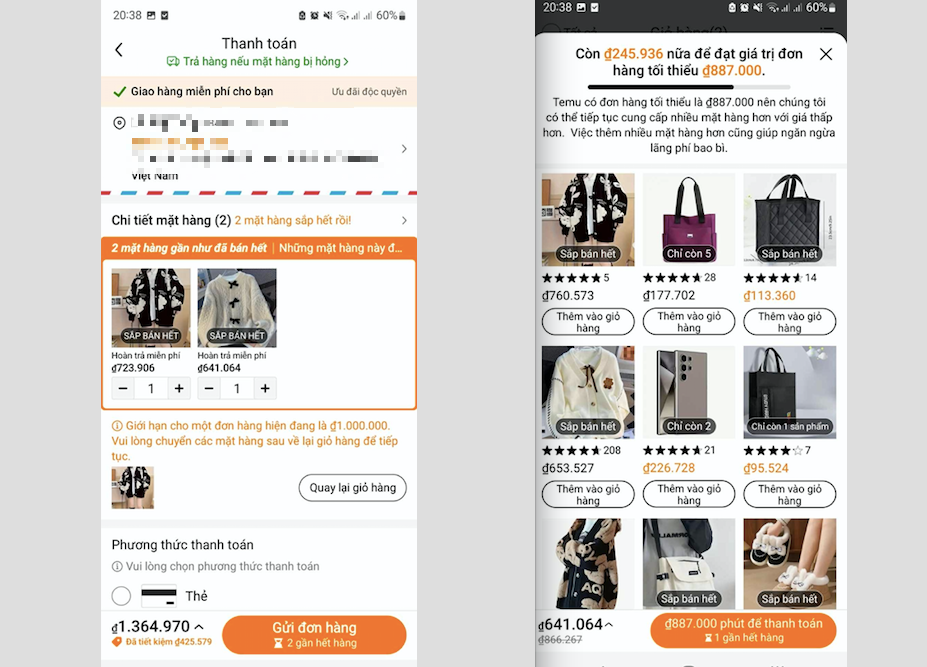

Temu only allows purchases between 887 thousand and 1 million VND

The reason, according to Temu, is that the platform has set a minimum order limit of VND 887,000 to continue offering a wide range of low-priced items.

“Adding more products also helps prevent packaging waste,” Temu explained.

However, when Ms. Lan decided to add another coat worth VND 723,000 to her cart, Temu notified her that the payment couldn’t be completed due to a current order limit of VND 1 million. “Please move the following items back to your cart to continue” – the platform suggested.

While the minimum order limit is justified for environmental protection, Temu has not provided a reason for the maximum limit.

This policy is a stark contrast to when Temu first entered the Vietnamese market, with no floor or ceiling on transaction values.

Notably, in Vietnam, imported goods with a small value of less than VND 1 million sent via express delivery services are exempt from import tax and VAT at the time of import under Decision 78/2010/QD-TTg of the Prime Minister.

According to data from the Postal Telecommunications Corporation in March 2023, about 4-5 million small-value orders are transported from China to Vietnam daily through e-commerce platforms.

On average, VND 45-63 billion in small-value goods are not subject to import tax and VAT daily.

At the National Assembly in late October, Deputy Prime Minister and Minister of Finance Ho Duc Phoc said that the Government will revoke Decision 78 on VAT exemption for goods worth less than VND 1 million imported through e-commerce platforms.

Low-Value Imports: A Case for Equal Tariffs with Domestic Goods

The rise of e-commerce has seen a shift in consumer behavior, with a preference for small-value orders from overseas online marketplaces being delivered to Vietnam. This trend, while offering consumers the benefits of low prices and fast delivery, presents a challenge to domestic producers and the government. It creates an uneven playing field for local businesses and leads to potential tax revenue losses for the country.

A Proposal to Exempt Individuals with an Annual Income Below 200 Million VND from Taxation

“In a recent development, the Finance and Budget Committee of the National Assembly has proposed to raise the threshold for value-added tax (VAT) liability. The committee suggested increasing the annual revenue threshold for VAT liability from the current 100 million VND to a range of 200 – 300 million VND. This adjustment is part of the ongoing revisions to the Value-Added Tax Law.”

Revolutionizing the National Innovation Hub: Unveiling a Treasure Trove of Opportunities

The Ministry of Planning and Investment has proposed additional incentives for the National Innovation Center (NIC), including land and tax breaks, as well as the establishment of a national innovation investment fund. These proposals aim to foster a thriving environment for innovation and entrepreneurship in the country.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)