On November 13, the State Bank of Vietnam (SBV) set the daily reference exchange rate at 24,288 VND/USD, the highest level this year. Commercial banks’ USD selling rates also surged, with some banks offering rates as high as 25,502 VND/USD, surpassing the previous peak of 25,500 VND in mid-year. Since the beginning of the year, the USD selling rate at commercial banks has increased by over 4.2%.

Multiple Pressures

The rate hike comes as the US Dollar Index (DXY) soared to 106 points in the international market, a significant jump from the 100-point range in mid-September, especially after Donald Trump’s victory in the US presidential election.

Dinh Duc Quang, Director of Currency Trading Division at UOB Vietnam, stated that the USD/VND exchange rate has rebounded in the past few weeks. This movement mirrors the recent sharp fluctuations in the global foreign exchange and currency markets. The US dollar strengthened in October, regaining its lost value after solid US economic data was released.

Commercial banks’ USD selling rates officially surpassed the mid-year peak on November 13. Photo: LAM GIANG

Le Tu Quoc Hung, Senior Analyst at Dragon Vietnam Securities Company (VDSC), noted that since October, the US dollar has strengthened significantly against other currencies due to investors’ optimism about the US economic outlook and escalating geopolitical risks in global hotspots. The monetary easing path undertaken by major central banks, such as the European Central Bank (ECB), the Bank of England (BoE), the Bank of Canada (BoC), and the recent policy easing by the People’s Bank of China, has also contributed to the US dollar’s recovery.

Additionally, Donald Trump’s victory in the US presidential election on November 6 has heightened expectations for US economic growth, further bolstering the US dollar’s strength in recent days and putting considerable pressure on Vietnam’s exchange rate.

According to Dragon Vietnam Securities’ experts, in addition to its correlation with the US dollar, foreign currency demands, including external debt payments, raw material imports, and profit repatriation by foreign-invested enterprises, are also exerting pressure on the exchange rate. “In late October 2024, the SBV sold USD into the market to curb the dong’s depreciation. Increasing foreign currency inflows from remittances and exports could help ease the pressure on foreign currency supply and demand. However, if the US dollar continues to strengthen, the SBV may need to continue selling foreign currency to stabilize the exchange rate,” said Hung.

A Challenging Task for the SBV

Nguyen The Minh, Director of Research and Product Development at Yuanta Vietnam Securities Company, attributed the exchange rate movement to the strengthening of the US dollar and the currently wide interest rate differential between the VND and the USD. However, Minh noted that Trump supports cutting interest rates to boost economic growth, so the interest rate differential between the VND and the USD is expected to narrow in early 2025, which would help ease pressure on the exchange rate. As a result, foreign investment flows into the stock market would also stop net selling.

According to several experts, the SBV has faced challenges due to the continuous exchange rate fluctuations since the beginning of the year. The central bank has had to navigate a delicate balance in managing exchange rates, currency, and interest rates to align with multiple objectives. In their latest report assessing the impact of Trump’s victory on Vietnam’s economy, analysts from Dragon Capital Vietnam highlighted an issue related to currency manipulation accusations. Since 2019, Vietnam has consistently asserted that it does not use exchange rate policies to gain competitive advantages in international trade. However, the US Department of the Treasury’s report in June 2024 once again placed Vietnam on the watchlist for currency manipulation. “Nonetheless, the likelihood of Vietnam being labeled a currency manipulator is low, as the Vietnamese government has implemented measures to prevent currency devaluation to avoid importing inflation and maintain domestic consumption, rather than seeking a trade price advantage,” said the Dragon Capital Vietnam expert.

The SBV has implemented various measures, including foreign currency sales interventions, to stabilize the VND, demonstrating its commitment to maintaining currency stability. Vietnam’s current account balance reached 5.8% of GDP, while the bilateral trade surplus with the US stood at $103 billion. This provides a basis for Vietnam to address concerns about currency manipulation by narrowing the trade surplus.

From another perspective, Tran Hoang Son, Head of Market Strategy at VPBank Securities Company, argued that the recent resurgence in exchange rates has negatively impacted the stock market. Foreign investors resumed net selling, causing domestic investors to become cautious, resulting in a lackluster market and record-low liquidity as investors refrained from trading.

Regarding businesses, the rebound in exchange rates after two months of stability has caused concern among some enterprises that import raw materials for production. At a recent dialogue between the government and businesses in Ho Chi Minh City, a chemical company inquired about the SBV’s measures to control exchange rate fluctuations within a stable range to support businesses in the final months of the year.

Nguyen Duc Lenh, Deputy Director of the SBV’s Ho Chi Minh City Branch, assured that the SBV always strives to manage policies in a reasonable manner to ensure the stability of the macroeconomy, the foreign exchange market, and to support economic growth. “The SBV does not manage exchange rates in a one-sided manner, favoring only importing or exporting enterprises,” Lenh explained.

Positive Signal from the Fed

Regarding the US Federal Reserve’s (Fed) decision to cut its benchmark interest rate by 0.25 percentage points to a range of 4.5-4.75%, several experts anticipated that this move would help ease pressure on the USD/VND exchange rate. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets, and Securities Services at HSBC Vietnam, analyzed that the exchange rate would remain stable in the final months of the year due to favorable fundamental factors, including a large trade surplus and strong foreign investment disbursements, reaching $20.8 billion and $17.3 billion, respectively, in the first nine months. “The SBV has always proactively intervened in the foreign exchange market when necessary to ensure its stable operation and avoid negative impacts on other macroeconomic objectives, such as economic growth and inflation control. Exchange rate pressure is more momentary, and the overall foreign currency supply in the market is not overly concerning, given Vietnam’s surplus in USD sources,” said Ngo Dang Khoa.

The expert from UOB Vietnam also forecasted that the exchange rate would fluctuate around the 3% range and reach approximately 25,200 VND/USD by the end of the year, supported by the trade surplus, foreign investment attraction, remittances, and tourism growth.

The Greenback Bounces Back: USD Exchange Rates Surge

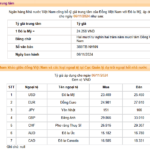

Today’s USD exchange rate on November 12, 2024, sees a rebound in USD prices at banks after a significant drop in the previous two sessions. Some banks increased their buying rates by 80-90 VND.

What Does the SBV’s Net Injection Move Mean?

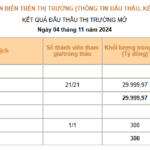

The recent net injection by the SBV on November 4th is a strong move to support liquidity, especially amidst the surging USD/VND exchange rate in both the official and free markets. The SBV’s intervention sends a clear message of their commitment to stabilizing the currency market and shielding the domestic financial sector from excessive volatility.

What Does the Latest Intervention in Exchange Rates by the Authorities Tell Us?

As the US dollar to VND exchange rate continues its upward trajectory, the State Bank of Vietnam has announced its decision to sell foreign currencies on the spot market to meet market demand. This proactive move by the central bank raises questions about its timing and potential impact on cooling down the market.

The Central Bank Governor: We Will Intervene in the Foreign Exchange Market During Times of Significant Volatility

Governor Nguyen Thi Hong affirmed that the State Bank of Vietnam (SBV) remains steadfast in its commitment to flexible exchange rate management, adapting to market fluctuations. The exchange rate is currently allowed to fluctuate within a band of +/- 5%. “In the event of significant market volatility, the State Bank will consider selling foreign currencies to stabilize and meet the needs of the people,” she added.