Source: SBV

|

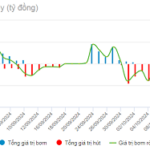

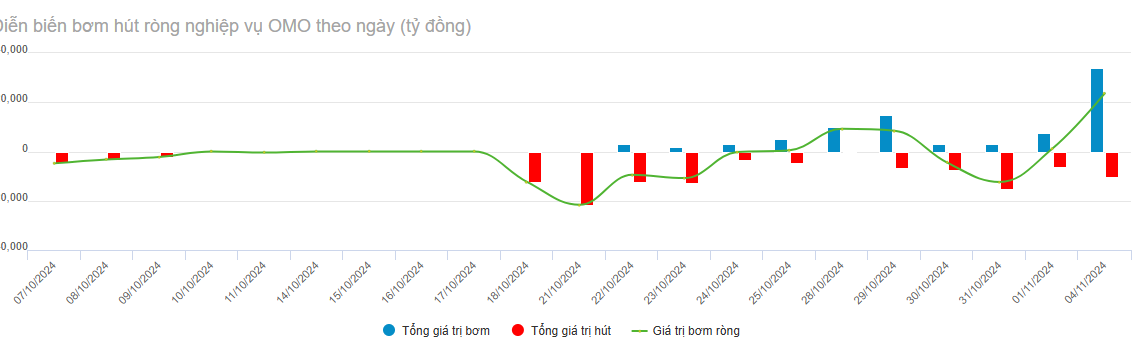

On November 4, 2024, the State Bank of Vietnam (SBV) injected a net amount of VND 23,599.97 billion into the market through open market operations to stabilize liquidity and manage the rising exchange rate pressure.

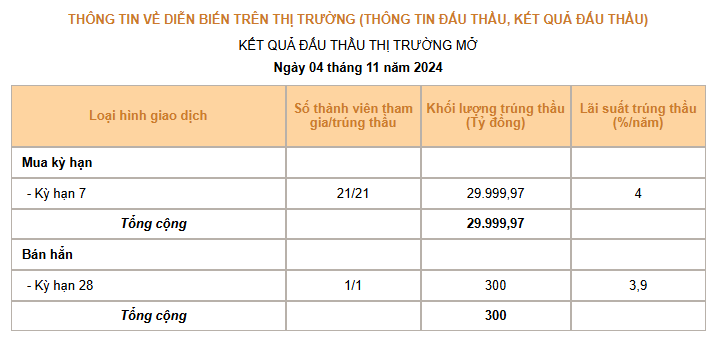

There were 21 participants, all of whom successfully bid on the repo channel with a value of VND 29,999.97 billion, a 7-day term, and a winning interest rate of 4%/year.

The SBV also issued VND 300 billion worth of 28-day bills at an interest rate of 3.9%/year, with only one successful bidder.

As a result, on November 4, the SBV injected a net amount of VND 23,599.97 billion into the market through open market operations.

Source: VietstockFinance

|

According to VNDIRECT Securities Corporation, the overnight interbank interest rate rose to 6.2% on November 4 due to liquidity shortages, prompting the SBV to increase money injection through the OMO channel to balance market liquidity.

In the context of rising exchange rate pressure, commercial banks benefited significantly from the SBV’s net injection decision. Injecting nearly VND 23,600 billion into the market not only eased liquidity tensions but also supported banks in meeting short-term capital demands, especially during the year-end period when capital demands tend to surge. This is when businesses ramp up their production and business activities, leading to increased capital needs. This puts considerable pressure on the banking system, and the SBV’s timely intervention helps protect liquidity and mitigate risks for the system.

Mr. Nguyen Quang Huy – CEO of Finance and Banking, Nguyen Trai University assessed that the SBV’s action could also be considered a strategic move to control the USD/VND exchange rate and ensure the stability of the monetary market amid global market volatility. This liquidity injection is not only an immediate solution but also demonstrates the SBV’s strong commitment to supporting the financial system’s long-term stability.

The SBV’s net injection is a strategic decision to stabilize liquidity amid rising USD/VND exchange rates and increasing pressure from the international market. With the support of year-end remittances and the international payment surplus, the SBV will have additional resources to maintain exchange rate stability and protect the economy from external shocks.

Exchange Rate Pressure: What’s the Limit for the VND?

In recent days, the USD/VND exchange rate has been surging, putting significant pressure on the economy. A weaker VND against the USD can fuel inflation as the cost of importing goods and raw materials increases, leading to domestic price pressures. Additionally, businesses with USD-denominated loans will face higher interest rate expenses, impacting their production and business operations.

The US presidential election also introduces uncertainties into the global financial market. Potential changes in US economic and trade policies could significantly affect investment flows and exchange rates in many countries, including Vietnam. Given this situation, the SBV needs to employ flexible and swift management measures to ensure exchange rate stability while maintaining healthy macroeconomic fundamentals.

The year-end season typically sees a significant increase in remittances from overseas Vietnamese supporting their families back home. This influx of foreign currency is crucial for boosting the country’s foreign reserves. Moreover, Vietnam’s import-export situation tends to achieve a surplus, especially during the last months of the year.

With the increase in remittances and foreign reserves, the SBV gains more leverage to adjust the market and stabilize the exchange rate in a way that supports economic growth. This also helps Vietnam avoid negative impacts from severe exchange rate fluctuations, providing a solid foundation for domestic businesses to maintain sustainable development.

Mr. Huy forecasts that, in the short term, the USD/VND exchange rate may continue to face pressure from high foreign currency demands and volatile international market conditions. However, with the SBV’s continuous liquidity injections and willingness to intervene by selling foreign currencies, the exchange rate is likely to be controlled within the permitted range, preventing significant disruptions.

In the long term, the exchange rate will depend on various macro factors, both domestic and international, such as foreign direct investment (FDI) inflows and the global economic landscape. If the Vietnamese economy maintains its growth trajectory and successfully attracts stable FDI inflows, the exchange rate is expected to remain stable within the permitted range. The SBV’s proactive actions can play a crucial role in protecting the VND against short-term pressures and strengthening its position over the long term.

The SBV’s commitment goes beyond short-term support; it lays the foundation for a long-term financial stability strategy. For the Vietnamese economy, exchange rate stability creates a favorable environment for businesses to thrive, contributing to the country’s sustainable growth. Amid global economic volatility, the SBV’s proactive approach is a significant step in solidifying Vietnam’s position in the region and the world.

“Interbank Overnight Rates Plummet as Liquidity Pressure Eases”

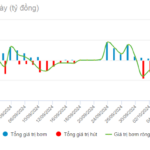

Through open market operations (OMO), the State Bank of Vietnam (SBV) injected a net amount of VND 50.55 trillion into the system last week (November 4-11, 2024), swiftly stabilizing the overnight interbank interest rate.

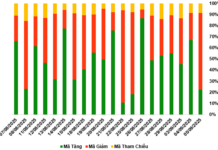

“The Shadow of Gloom and Doubt on the Stock Market”

The liquidity turnover on HOSE indicates that the doldrums of early 2023 are back. While the flow of funds remains stagnant, there are opportunities to be found in the market.

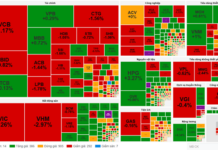

SSI Research: Short-term Volatility Presents Buying Opportunities for Long-term Investors

“According to SSI Securities Corporation’s November 2024 strategy report, the SSI Research Center for Analysis and Investment Consulting believes that the market may fluctuate in the short term. However, this also presents an opportunity to buy potential stocks at reasonable prices to build a long-term investment portfolio.”