|

Mr. Dinh Duc Quang, Director of Currency Business, UOB Vietnam Bank

|

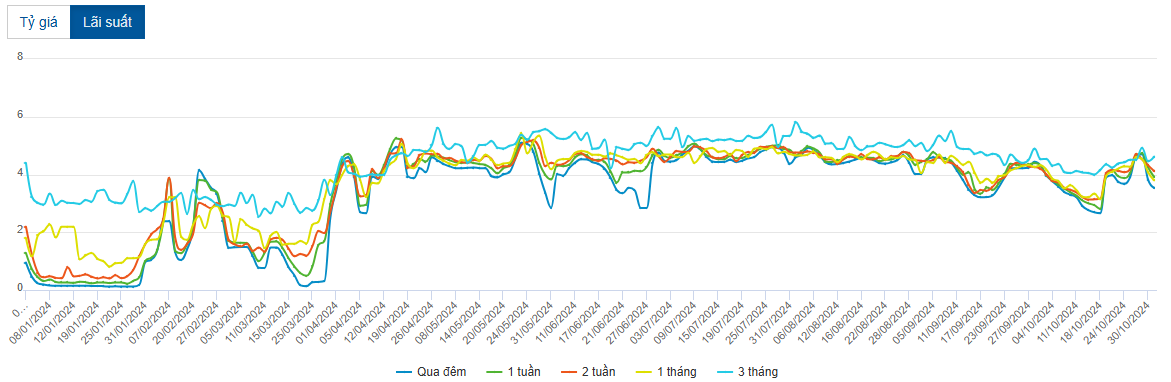

In the first few days of November 2024, the market witnessed an increase in the VND interbank interest rate compared to the quite low average trading level in October. At the same time, the USD/VND exchange rate in the past few weeks has also rebounded, reaching near the highest level in mid-2024.

Data from the SBV showed that, as of November 1st, the overnight interest rate increased to 4.02%/year, the 1-week rate increased to 4.16%/year, and the 1-month rate increased to 4.81%/year.

|

Interbank interest rates rebound

Source: VietstockFinance

|

Mr. Dinh Duc Quang, Director of Currency Business at UOB Vietnam Bank, said that these developments are quite similar to the recent sharp fluctuations in the global foreign exchange and monetary markets due to significant events such as conflicts in Ukraine and the Middle East, which show no signs of cooling down, the unpredictable outcome of the election in the world’s largest market, and the varying speed of economic development among major economies, leading to multiple trends in asset and investment risk diversification and distribution.

From a global perspective, US economic data remains surprisingly strong compared to other major economies, despite the USD interest rate remaining high over the past two years. The USD depreciated in September after the US Federal Reserve (Fed) cut interest rates by a high of 50 points. However, in October, the greenback almost regained its entire lost value after solid economic data was released (economic development, solid new jobs, and falling inflation).

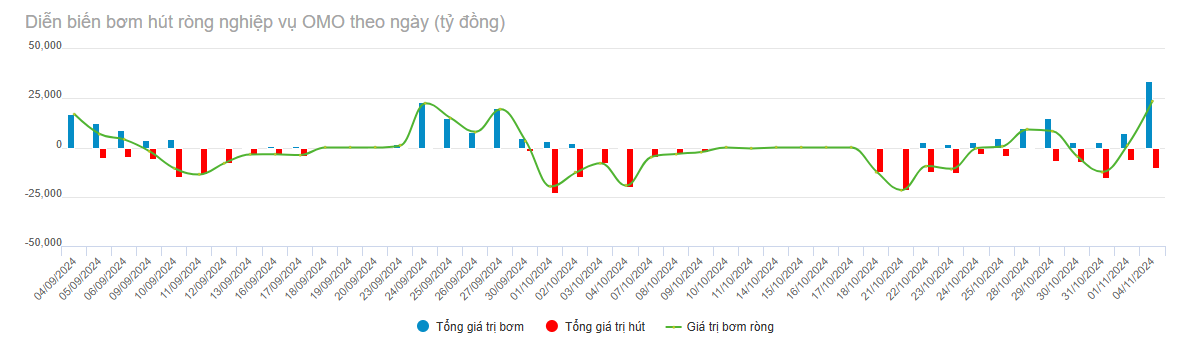

In the domestic market, given these circumstances, the State Bank has intervened to stabilize the markets. When the USD/VND exchange rate increased sharply, the managing agency issued bills to absorb excess liquidity from the market to ease the pressure on the exchange rate. Foreign exchange trading data over the past few months has shown a relatively large demand for foreign currency purchases from the State Treasury, along with the Treasury reducing VND deposits in the commercial banking system. When the market needed more VND liquidity, the SBV provided support through the open market operation channel.

According to reference data up to the end of November 4th, the bill issuance balance was about VND 80 trillion (absorption channel) while the open market operation balance was VND 50 trillion (injection channel). Mr. Quang stated that the SBV has been and is harmoniously using market stabilization tools, indicating no liquidity shortage in the market. Deposit interest rates for individuals and enterprises at commercial banks remained stable in October and early November, confirming that the market showed no signs of liquidity shortage.

Source: VietstockFinance

|

Based on the fundamentals and the positive potential of the Vietnamese economy in 2024 and 2025, Mr. Quang forecasts that the SBV will not adjust policy interest rates (refinancing rate, rediscount rate, and deposit interest rate ceiling) and will continue to actively use commercial intervention interest rates (bill issuance rate, open market operation rate) to maintain the short-term 3-month mobilization rate at around 3-4% and the long-term 12-month rate at 5-6%.

Given that Vietnam continues to ensure major balances, trade surpluses, attract foreign investment, and increase remittances and tourism growth, Mr. Quang expects the USD/VND exchange rate to fluctuate around 3% annually, with the rate at VND 25,200/USD in Q4/2024, VND 25,000/USD in Q1/2025, VND 24,800/USD in Q2/2025, and VND 24,600/USD in Q3/2025. At the same time, “the election results in the US will have little direct impact on VND interest rates and the USD/VND exchange rate, as the domestic currency has been and is being tightly managed within the framework of long-term commercial and investment activities rather than short-term investment and speculation”, added Mr. Quang.

SSI Research: Short-term Volatility Presents Buying Opportunities for Long-term Investors

“According to SSI Securities Corporation’s November 2024 strategy report, the SSI Research Center for Analysis and Investment Consulting believes that the market may fluctuate in the short term. However, this also presents an opportunity to buy potential stocks at reasonable prices to build a long-term investment portfolio.”

When Will a Market Correction Be an Opportunity?

“Market Update: Seeking Attractive Opportunities for Long-Term Investors”

Renowned market strategist and VPBank Securities’ Market Strategy Director, Tran Hoang Son, shared his insights on the current market landscape on the November 4th episode of ‘Khớp lệnh’. He suggested that a market correction is necessary to create more appealing entry points for mid to long-term investors.

The Greenback’s Rally: USD/VND Hits All-Time Highs as Banks Push the Ceiling

The U.S. dollar index (DXY) hovers around a four-month high as markets react to Donald Trump’s decisive victory in the U.S. presidential election. This development underscores the pivotal role that political events can play in shaping global economics and currency dynamics.