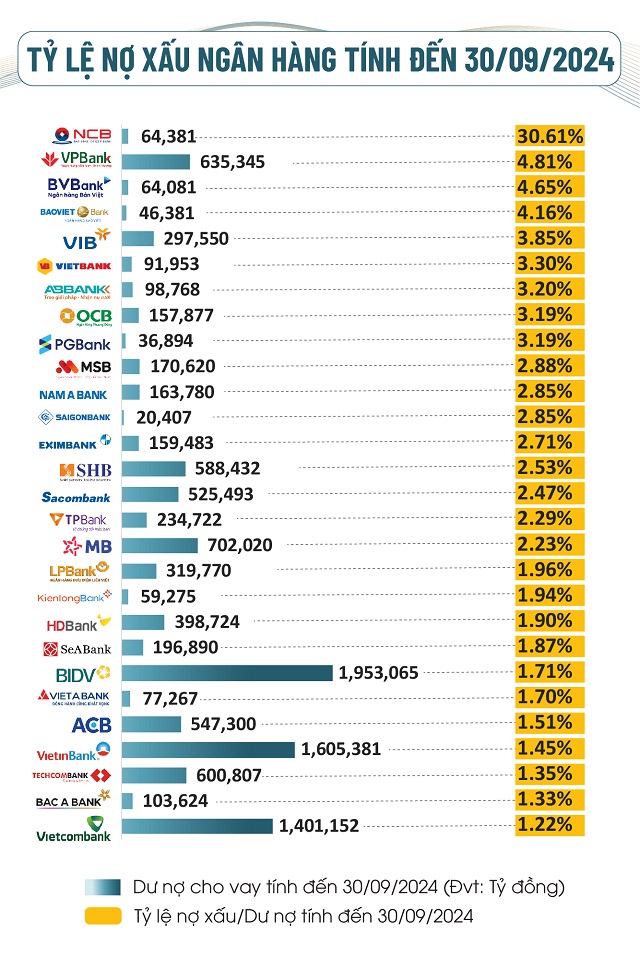

According to data from VietstockFinance, as of September 30, 2024, the total outstanding debt of 28 banks that have published financial statements amounted to over 11.3 quadrillion VND, a nearly 12% increase compared to the beginning of the year.

All banks experienced positive credit growth, with Techcombank (TCB) leading the pack at a 20% increase, followed by NCB (NVB) at 16.3%, HDBank (HDB) at 16.1%, and LPBank (LPB) also at 16.1%.

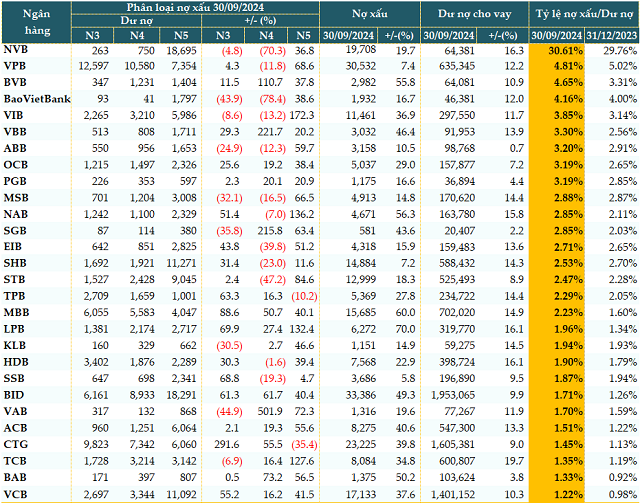

While credit growth was widespread, bad debt continued to rise across the board. As of the end of the third quarter, the total bad debt of the 28 banks stood at 253,908 billion VND, an increase of over 29%. LPB, MB (MBB), NAB, BVB, and Bac A Bank (BAB) witnessed the highest bad debt growth rates, ranging from 50% to 70%.

The composition of bad debt also worsened, with doubtful debt (Group 5) increasing by more than 39%, substandard debt (Group 3) rising by nearly 39%, and questionable debt (Group 4) climbing by over 6%.

|

Loan Quality of Banks as of September 30, 2024 (in trillion VND)

Source: VietstockFinance

|

25 out of 28 banks witnessed an increase in their non-performing loan (NPL) ratio compared to the beginning of the year. The number of banks with an NPL ratio above 3% remained unchanged from the previous quarters at 9, while there were only 5 such banks at the start of the year.

On a positive note, 3 banks, including VPBank (VPB), SeABank (SSB), and SHB, managed to improve their NPL ratios during this period.

Source: VietstockFinance

|

In a press conference held on July 23, 2024, to announce the tasks for the last six months of the year, Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu stated that bad debt is a significant concern and a consequence of a prolonged issue. He attributed the rise in bad debt to the aftermath of the two-year COVID-19 pandemic and the economic challenges faced in 2023, assuring that the SBV will take proactive measures to ensure credit quality and control bad debt, including increased provisioning to safeguard banks.

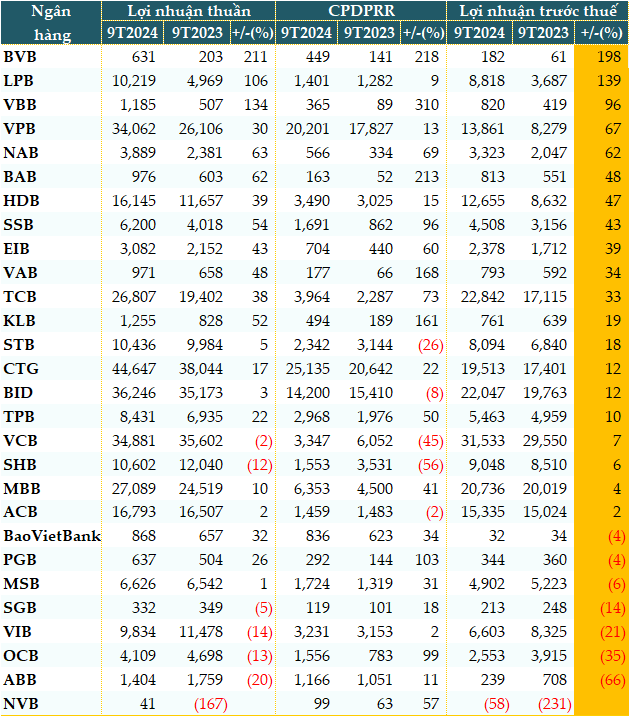

As bad debt continues to climb, especially amidst the economic challenges exacerbated by the recent Typhoon Yagi, banks have been ramping up their provisions to mitigate risks. Data from VietstockFinance reveals that the total credit risk provisions of the 28 banks for the first nine months of 2024 amounted to 100,045 billion VND, a 10% increase compared to the same period last year. Out of these banks, 23 increased their provisions, with some even doubling their allocations, which led to a decline in their profits. Consequently, 7 banks reported a decrease in their pre-tax profits for the first three quarters, and 1 bank posted a loss.

|

Pre-tax Profits of Banks for the First Nine Months of 2024 (in trillion VND)

Source: VietstockFinance

|

Associate Professor Dr. Nguyen Huu Huan, a lecturer at the University of Economics Ho Chi Minh City, asserted that while it is challenging to pinpoint the exact figures, the bad debt situation in banks is undoubtedly more severe than what is publicly disclosed. With the expiration of Circular 02, the surge in bad debt has compelled banks to bolster their risk provisions.

Dr. Nguyen Tri Hieu, a finance and banking expert, attributed the rise in bad debt, in part, to the real estate market. He highlighted that many real estate businesses are operating with high financial leverage, with debt levels four to five times their equity, which poses a significant risk of default should the market encounter difficulties.

Sharing this sentiment, Mr. Nguyen Quang Huy, from Nguyen Trai University, emphasized the strong correlation between the rising bad debt and the real estate sector, where credit growth has outpaced that of the overall economy. Despite price increases in various real estate segments, the demand for affordable and social housing remains unmet, creating substantial pressure on the banking system.

In light of these developments, the new Law on Credit Institutions (CIs) of 2024 presents a golden opportunity for banks to address their bad debt challenges. The new provisions allow banks to transfer a portion of their real estate projects linked to non-performing loans and participate in the debt trading market. This flexibility not only aids in capital recovery but also expedites the removal of bad debt from their balance sheets, alleviating financial strain.

In scenarios where a large loan secured by a real estate project encounters financial difficulties, banks can now transfer a portion of the project to another investor. This innovative approach facilitates project continuation, attracts new capital, and enables banks to recover their funds without waiting for the full repayment of the debt. With approximately 70% of the collateral in the banking system tied to real estate, this flexibility in handling secured assets will significantly reduce bad debt and stimulate the real estate market.

Moreover, by actively engaging in the debt trading market, banks can swiftly offload non-performing loans from their balance sheets. Collaborating with debt management companies or international financial institutions to handle large-scale bad debt can improve asset quality and alleviate financial strain.

To bolster their financial positions, banks can opt to issue shares to increase their charter capital. This strategy enhances capital safety, fosters sustainable development, improves bad debt coverage ratios, and mitigates risks for the entire system.

In addition to bad debt management strategies, banks should focus on diversifying their revenue streams by developing non-credit income sources to reduce their reliance on traditional credit and generate stable revenue.

By leveraging intelligent credit management systems, banks can closely monitor and identify risky loans from the outset, enabling them to implement timely loan restructuring measures.

Cát Lam

What Are Proprietary Trading Firms Holding in Their Portfolios?

The proprietary trading segment has brought in a substantial profit of over 3.53 thousand billion VND for securities companies, despite a modest increase. What are the secret weapons in the portfolios of these securities firms, and how have they achieved this success? It’s time to delve into the strategies and uncover the key drivers behind these impressive results.

“VinaCapital Fund Sells Over 1 Million KDH Shares”

Vietnam Ventures Limited, a member of the VinaCapital group, has announced the sale of over 1 million shares of Khang Dien House Trading and Investment Joint Stock Company (HOSE: KDH). This move continues the downward trend in ownership witnessed over the past period.

“Soaring Provisioning Costs, Yet BVBank’s 9-Month Pretax Profit Triples Year-on-Year”

The consolidated financial statements show that despite increasing provisions for risk, BVBank (BVB on UPCoM) reported a remarkable performance with a near threefold increase in pre-tax profit for the first nine months, totaling VND 182 billion. This impressive growth is a testament to the bank’s core lending business, which has seen a significant boost in revenue.

“Overcoming a Financial Stigma: How I Rose Above a $500 Debt Rejection”

Mr. Quang is currently classified as a subprime borrower, but he continues to face rejection from banks when seeking a mortgage. This is due to a previous bad debt of VND 5 million, which he has since fully repaid as of 2022. Despite this, the shadow of his past financial misstep continues to haunt him, leaving him struggling to secure the loan he needs.

The Inspector General’s Report: Unraveling the High Rate of Non-Performing Loans at An Giang Development Investment Fund

The latest lending data from An Giang Province’s Investment and Development Fund reveals a worrying trend. In 2022 and 2023, non-performing loan rates surged to alarming levels. By the end of 2023, total outstanding debt had climbed to over 80 billion VND, with non-performing loans accounting for a staggering 43.6 billion VND – that’s over 54% of the total debt. This presents a significant challenge and underscores the urgent need for effective strategies to address this issue.