|

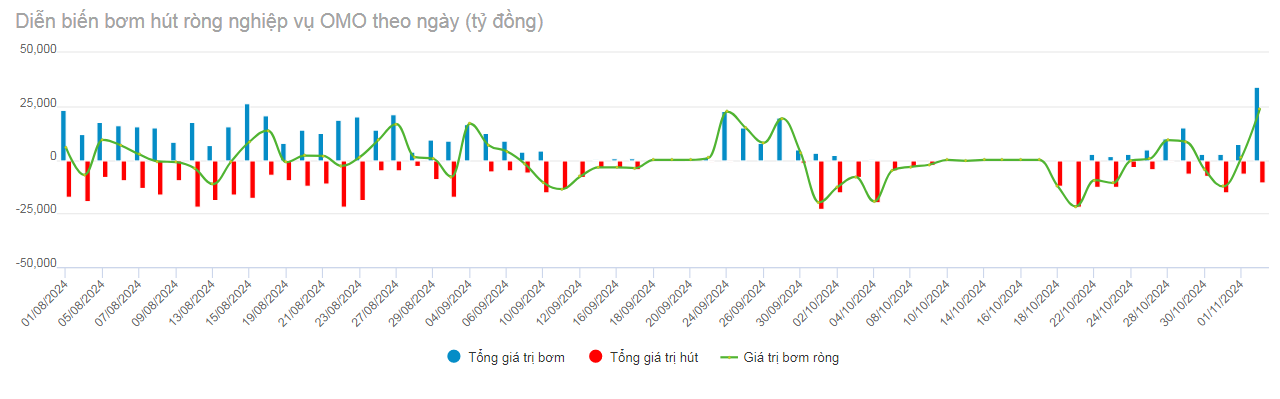

Net OMO pumping and sucking developments by day from August to October 2024. Unit: VND billion

Source: VietstockFinance

|

Specifically, during the period from October 28 to November 4, the SBV lent commercial banks VND 64,000 billion through the 7-day term buying channel at an interest rate of 4%/year. Of which, the November 4 session had the highest value in more than 3 months, up to VND 30,000 billion.

On the contrary, the regulator issued bills worth VND 23,850 billion in 2 terms of 14 days (VND 15,600 billion) and 28 days (VND 8,250 billion). The winning interest rate for the 14-day term reached 3.7-3.75%/year and the 28-day term was fixed at 3.99%/year.

On the other hand, during the period from October 29 to November 4, the weekly pledge loan (October 22-28) matured, sucking VND 23,015 billion of liquidity out of the market. In addition, VND 4,400 billion and VND 3,900 billion worth of bills issued in the October 18 and October 21 sessions matured in the November 1 and November 4 sessions, respectively, so VND 8,300 billion was pumped back into the market.

Thus, the SBV net injected VND 25,435 billion of liquidity into the system through the open market operation channel. Of which, there were VND 54,000 billion circulating in the pledge channel and VND 82,500 billion worth of SBV bills circulating in the market.

According to SSI Research, the SBV flexibly combines both the term buying channel and the bill issuance channel in the open market operation channel to control liquidity in the system. In which, the end-of-month seasonal factor makes some commercial banks increase the use of the term buying channel.

|

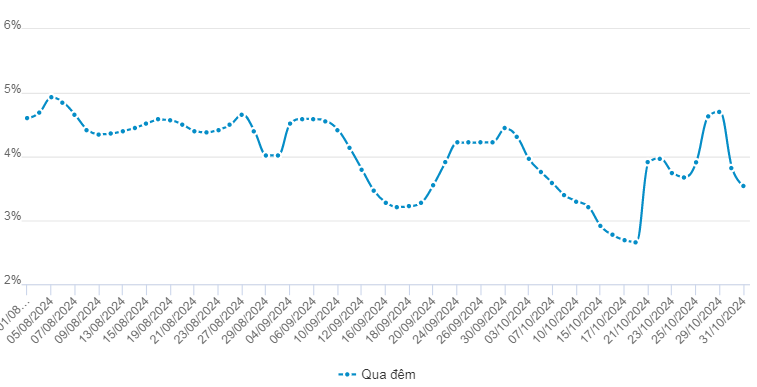

Interbank interest rates by term from August to November 2024. Unit: %

Source: VietstockFinance

|

After the SBV’s move, the overnight interbank interest rate jumped strongly in the first two days of the week (October 28-29) to 4.7%/year and cooled down towards the end of the week (November 1) to 3.9%, unchanged from the previous week. However, SSI experts forecast that in the week of November 4-8, liquidity pressure remains as the results of the US presidential election or the decision of the Federal Reserve (Fed) in the November meeting will affect exchange rate movements, and SBV interventions may affect market liquidity and interest rates. interbank market)

“The Shadow of Gloom and Doubt on the Stock Market”

The liquidity turnover on HOSE indicates that the doldrums of early 2023 are back. While the flow of funds remains stagnant, there are opportunities to be found in the market.

SSI Research: Short-term Volatility Presents Buying Opportunities for Long-term Investors

“According to SSI Securities Corporation’s November 2024 strategy report, the SSI Research Center for Analysis and Investment Consulting believes that the market may fluctuate in the short term. However, this also presents an opportunity to buy potential stocks at reasonable prices to build a long-term investment portfolio.”

When Will a Market Correction Be an Opportunity?

“Market Update: Seeking Attractive Opportunities for Long-Term Investors”

Renowned market strategist and VPBank Securities’ Market Strategy Director, Tran Hoang Son, shared his insights on the current market landscape on the November 4th episode of ‘Khớp lệnh’. He suggested that a market correction is necessary to create more appealing entry points for mid to long-term investors.

The Financial Currency Market: A Stable Investment Haven

According to a report by the Ministry of Planning and Investment, despite facing challenges and difficulties, the economy in October and the ten-month period showed a strong recovery. Economic and social activities rebounded quickly after natural disasters and floods. In October, several international organizations upgraded their growth forecasts for Vietnam in 2024, predicting it could be the highest among ASEAN+3.