|

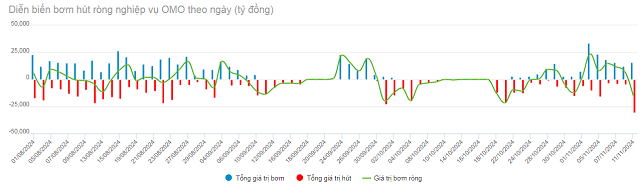

Net OMO pumping by day from August-November 2024. Unit: VND billion

Source: VietstockFinance

|

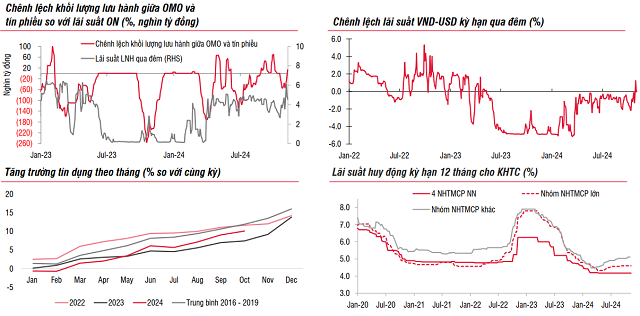

Specifically, between November 4-11, the SBV lent commercial banks VND 105,000 billion through the 7-day term buying channel at an interest rate of 4%/year.

Meanwhile, the regulator only issued a modest amount of bills worth VND 4,450 billion in the 28-day term. The winning interest rate was fixed at 3.9%/year.

On the other hand, during the period from November 4-11, the weekly pledge channel loan (October 28-November 4) matured, sucking VND 64,000 billion in liquidity out of the market. In contrast, VND 14,000 billion worth of bills issued in the previous week (October 21-28, 2024) matured and were pumped back into the market.

Thus, the SBV net injected VND 50,550 billion of liquidity into the system through the open market operation channel. Of this, VND 75,000 billion was circulating in the pledge channel and VND 74,150 billion worth of SBV bills were circulating in the market.

|

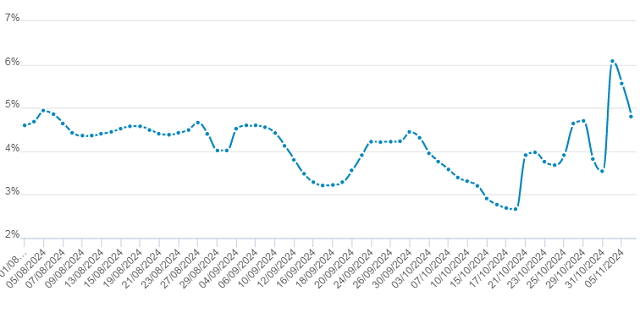

Interbank interest rates from August to November 2024. Unit: %

Source: VietstockFinance

|

According to SSI Research, the overnight interbank interest rate surged to 6.1% in the first session of the week on November 4. Unlike the movement of interbank interest rates at the end of October (mainly due to exchange rate pressure), the “jerk” of interbank interest rates last week was mostly due to the local liquidity shortage.

Thanks to the proactive support of liquidity through open market operations, the overnight interbank interest rate quickly cooled down by the end of the week (November 8), reaching only 4.55%/year (up 50 basis points compared to the previous week). The VND-USD interest rate spread has turned positive.

Source: SSI Research

|

Also according to SSI experts, in a report sent to National Assembly deputies, the SBV said that credit growth as of October 31 reached 10.08% – equivalent to a rise of 16.7% over the same period, and maintained the credit growth target for 2024 at about 15%. To ensure macroeconomic balances such as inflation and exchange rates, and lending interest rates have maintained a downward trend in the first ten months of 2024, the SBV said that the interest rate level is difficult to continue to decrease.

In the domestic market, similar to regional currencies and the STB may have completed its foreign currency purchasing needs, the USD/VND interbank exchange rate decreased by 0.4%. However, the exchange rate quoted by commercial banks still traded around the ceiling rate according to regulations throughout the week, while the black market exchange rate rose and fell strongly, reflecting the high demand for USD in the market. Exchange rate pressure will remain as the market is still cautious, awaiting new policies to be introduced by the new US President.

Khang Di

The Liquidity Landscape: A Market Flush with Funds

Mr. Dinh Duc Quang, an esteemed financial analyst, asserted that the State Bank of Vietnam has adeptly utilized its regulatory tools to maintain market stability, and there are no indications of any liquidity shortages within the financial system.

SSI Research: Short-term Volatility Presents Buying Opportunities for Long-term Investors

“According to SSI Securities Corporation’s November 2024 strategy report, the SSI Research Center for Analysis and Investment Consulting believes that the market may fluctuate in the short term. However, this also presents an opportunity to buy potential stocks at reasonable prices to build a long-term investment portfolio.”

When Will a Market Correction Be an Opportunity?

“Market Update: Seeking Attractive Opportunities for Long-Term Investors”

Renowned market strategist and VPBank Securities’ Market Strategy Director, Tran Hoang Son, shared his insights on the current market landscape on the November 4th episode of ‘Khớp lệnh’. He suggested that a market correction is necessary to create more appealing entry points for mid to long-term investors.