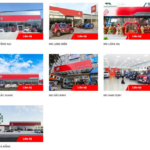

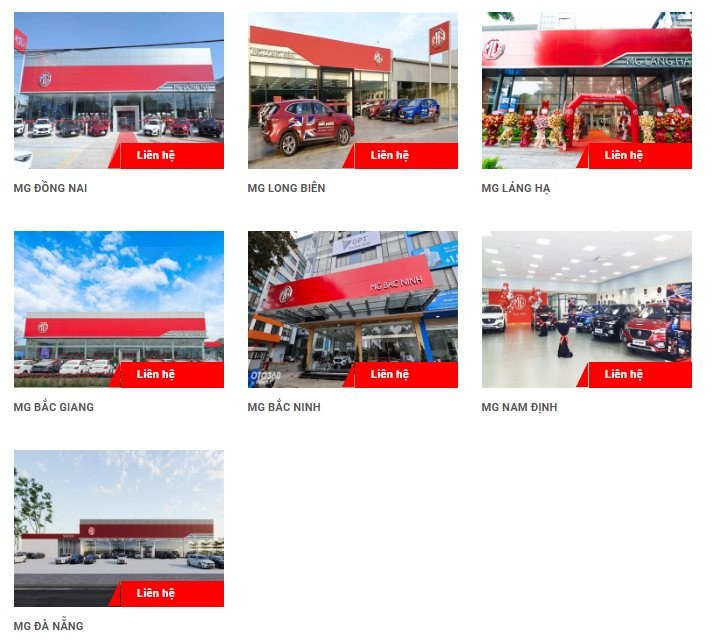

On November 13, the Board of Directors of Haxaco, a leading automotive services company (coded: HAX), approved the plan to list the shares of PTM Automotive Production, Trading and Services Joint Stock Company on HoSE. PTM is a subsidiary of Haxaco with a charter capital of VND 320 billion. PTM is currently responsible for distributing MG cars for Haxaco with a total of seven dealerships nationwide.

Accordingly, the implementation will start from November 2024. The Haxaco Board of Directors will assign the company’s Board of Directors to establish/assign a specialized department to support and coordinate with PTM to complete the necessary procedures to fulfill the public company registration and stock trading registration obligations on HoSE as regulated.

At the same time, the Haxaco Board of Directors and the PTM Board of Directors are tasked with cooperating with partners to establish a Project Management Board to effectively develop and expand PTM’s production and business activities in 2025.

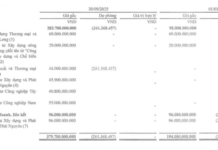

Previously, PTM conducted a rights offering at a 1:1 ratio and increased its charter capital to VND 320 billion. Accordingly, Haxaco also approved the additional capital contribution of nearly VND 82.6 billion to exercise the share purchase rights of existing shareholders in PTM’s additional public offering. As a result, Haxaco currently holds 51.62% of the charter capital in this company.

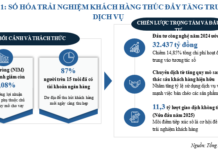

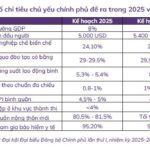

In the first nine months of 2024, Haxaco recorded net revenue of VND 3,696 billion, up 27% over the same period. After-tax profit reached VND 144 billion, up 888% over the same period in 2023.

In 2024, Haxaco targets a pre-tax profit of VND 200 billion. Thus, the Company has accomplished 91% of the full-year pre-tax profit plan.

The Master Dealer’s New “Game”: Taking the MG Car-Selling Subsidiary Public

PTM is currently the distributor of MG motor vehicles for Haxaco, with a nationwide network of 7 dealerships.

The Surprising Surge of Penny Stocks: A Market Phenomenon

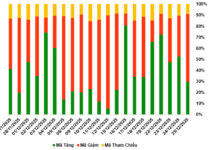

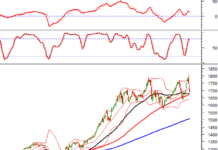

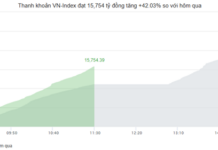

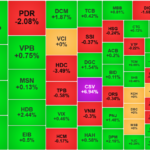

Liquidity saw a significant improvement during the afternoon session; however, funds did not largely flow into the blue-chip stocks. It was the mid-cap and small-cap stocks that witnessed a surge as the liquidity in the mid-cap group increased by 37% compared to the previous day, while the small-cap group witnessed a remarkable 44% increase, leaving the VN30 with just a 14% gain.