After a profitable first half of the year, driven by a rebound in insurance demand and stable compensation rates, the fortunes of insurance companies took a drastic turn due to the devastating impact of Typhoon Yagi, the third storm of the season.

Yagi was the strongest typhoon in 30 years to hit the South China Sea and the most powerful in 70 years to make landfall in Vietnam. It was unprecedented in terms of wind speed, with gusts of up to 17, its prolonged duration over land, its wide reach covering all 26 northern provinces and Thanh Hoa, and the prolonged heavy rainfall that triggered severe flooding and landslides in many localities. The storm caused an estimated damage of over 81 trillion VND nationwide, an unprecedented loss for the Vietnamese insurance industry, with massive compensation payouts.

Profits Swept Away

Typhoon Yagi struck during the last month of the third quarter, which is typically a peak business month for non-life insurance companies. As a result, the compensation payouts that these companies had to make to their customers could not be fully accounted for in the third quarter and will continue to impact the fourth quarter as well.

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

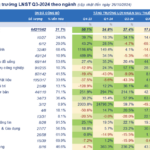

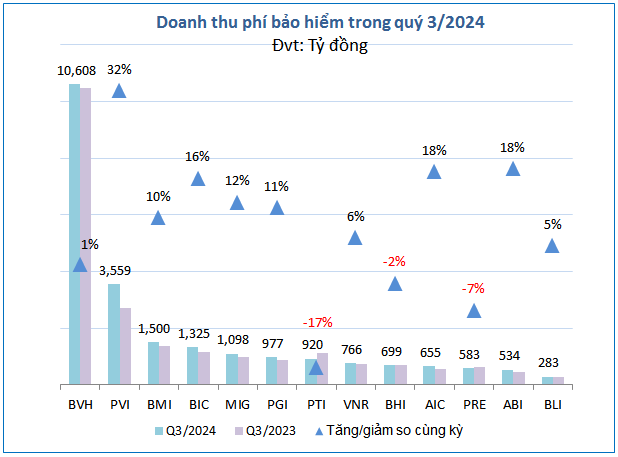

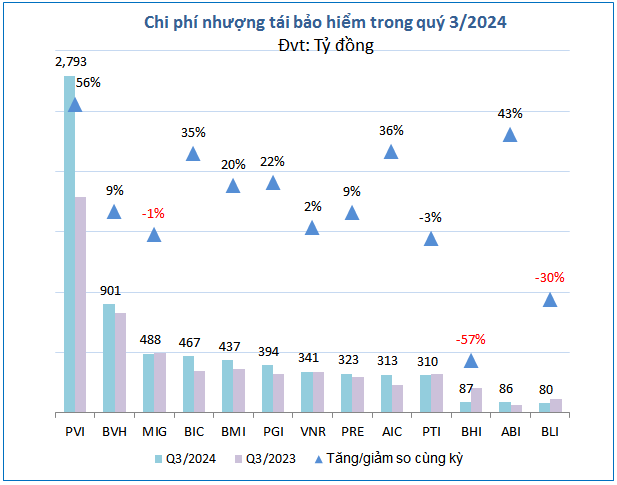

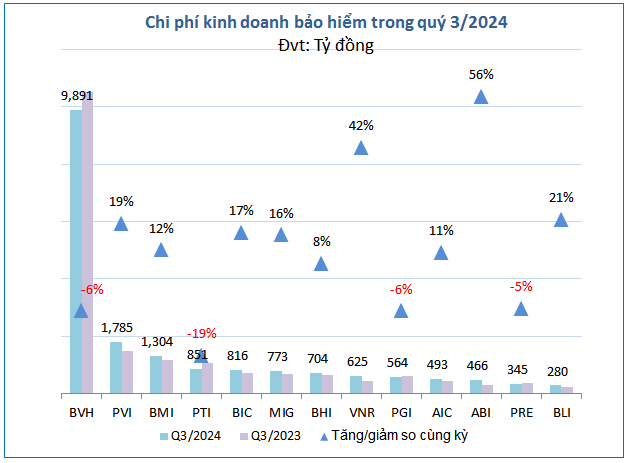

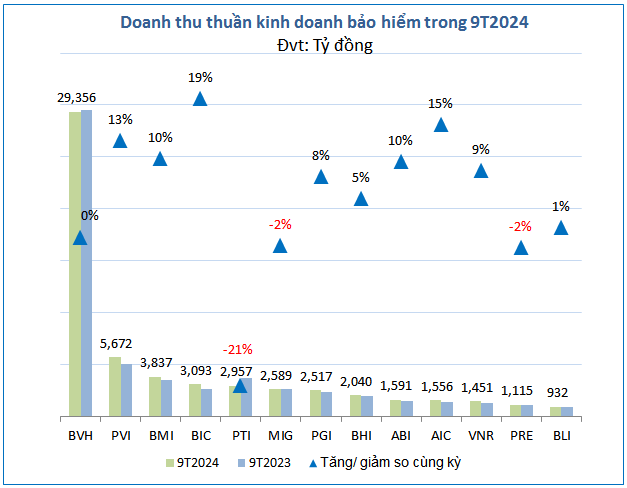

According to statistics from VietstockFinance, in the third quarter of 2024, the insurance premium revenue of 13 non-life insurance companies listed on the stock exchanges (HOSE, HNX, and UPCoM) reached 23,506 billion VND, a 7% increase compared to the same period last year. However, the cost of reinsurance ceded increased by 23% to 7,019 billion VND, resulting in only a slight 2% increase in net revenue from insurance business, totaling 19,193 billion VND.

Source: VietstockFinance

|

Source: VietstockFinance

|

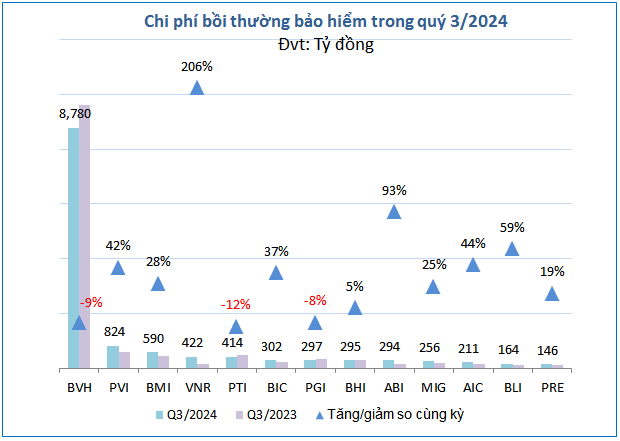

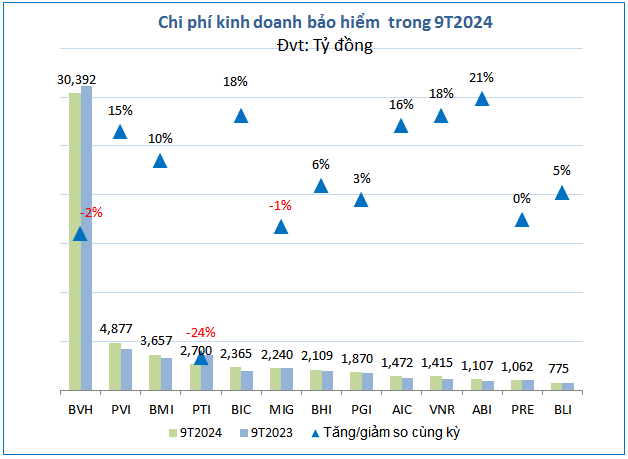

Meanwhile, insurance compensation expenses of these companies increased by 2% over the same period to 12,994 billion VND, resulting in a slight 1% increase in total insurance business expenses to 18,897 billion VND.

Source: VietstockFinance

|

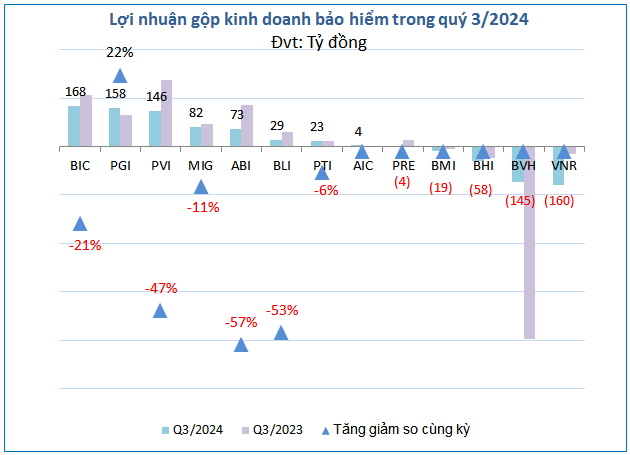

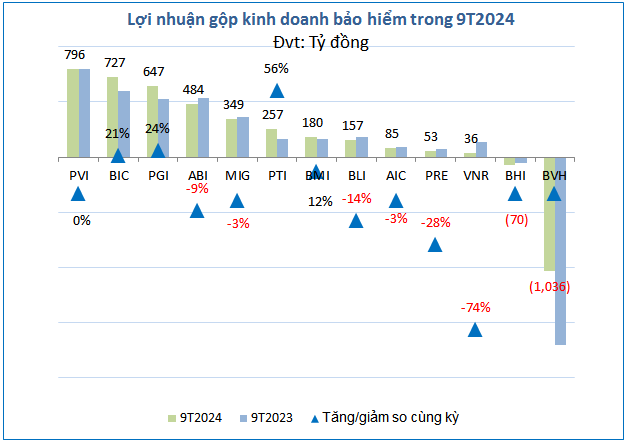

Thanks to the stronger growth in net revenue compared to expenses, the gross profit from insurance business in the third quarter of 2024 was 2.7 times higher than the same period last year, reaching 296 billion VND.

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

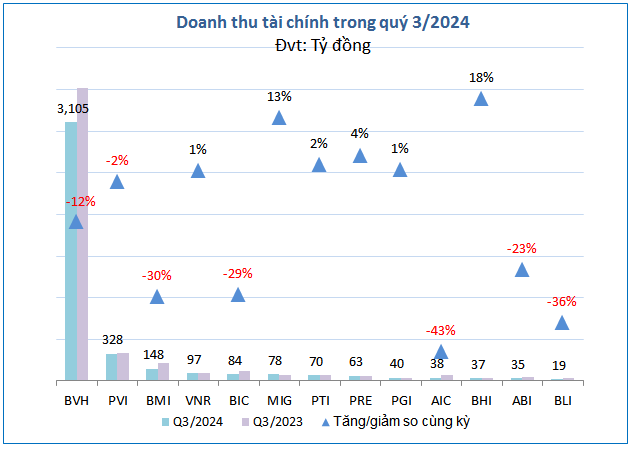

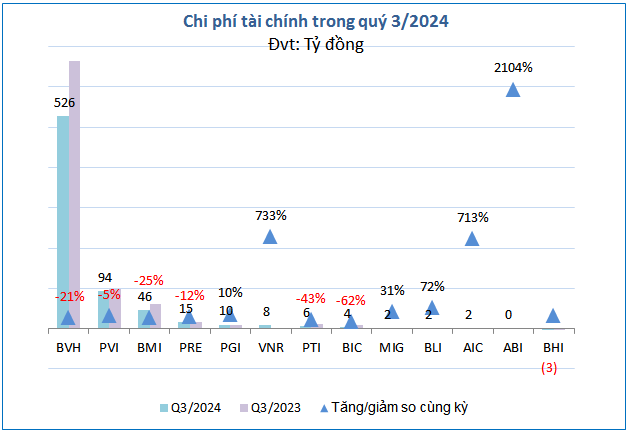

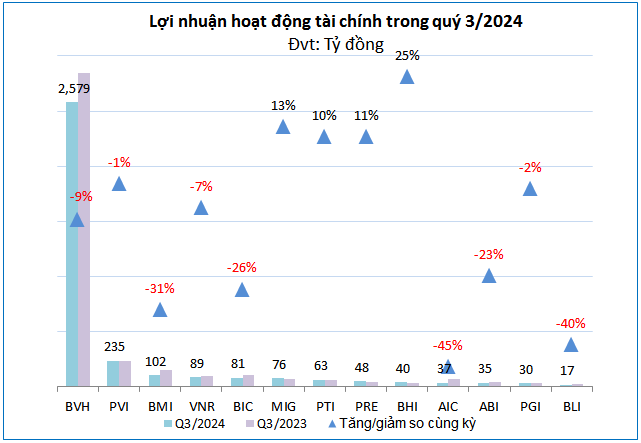

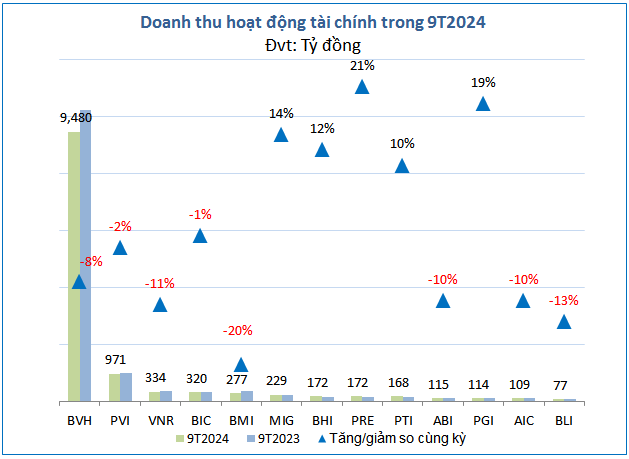

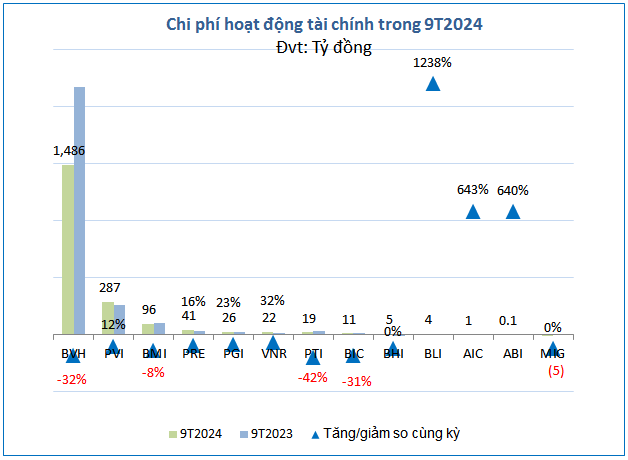

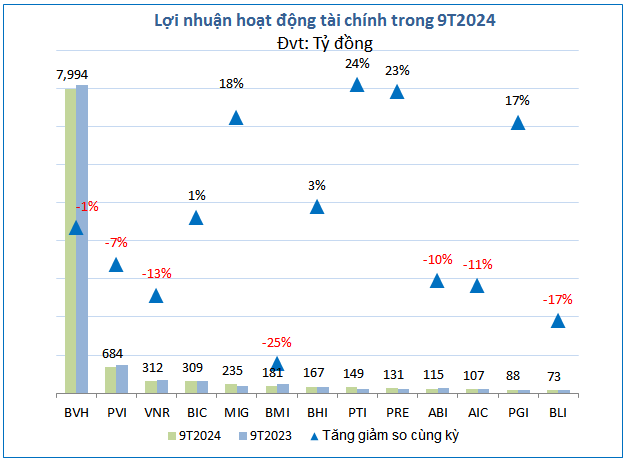

In contrast to the positive performance of the insurance business, the financial sector continued to see a decline in profit in the third quarter, falling by 10% to 3,433 billion VND. This was mainly due to a 12% decrease in financial income, totaling 4,144 billion VND, as interest rates on bank deposits were lower compared to the previous year.

Source: VietstockFinance

|

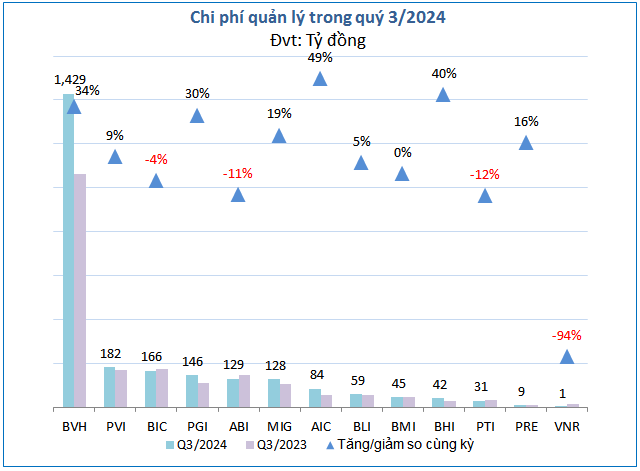

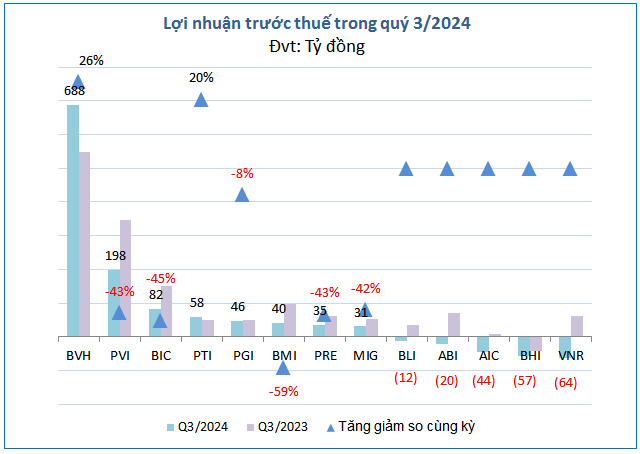

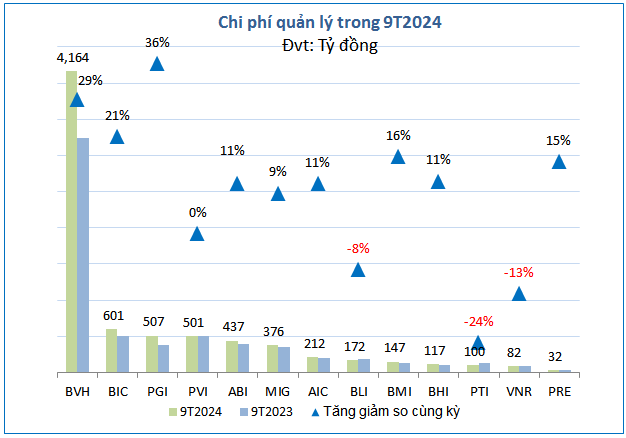

The double blow of reduced financial income and a sharp 22% increase in management expenses to 2,450 billion VND compared to the same period led to a 34% drop in pre-tax profit for the third quarter to 981 billion VND for the non-life insurance companies, despite the growth in insurance business profits.

Source: VietstockFinance

|

While the overall picture of compensation expenses remained relatively stable, a closer look at individual companies reveals that this was the main reason behind the losses incurred by several businesses in the third quarter.

| VNR’s pre-tax profit by quarter over the years |

As a reinsurance company, the “giant” National Reinsurance Corporation of Vietnam (VNR) had to bear the brunt of compensation payouts for reinsurance contracts with primary insurance companies. This led to a significant increase in insurance compensation expenses, which tripled compared to the same period last year, reaching 422 billion VND. As a result, VNR recorded the heaviest loss in the industry, amounting to 64 billion VND. This was an unprecedented loss for VNR, making it the insurance company most severely impacted by Typhoon Yagi.

While other companies incurred smaller losses, the third quarter was still a disappointing period for BHI, AIC, ABI, and BLI, with losses of 57 billion, 44 billion, 20 billion, and 12 billion VND, respectively.

A few insurance companies managed to stay afloat without incurring losses, but their profits plummeted in the third quarter, including BMI (-59%), BIC (-45%), PVI (-43%), PRE (-43%), and MIG (-42%).

Despite the overall gloomy picture, there were bright spots in the industry. Two major players, BVH and PTI, reported profit increases of 26% and 20%, respectively, compared to the same period last year. Interestingly, the factor that contributed to their improved performance was a reduction in insurance compensation expenses, which decreased by 9% and 12%, respectively.

As a result of lower compensation expenses, BVH’s gross loss in the insurance business segment narrowed to 145 billion VND, a significant improvement from the 795 billion VND loss in the third quarter of 2023.

BVH’s performance also played a crucial role in supporting the profit growth of the insurance group, as most other companies experienced declining profits in this sector.

The Road to Profitability Map Wiped Out by the Storm

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

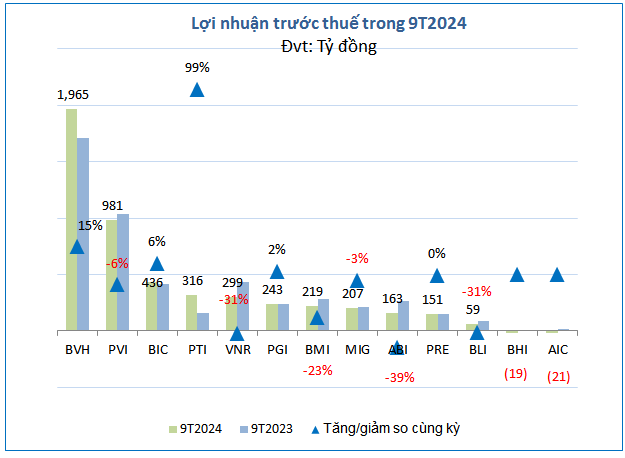

Looking at the nine-month period of 2024 as a whole, the pre-tax profit of the 13 non-life insurance companies was only 23 billion VND lower than the same period last year, totaling nearly 5,000 billion VND. Financial income decreased by 2% (mainly due to lower interest income), amounting to 10,545 billion VND, while management expenses increased by 20% to 7,449 billion VND. On the other hand, insurance business profit increased by 43% to 2,666 billion VND, as revenue growth outpaced expense growth.

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

When examining the performance of individual companies, it is evident that the setbacks faced in the third quarter significantly impacted the nine-month results for many non-life insurance companies.

Source: VietstockFinance

|

Source: VietstockFinance

|

The unluckiest company was undoubtedly the Saigon-Hanoi Insurance Corporation (BHI), as their six-month profit of 37 billion VND was completely wiped out, resulting in a loss of 19 billion VND in the nine-month period.

Source: VietstockFinance

|

Moreover, BHI had initially surpassed its full-year profit target in just six months, achieving a remarkable 357% completion rate. However, due to the losses incurred in the third quarter, they now find themselves far from reaching their 2024 profit goal.

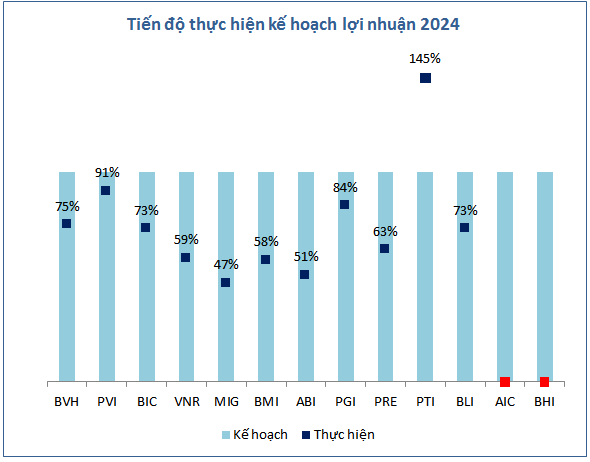

If not for Typhoon Yagi, some insurance companies would have likely achieved their full-year profit targets within the first nine months, such as PVI and BLI.

Despite a nearly 50% drop in profit in the third quarter, PVI still managed to achieve 91% of its full-year profit target in the first nine months. BLI, on the other hand, slipped to a 73% completion rate after incurring a loss in the third quarter, down from the 87% achieved in the first six months.

Despite the challenges posed by Typhoon Yagi, PTI emerged as the rising star of the insurance industry. They were the only company to surpass their full-year profit target in the first nine months, thanks to their consistent profit growth over the past three quarters. Compared to their plan to achieve an after-tax profit of 175 billion VND (a 31% decrease compared to the 2023 result), PTI exceeded their target by 45%.

Khang Di

The Bottom Line: 642 Businesses Report 17.8% Increase in Q3 Profits, Real Estate Sector Bounces Back.

The third-quarter post-tax profits of 642 enterprises rose by 17.8% year-on-year, a notable increase yet shadowed by the impressive 27.4% surge in the previous quarter. This slight dip can be attributed to the high comparative base. Notably, the real estate sector experienced a profit decline this quarter, indicating a downward trajectory and a potential bottoming-out phase.

Business Confidence Index of European Businesses in Vietnam Surges

The Business Confidence Index (BCI) for Q3 rose to 52, up from 45.1 in the same quarter last year, marking a strong rebound amidst a tumultuous year fraught with external factors.

The Post-Storm Economic Growth Forecast: Vietnam’s Resilience and Rebound

For Q3, UOB Singapore forecasts Vietnam’s economic growth to slow down to 5.7%, down from the previous projection of 6.0%. The bank predicts a growth rate of 5.2% for Q4, a decrease from the earlier estimate of 5.4%. As a result, UOB has lowered its annual growth projection for Vietnam to 5.9%, a 0.1% reduction from the previous forecast.