In Q3 2024, revenue for major wholesalers in the technology equipment industry, such as Digiworld (HOSE: DGW) and Petrosetco (HOSE: PET), saw positive growth, increasing by 15% and 33%, respectively, compared to the same period last year. Along with this, both companies improved their profits.

At the Investor Meeting on the afternoon of November 5, Digiworld’s Chairman, Mr. Doan Hong Viet, shared his thoughts on the consumer market. He believed that it had hit its lowest point in the first half of the year and was showing signs of recovery in the latter half, although not strongly. Mr. Viet expected that the demand situation would continue to improve as we move into 2025.

This year, Apple’s new phone line-up arrived in the Vietnamese market a week earlier than usual (in the last week of September), contributing to the Q3 performance of distributors and retailers alike.

“The number of iPhone 16 units exceeded that of the previous iPhone 15, resulting in better sales performance this quarter compared to the same period last year,” shared Mr. Viet of Digiworld.

“iPhone sales in September increased by more than 50% compared to August, just a few days after the product launch,” said Mobile World Investment Corporation (HOSE: MWG) in its business performance update report.

However, amid this optimistic picture for major players in the ICT industry, the FPT Shop chain of FPT Retail (HOSE: FRT) witnessed lower revenue compared to the previous year.

|

Mixed Performance

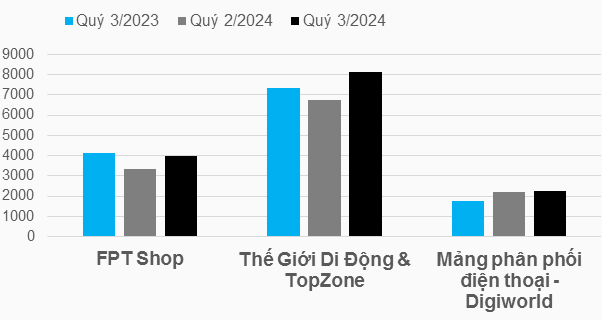

FPT Shop’s Q3 2024 revenue was lower than the previous year, while the phone segment of MWG and Digiworld thrived. Unit: VND billion

Source: VietstockFinance

|

While phones continued to sell slowly, FPT Retail’s revenue growth was driven by the expansion of the Long Chau chain, including its pharmacy system and vaccination centers.

FPT Retail’s consolidated net profit in Q3 2024 reached VND 140 billion, the highest since the last quarter of 2021, mainly due to the pharmaceutical business segment.

In contrast, MWG’s An Khang pharmacy chain closed 155 stores in the last quarter, corresponding to the cessation of operations of up to one-third of its total outlets. However, the pharmaceutical segment accounts for a small proportion of MWG’s overall business results.

For the retail conglomerate led by Mr. Nguyen Duc Tai, consolidated revenue is largely boosted by the momentum of the mini-supermarket chain.

In Q3 2024, Bach Hoa Xanh continued its growth trajectory, albeit with some slowdown, as the average revenue per store remained at VND 2.1 billion for three consecutive months, instead of rapidly increasing as in the same period last year. Notably, the chain reported a profit of approximately VND 90 billion in the last quarter, marking its second consecutive profitable quarter.

|

Pharmaceuticals and Groceries as Growth Drivers

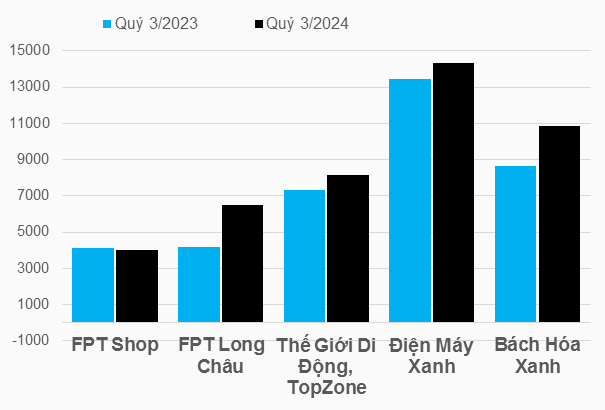

Revenue of the chains (with significant contributions) of the two retail giants – FPT Retail and MWG Unit: VND billion

Source: VietstockFinance

|