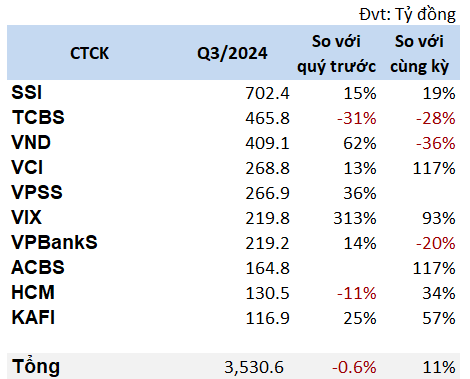

According to data from VietstockFinance, proprietary trading activities of securities companies generated a profit of over 3,530 billion VND in Q3/2024. This quarter’s results decreased slightly by 0.6% compared to the previous quarter. However, it improved by 11% year-over-year.

|

Top 10 Profitable Securities Companies in Proprietary Trading, Q3/2024

|

|

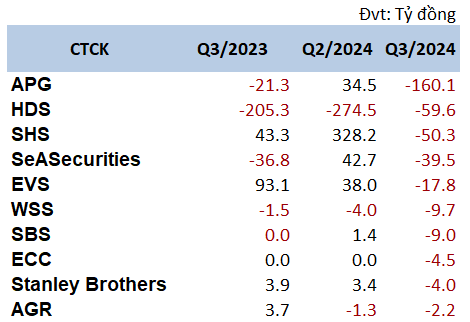

Top 10 Loss-making Securities Companies in Proprietary Trading, Q3/2024

Source: VietstockFinance

|

The proprietary trading profits reflect the stock market performance in Q3, which witnessed a sharp decline from 1,285 to 1,190 points, followed by a rebound to the 1,285-point level of the VN-Index. As the market has not escaped the resistance zone, securities companies have struggled to grow their proprietary trading profits.

Compared to the same period last year, profits from financial assets recorded through gains/losses (FVTPL) decreased by 10%, reaching 7,580 billion VND. Losses from FVTPL assets decreased by 18%, amounting to 3,800 billion VND. By controlling the losses in FVTPL assets, securities companies managed to achieve an overall increase in profits compared to the previous year.

This quarter, there was a significant disparity in the scale of proprietary trading profits among securities companies. SSI Securities led the way with a profit of over 702 billion VND, far surpassing TCBS Securities, which ranked second with a profit of 465.8 billion VND.

SSI’s proprietary trading profit increased by 15% compared to the previous quarter and 19% year-over-year. In contrast, TCBS’s profit decreased by approximately 30% compared to both the previous quarter and the same period last year.

Several securities companies witnessed a significant surge in proprietary trading profits, including VIX Securities, which earned nearly 220 billion VND, quadrupling the profit from the previous quarter and almost doubling that of the same period last year.

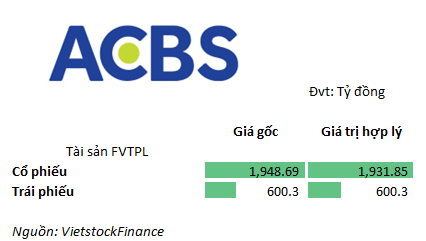

ACBS also saw a jump in profits, surpassing 165 billion VND, more than doubling the figure from the previous year and turning a loss in Q2 into a profit this quarter.

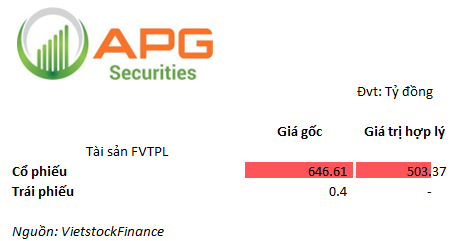

However, some companies suffered significant losses in this segment. APG Securities lost up to 160 billion VND, while HD Securities lost nearly 60 billion VND, and SHS lost more than 50 billion VND.

For APG, proprietary trading was the primary reason for the company’s loss of nearly 150 billion VND in Q3. As for HD Securities, the loss was relatively positive as the scale of the loss decreased compared to the previous quarters, falling from 200-300 billion VND to just 60 billion VND.

What’s in the proprietary trading portfolios of securities companies?

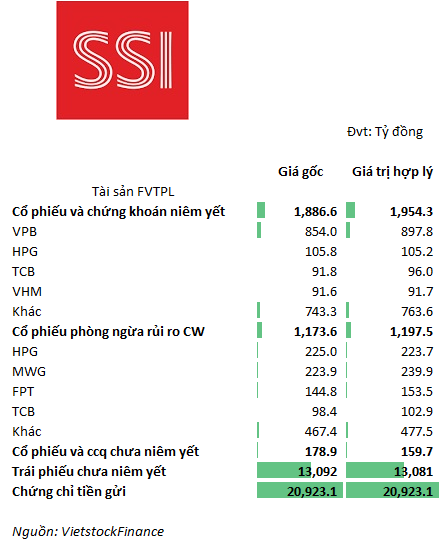

Leading the way in proprietary trading profits, SSI Securities currently holds nearly 1,900 billion VND in listed stocks. This portfolio is temporarily up by 3.5%. Notably, VPB and HPG are two prominent investments within this portfolio.

Examining the FVTPL asset portfolio, SSI holds 13 trillion VND in unlisted bonds and nearly 21 trillion VND in deposit certificates.

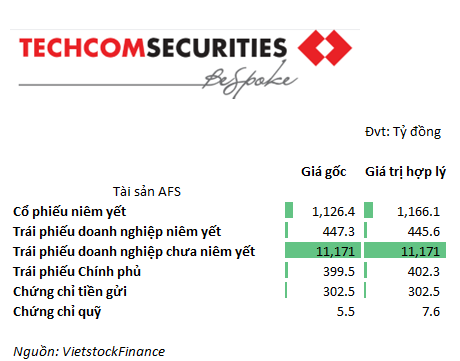

For TCBS, investments in unlisted bonds remain crucial. The company’s financial assets are primarily held in the form of available-for-sale (AFS) assets, with 83% comprising unlisted bonds worth over 11.1 trillion VND.

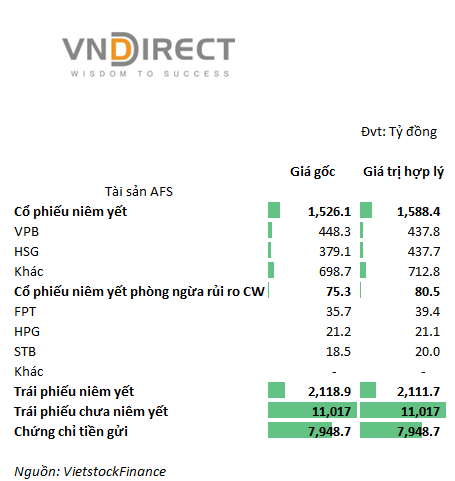

VNDIRECT also holds over 11 trillion VND in unlisted bonds and nearly 8 trillion VND in deposit certificates.

In terms of stock holdings, the company primarily invests in VPB and HSG.

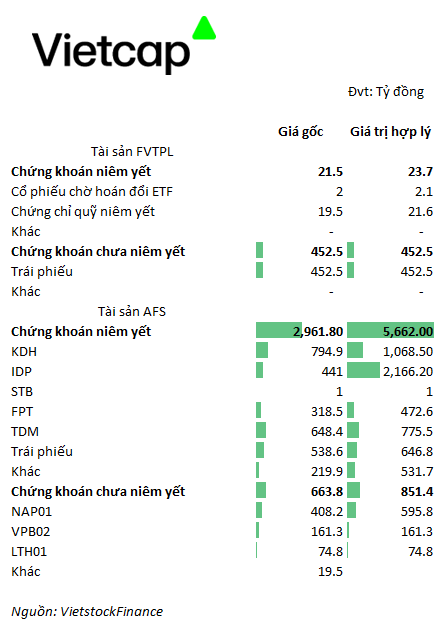

Vietcap’s massive profit lies in its AFS asset portfolio, with investments in KDH, IDP, TDM, and FPT. Notably, the investment in IDP has quintupled in value.

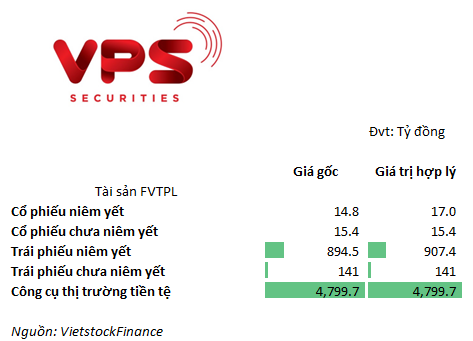

VPS Securities focuses on holding listed bonds and money market instruments.

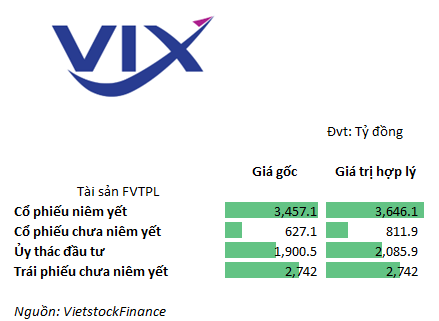

For VIX, listed stocks and unlisted bonds are the two main pillars. Additionally, the company still holds a trust investment of 1.9 trillion VND.

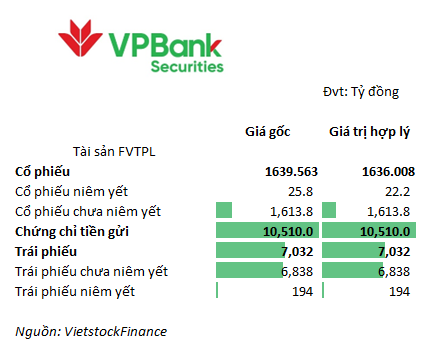

Gaining momentum in proprietary trading, VPBank Securities (VPBankS) has a portfolio similar to the industry leaders, focusing on deposit certificates and bonds.

In contrast, ACBS concentrates on stocks, with equities accounting for three-quarters of the value of FVTPL assets.

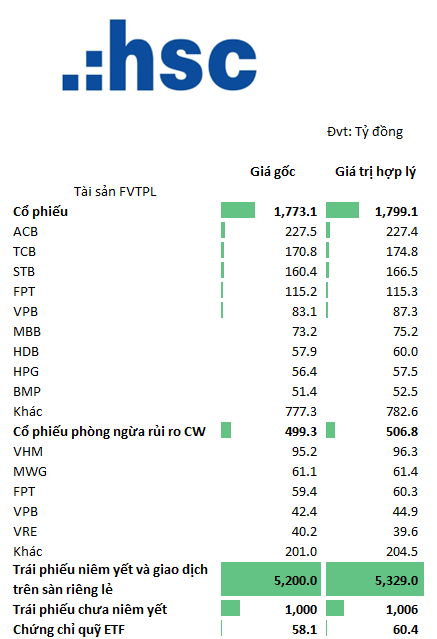

HSC Securities holds over 5.2 trillion VND in listed bonds and privately placed bonds.

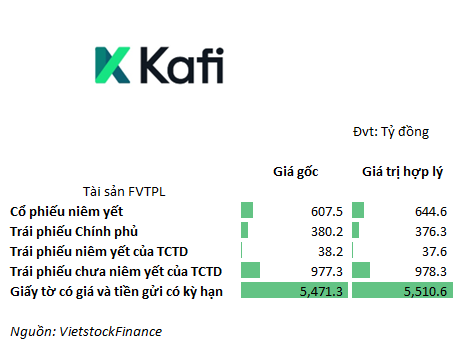

Kafi Securities’ proprietary trading strategy involves allocating funds to safe assets, such as securities and fixed-term deposits, while also investing a portion in stocks and bonds.

In the group of loss-making companies, the portfolios mainly consist of stock holdings.

APG Securities’ portfolio is heavily focused on stocks. As of the end of Q3, this portfolio incurred a loss of over 143 billion VND.

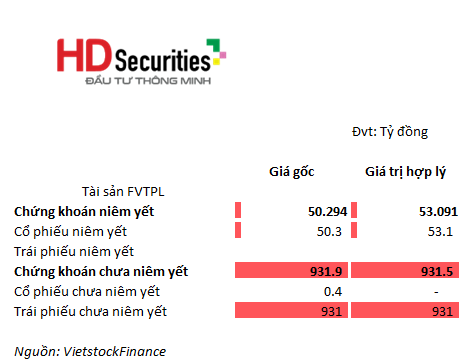

HDS’s portfolio is dominated by unlisted bonds, accounting for 931 billion VND or 95% of the total portfolio composition.

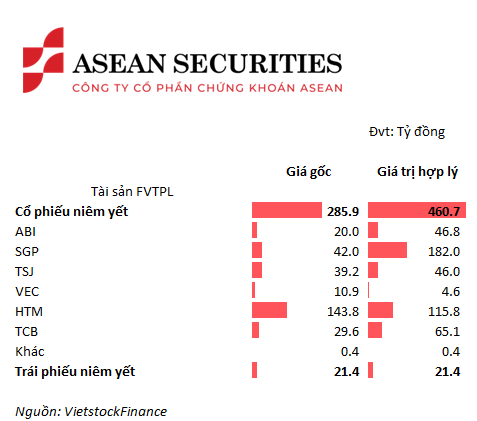

Asean Securities holds primarily listed stocks. With a purchase price of 285.9 billion VND, the portfolio is currently up by over 60%. However, the company still reported a loss in proprietary trading due to a significant reduction in its stock holdings compared to the end of Q2. At the end of Q2, the company held the same portfolio with a profit margin of up to 76%.

Notable stocks in Asean Securities’ portfolio include HTM, SGP, and TSJ, with SGP being the most profitable investment.

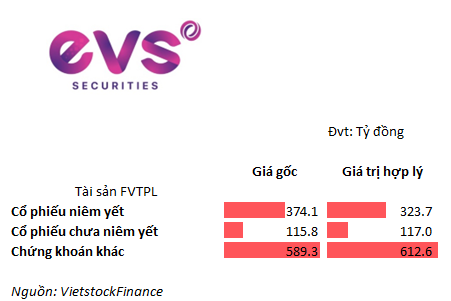

EVS Securities holds 374 billion VND in listed stocks (temporarily down by 13.5%). The portfolio of Other Securities has the highest weight, valued at nearly 590 billion VND (temporarily up by 4%).

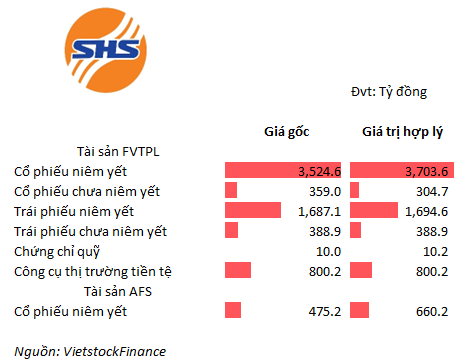

SHS Securities focuses on two main items: listed stocks and listed bonds, valued at 3.5 trillion VND and nearly 1.7 trillion VND, respectively. Additionally, the company holds 475 billion VND in listed stocks within its AFS asset portfolio. These investments have yielded a profit of almost 40%.

[Chí Kiên]

The Savvy Investor’s Bottom-fishing Expedition

The VN-Index pared losses, forming a Hammer candlestick pattern with above-average volume. This indicates a temporary reprieve from market risks as bottom-fishing funds entered the market, spurring a surge in trading volume. The Stochastic Oscillator, having exited oversold territory, continues to signal a buy. If this signal holds in the coming sessions, the short-term outlook may not be as pessimistic.

The Surprising Surge of Penny Stocks: A Market Phenomenon

Liquidity saw a significant improvement during the afternoon session; however, funds did not largely flow into the blue-chip stocks. It was the mid-cap and small-cap stocks that witnessed a surge as the liquidity in the mid-cap group increased by 37% compared to the previous day, while the small-cap group witnessed a remarkable 44% increase, leaving the VN30 with just a 14% gain.

Industrial Real Estate Stocks: A Week of Capital Attraction

Liquidity remained lackluster during the week of November 4–8, with no significant improvements observed. However, certain sectors stood out as money magnets, attracting investors’ attention with their unique narratives.