On November 9, TNC held an extraordinary General Meeting for 2024 in Ba Ria city to approve the addition of content to the Restructuring Plan of TNC Rubber Joint Stock Company for the period of 2021-2025, as directed by the People’s Committee of Ba Ria – Vung Tau province on August 22, 2024. The meeting was attended by 12 shareholders, representing over 94% of the capital with voting rights of TNC.

According to the content presented to the shareholders, the government wants TNC to focus on its main business field and therefore will divest its investment in Baria Serece, a company providing port services in the Cai Mep – Thi Vai area, which is outside of TNC‘s core business. This decision faced opposing views from the company’s owners.

Entrance to Baria Serece port

|

According to a female shareholder who owns and represents more than 20% of TNC‘s capital, the investment in Baria Serece is very effective, and divesting will greatly affect the interests of shareholders. “Therefore, I do not agree with the divestment,” said the shareholder, adding that she also disagreed with the addition of the above content.

“If the government considers it an investment outside the company’s main field, we should add business lines to our business registration certificate,” she said. “In case the meeting votes to approve, give us the priority to buy back the capital.”

However, the divestment received consent from the representative of another group of shareholders, who also hold more than 20% of TNC‘s capital. They requested a “full dividend for the income from the above divestment.”

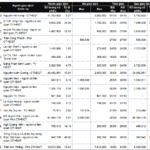

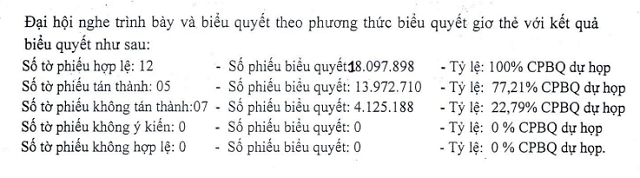

The content was eventually approved by 51% of TNC‘s capital, which belongs to the People’s Committee of Ba Ria – Vung Tau province, despite the voting results showing that 7 people, holding more than 20% of the capital, disagreed.

7 people representing 21% of TNC‘s capital disagreed with the proposal. Source: TNC

|

Baria Serece is a foreign-invested joint venture established about 30 years ago. The company, headquartered in Phu My town, provides port operation services on the Thi Vai River and is believed to have owned Vietnam’s first deep-water port at that time. The nearly VND 27 billion contributed to Baria Serece in the books is the state capital inherited by TNC since 2003, which has remained unchanged since then.

At the end of 2006, Baria Serece had accumulated losses of nearly VND 15 billion, but the head of TNC still assessed that “the ability to generate profits from this project in the coming years is entirely feasible” – according to TNC‘s prospectus.

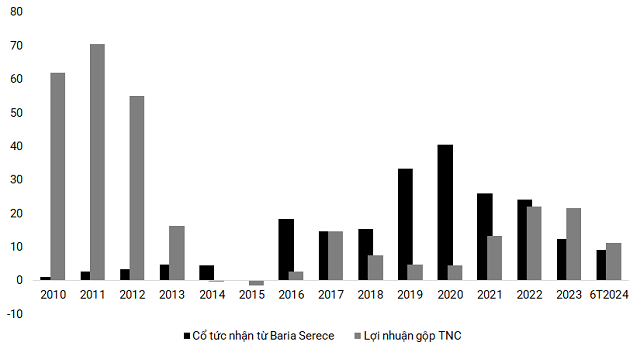

As predicted by the leadership, the port service company’s business operations went smoothly in the following nearly 20 years. Moreover, from 2016 until now, Baria Serece has brought more profits to TNC shareholders than those from its core business. During the period of 2010-6/2024, TNC received a total of more than VND 210 billion in dividends from this joint venture.

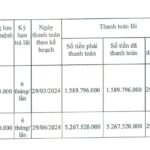

|

TNC earned substantial dividends from its VND 27 billion investment in Baria Serece (Unit: VND billion)

Source: Author’s compilation

|

However, the benefits from dividends in the coming years will decrease significantly as Baria Serece is in the process of investing in upgrading and expanding the scale of the port, with an estimated investment cost of $48 million (about VND 1,200 billion, at an exchange rate of 25,000 VND/USD) financed by retained dividends and bank loans.

“Dividends distributed during the period of 2022-2025 will decrease by 40-60%.” according to TNC‘s 2023 annual report. However, the important thing is probably the slow progress of the project due to environmental and administrative management procedures, which may be one of the reasons for the provincial leadership’s decision to divest.

Not to mention the problems related to Baria Serece today, as the foreign shareholder holds 88% of the capital with voting rights.

“DIG Increases Ownership in Cap Saint Jacques Building Operator to 99.9%”

In a recent disclosure, the Construction Development Investment Corporation (HOSE: DIG) announced that it has increased its ownership stake in its subsidiary, DIC Hospitality, from 78.3% to 99.9%.

The Latest and Largest Shareholder Unveiled in Renowned Bank

The Credit Institutions Act of 2024 mandates that banks disclose personal information, ownership ratios, related-party information, and ownership ratios of related parties for shareholders holding 1% or more of the bank’s charter capital. Several banks have recently published their shareholder lists, shedding light on the ownership structure and key stakeholders. This move towards transparency is a positive step for the industry, providing valuable insights into the complex web of investments and relationships that underpin the financial sector.