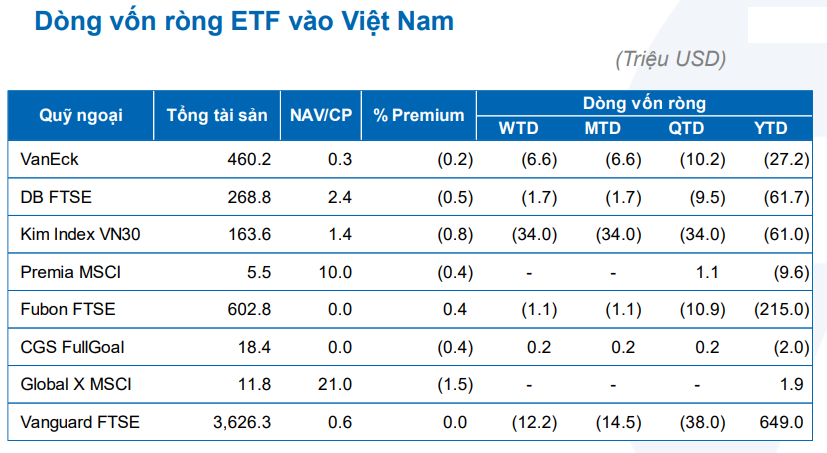

According to data from Yuanta Vietnam, foreign ETFs continued to withdraw a net amount of $9.2 million from the Vietnamese market, with selling pressure mainly concentrated in the Kim Index VN30 fund (34 million) and the VanEck fund (6.6 million).

Notably, while Vietnam witnessed capital outflows, ETFs investing in the Southeast Asian region attracted strong net inflows of $86.8 million. Singapore was the top destination with $90.8 million, followed by Indonesia with $10.3 million.

Meanwhile, capital flowed strongly into the US market after Donald Trump’s victory in the US presidential election and the Fed’s decision to cut interest rates by 25 basis points. This capital pushed all three major stock indexes to record highs. ETFs in the US recorded a strong week of capital inflows, totaling $21.9 billion, with equity funds seeing a surge of 81% to $18.5 billion.

Year-to-date, large foreign ETFs in Vietnam such as VanEck, DB FTSE, and Kim Index VN30 have all experienced significant net outflows of $27.2 million, $61.7 million, and $61 million, respectively. This trend reflects foreign investors’ caution towards the Vietnamese market, despite the region’s positive outlook.

Vu Hao

Gold Prices Plummet Following Trump’s Election Victory

The global gold price plunge has dragged the price of 99.99% gold rings below the 88 million VND per tael mark.

“Important Notice for LPBank Customers: Two Scenarios that Will Halt Online Money Transfers Starting January 1, 2025”

To access online transactions (money transfers, e-wallet top-ups and withdrawals, etc.), and to utilize their debit cards and payment accounts, customers must complete the following two steps.